7 Best Accounting Software Tools for Real Estate Businesses (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate agents and brokers to share their expertise on the best real estate accounting tools to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best real estate financial software tools and evaluated them based on critical factors that are important for real estate agents. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

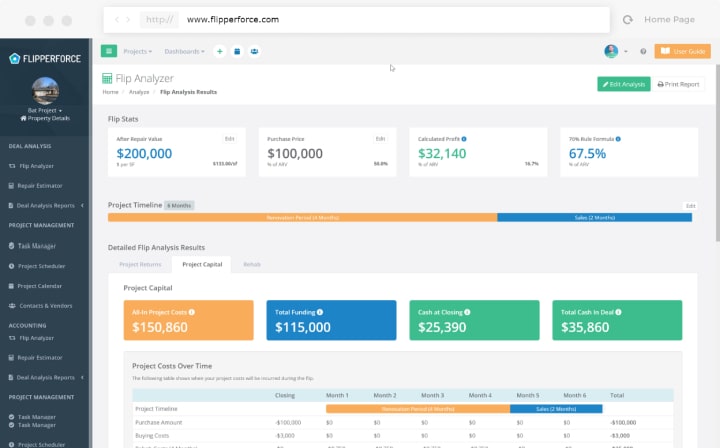

FlipperForce — Best Accounting Software for House Flipping Business

FlipperForce is one of the best accounting software tools for real estate investors.

This cloud-based house flipping software is designed as a real estate investment evaluation software for analyzing rehab deals, managing projects, tracking project financials, and more.

It provides an all-in-one solution for house flippers, real estate developers, and real estate wholesalers.

FlipperForce simplifies the entire real estate investment process by automating many tedious tasks and providing users with actionable insights.

Features

Project Budgeter

The project budgeter feature helps investors generate budgets, monitor project expenditures, and predict future profitability.

It keeps track of real expenses by grouping them into categories and vendors. This empowers users to contrast the numbers with their budget and evaluate any excess spending.

Flip Analyzer

This feature allows users to analyze deals and create a baseline project budget for their home rehab project.

It is used to establish an initial budget for the project, which can then be adjusted to create a baseline that will be used to compare actual expenses on the project.

Project Tracking Tools

FlipperForce provides real estate investor tools that simplify project progress tracking.

These tools provide an overview of the current status and timeline of each project, as well as key insights into overall performance.

This information can be used to forecast project profitability.

These and other features are described in more detail in our FlipperForce review.

Plans and Pricing

FlipperForce offers three pricing plans: Solo, Team, and Business. The Solo plan costs $79/month, or $59/month when billed annually.

It includes 1 user account plus 50 active projects, nationwide property and owner data, deal analysis, repair estimation, project management, project accounting, and reporting.

The cost of the Team plan is $199 per month, or $149 per month if billed annually. This plan includes 5 user accounts and the ability to have 100 active projects, in addition to all of the features in the Solo plan.

Furthermore, the Team plan offers team management functions and access control capabilities.

The Business plan, on the other hand, costs $499 per month, or $349 per month if billed annually. It offers unlimited users and projects, in addition to all Team plan features.

Pros and Cons

Pros

- Constantly updated. FlipperForce has been steadily adding new features to its platform. The latest additions include comps and comp table sorting, property and owner data, as well as a material catalog for saving commonly used materials.

- Comprehensive reporting. It offers comprehensive reports in both spreadsheet and PDF formats on project estimates, profit margins, expenses and invoices.

- Doesn’t require much setup. FlipperForce’s tools are easy to set up and use.

Cons

- No mobile app. FlipperForce doesn’t have a mobile app; users access the platform through a browser on mobile devices.

- Limited team management abilities. FlipperForce’s capabilities for managing teams and tasks are limited.

Integrations

- Zapier

- QuickBooks

- Google Calendar

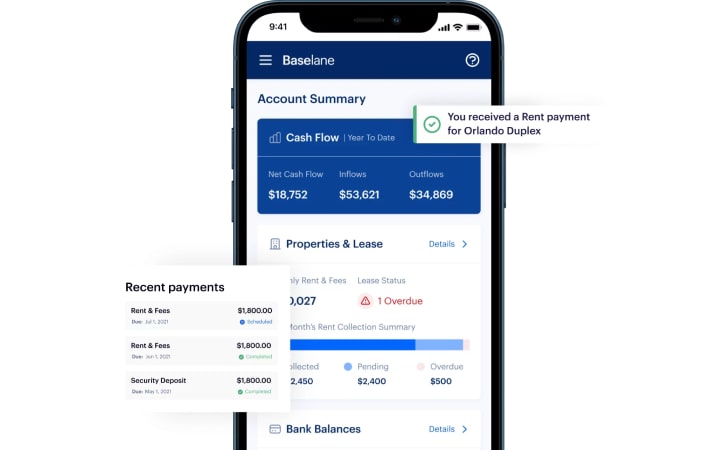

Baselane — Best Rental Property Bookkeeping Software for Landlords

Baselane is a real estate financial software designed for individual real estate investors and landlords.

As one of the best property management accounting software tools, it provides integrated banking, rent collection, bookkeeping and reporting services, while also facilitating convenient access to business loans, home insurance and investment opportunities.

The platform is easy to use and offers a variety of services tailored to the bookkeeping needs of independent landlords managing property from a distance.

Features

Tax Reports

As a convenient accounting and bookkeeping software app for landlords, Baselane offers an auto-generated tax report and Schedule E with a click of a button.

This saves time and reduces errors compared to manual entry or complex calculations. By automating the process, Baselane makes it easy to accurately report taxes.

Transaction Tagging

This feature allows landlords to categorize transactions by property, making it easy to track expenses by type.

This helps landlords stay organized, efficiently manage their properties, and keep records of all transactions. It also provides them with a better understanding of their finances.

Bookkeeping and Reporting

Baselane offers automated rental property bookkeeping and precise reporting. Landlords can generate cash flow analytics and income statements by property or portfolio.

Transactions are imported directly from your bank, simplifying tax reporting. Baselane also allows users to export reports in CSV format.

Rent Collection

By using Baselane as a rent collection software, landlords can accept payments by ACH or card.

Automated reminders are also sent to tenants to ensure they don’t miss a payment.

We discuss these features and more in our Baselane review.

Plans and Pricing

Baselane is free to use with no hidden charges.

Pros and Cons

Pros

- It is free. This property management software for landlords is totally free to use.

- Support for multiple payment platforms. This tool supports multiple payment platforms, allowing users to choose the easiest payment method for them.

Cons

- No rental property marketing or syndication tools. Baselane does not offer an advertising or rental listing syndication service.

- No integrations with other accounting tools. Baselane doesn’t integrate with accounting tools like QuickBooks and Xero. However, users can download custom reports to import into external tools.

Integrations

- TurboTenant

- Avail

- DoorLoop

- TenantCloud

- Stessa

- RentPrep

- Buildium

- Innago

- Landlord Studio

- Hostfully

- Hostify

- Nearside

- Novo

- Hemlane

- OwnHome

DoorLoop — Best Commercial Real Estate Accounting Software

DoorLoop is an all-in-one property management software solution. It simplifies operations and provides solutions for tenant management, accounting, marketing, maintenance, and more.

DoorLoop offers an easy-to-use interface on both web and mobile. It also streamlines communications, allowing owners and property managers to communicate with tenants quickly and easily.

Features

Automated Payments

DoorLoop enables users to conveniently set rental rates, handle recurring charges, and receive automated payments.

Users can tailor lease terms and rental fees based on each lease. They can levy one-time or recurring fees on tenants and sync their bank accounts to reconcile all transactions.

Property Management Reports

As comprehensive residential and commercial property management software, DoorLoop offers more than 60 built-in report templates and unlimited custom reports.

You can generate reports like profit and loss (P&L) statements, balance sheets, and cash flow statements. You can filter reports by date, accounting method, property, lease, and more.

Bank Sync

Users can connect their bank account, credit card, or debit card with DoorLoop to simplify the categorization and reconciliation of property transactions.

This feature provides better financial reporting at tax time since users no longer need to manually track their spending.

To learn more about this tool, read our full DoorLoop review.

Plans and Pricing

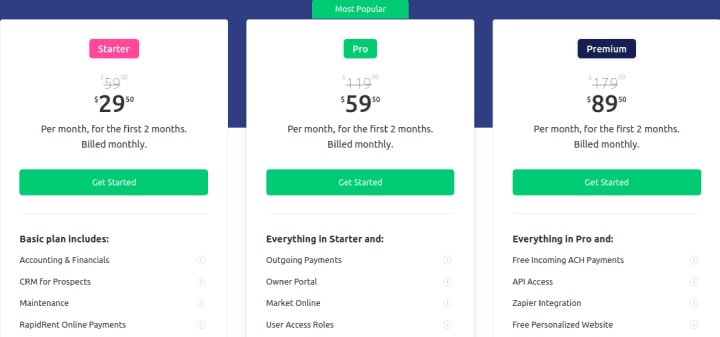

DoorLoop offers three pricing plans: Starter, Pro, and Premium. For their first 2 months, new users get a 50% discount on all plans.

The Starter plan costs $588 annually and $59 monthly. This plan offers access to all accounting, maintenance, tenant screening services for landlords, and rent collection features.

It also offers a customizable tenant portal and a real estate investor CRM for prospecting. You can also use HelloSign eSignatures at additional costs.

The Pro plan costs $1,188 per year or $119 monthly. This plan includes all the features of the Starter plan, plus an owner portal, real estate investor bank account reconciliations, QuickBooks Online Sync, CAM charges, and more.

The Premium plan costs $1,788 per year and $179 monthly. It includes everything in the Pro plan, plus a free personalized website and Zapier integration.

Users can also enjoy unlimited eSignatures and add an unlimited number of users.

Pros and Cons

Pros

- Ease of use. This residential and commercial real estate software is easy to use with a user-friendly interface.

- Excellent customer support. DoorLoop’s customer support team is excellent. They respond quickly to inquiries and are always willing to help.

Cons

- Cumbersome onboarding process. DoorLoop’s onboarding process is cumbersome. This can result in longer onboarding times and a poor user experience.

- Zapier integration is only available on the Premium plan. Zapier and API access are only available on the Premium plan. On the lower plans, users may not be able to integrate the software with other tools they use.

Integrations

- Expensify

- FreshBooks

- QuickBooks

- Zapier

- DocuSign

- Cloze

- Copper CRM

- Slack

- RingCentral

Wave — Best Free Accounting Software for Small Real Estate Businesses

Wave is a powerful contender for the best real estate accounting software, designed to help businesses manage their finances both in the office and on the go.

This real estate financial software automates tedious tasks such as payments and invoicing, while providing realtors with real-time financial insight.

It is easy to use and offers comprehensive reporting tools to aid users in making better decisions.

Features

Invoicing

Wave’s invoicing tool creates a streamlined invoicing process, allowing users to create and send professional invoices in seconds.

Users can set up recurring invoices and automatic credit card payments for repeat customers.

They can also access all customer information in one place and track payments and communication.

Payments

As a top real estate financial software, Wave offers an easy-to-use payment tool that allows users to get paid quickly by bank deposit, credit card, and Apple Pay.

It charges fees as low as 1%, and payments automatically flow into accounting records.

Accounting

You can connect Wave with your bank accounts to automatically record transactions, generate reports, and reconcile your books.

You can also create charts of accounts — a list of assets, liabilities, income, expense, and equity accounts — as well as generate financial statements such as cash flow reports and balance sheets.

Payroll

Wave’s payroll tool simplifies realtors’ payroll processes. It makes it easy to pay employees and independent contractors, as well as generate W2 and 1099 forms for tax season.

Real estate businesses can automatically pay and file state and federal payroll taxes.

It also allows users to deposit payments directly into employees’ bank accounts and automate payroll journal entries.

Plans and Pricing

Wave’s invoicing and accounting software real estate agents is free to use. Payment charges are 2.9% plus $0.60 per credit card transaction, and 3.4% plus $0.60 per AMEX transaction.

Bank payments cost 1% per transaction with a $1 minimum fee.

The monthly fee for the payroll tool varies depending on whether you are in a tax-service state or a self-service state.

Tax-service states include Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

All other 36 states are self-service states. Customers in these tax-service states pay $40/month.

In self-service states, the payroll software costs $20/month. Apart from these fees, employers pay $6 per active employee and $6 per independent contractor paid.

Pros and Cons

Pros

- Free accounting tool. Wave offers a free invoicing and accounting tool.

- Robust invoicing feature. Wave offers unlimited invoicing with customizable templates and payment terms, as well as a mobile app for dedicated invoicing.

- Great user interface. The platform is easy to use both on web and mobile.

Cons

- Paid customer support. Users can access free live chat and email support. However, phone support is not free and users optionally pay extra for one-on-one coaching sessions with Wave Advisors.

- Basic payroll system. Wave Payroll has fewer automation features than its competitors, Square Payroll and Paycom. It can only help with payroll tax filing in 14 states.

- Not created for large brokerages. Wave is best suited to small real estate businesses and solo agents. It may not be the right fit for mid-scale and large businesses.

Integrations

- Zapier

- Google Drive

- PayPal

- Stripe

- HubSpot

- Google Forms

- HoneyBook

- Microsoft Outlook

- Mailchimp

- QuickBooks

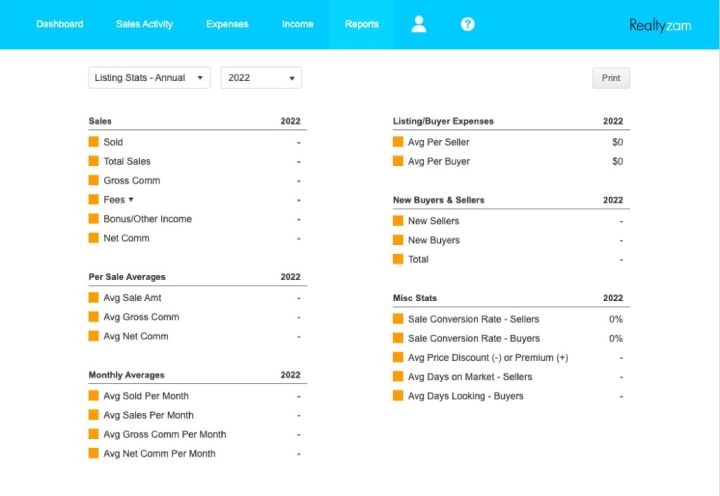

Realtyzam — Best Real Estate Agent Accounting Software

Realtyzam is the best accounting software for real estate agents. It’s simple to use and designed specifically for realtors.

Realtyzam helps agents track commissions and expenses by generating a profit and loss report for taxes.

It also monitors sales activity and provides real estate agents with access to all their business financial information on a single dashboard.

Features

Expense Tracking

This tool helps agents keep track of their expenses and categorize them. Agents can choose from a list of default categories or add customized ones to categorize their expenses.

It also helps with setting budgets and keeping finances organized.

Income Tracking

The income tracking tool helps agents monitor their income from various sources.

This tool allows them to generate reports showing commission, miscellaneous income, and referral income.

They can also track income based on real estate lead sources, so they know which client or deal makes them the most money.

Financial Reports

Realtyzam offers agents the ability to generate reports to track key metrics, including average commissions, prospecting, buyer and seller conversion rates, and sales prices.

They can also monitor listing and buyer expenses, new buyers and sellers, and sources of income. Agents can print or share these reports.

Receipts Upload

Real estate agents can upload their expense receipts on Realtyzam, and the system will automatically link them to transactions.

The process can be done by using a tablet, computer, or mobile device with the Realtyzam mobile app.

Learn about these functions and other features of the tool from our detailed Realtyzam review.

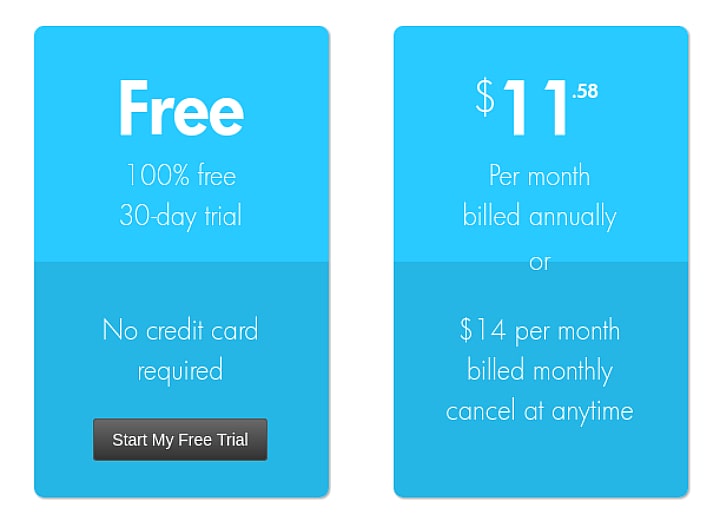

Plans and Pricing

Realtyzam offers a 30-day free trial period, after which it is billed at $14 per month, or $12 per month when billed annually.

Pros and Cons

Pros

- It is affordable. It is cheaper than most other real estate accounting programs with a 30-day free trial.

- Bank account integration. It integrates multiple bank accounts, allowing agents to import transactions from their banks easily.

- Easy-to-use software. The app has a great UI. The platform is easy to use, even for non-tech-savvy agents.

Cons

- Not a team/brokerage solution. It does not offer tools for real estate teams or brokerages. It is designed exclusively for single real estate agents.

- Can’t track assets and liabilities. Realtyzam does not track assets and liabilities, so agents cannot compile a balance sheet. It also does not have a mileage tracker which is useful when calculating taxes.

- No invoicing feature. Agents can’t send out invoices through Realtyzam.

- No third-party integrations. While it can connect to multiple bank accounts and credit cards, it doesn’t integrate with other apps like QuickBooks.

Integrations

Realtyzam does not offer integrations with any third-party software.

Constellation1 — Best Real Estate Brokerage Accounting Software

Constellation1 is a software platform that provides real estate brokerages and MLS with a full suite of management services.

This real estate brokerage software offers sales and marketing tools such as real estate leads and relocation management, accounting tools for back office functions, real estate agent CRM, eSignature capabilities, real estate IDX websites, and more.

This makes it a contender for the best accounting software for real estate companies.

Features

Commission Management

This feature allows brokerages to set up and manage automated commission plans. Once the commission rate is set, the plan is automatically applied to all transactions.

With this feature, brokerages can easily configure and manage their commission plans, allowing them to assign different commission rates to each real estate agent or team.

Referral Tracking

The referral tracking feature facilitates the tracking and issuance of payments to third-party entities that provide referral leads for realtors and brokerages.

It allows for the automation and optimization of the referral process, promoting precision and openness in the payment of referral agents.

Recurring Charges and Bills

Constellation1 enables brokerages to create recurring charges and bills, streamlining the billing process for both clients and brokerages.

The platform automates billing and charging processes, freeing up time for brokerages to focus on other tasks.

Financial Reporting

Constellation1 offers brokerages a single dashboard that displays real-time financial reports.

This dashboard provides in-depth data on client portfolios, including metrics like performance and assets under management.

Plans and Pricing

Constellation1 does not provide pricing information on its website. To get a price quote, users must schedule a presentation with their sales team.

Pros and Cons

Pros

- High data security. Constellation1 offers high data security levels, enhanced by regular security audits and updates.

- Comprehensive eSignature feature. Constellation1 offers a complete eSignature solution that streamlines the process of obtaining legally enforceable signatures on significant documents.

- Easy to use. The software is intuitive and easy to use for people without an accounting background.

Cons

- High cost. Constellation1 offers a variety of front and back office solutions that brokerages can choose from. The full suite of Constellation 1 products can be expensive for small brokerages.

- Limited integrations. The software doesn’t integrate with some major real estate communication and marketing tools.

Integrations

- QuickBooks

- Testimonial Tree

- Emphasys

- Paradym

Anton Systems — Best Real Estate Development Accounting Software

Anton Systems handles all aspects of real estate development, from pre-development costs to final funding, and from project construction to property management.

The company is the creator of two software systems: BudgetTrac and Skyline. Both software offer detailed accounting and reporting tools for developers and construction project managers.

Anton System’s BudgetTrac software helps real estate construction companies:

- create customized budgets

- monitor spending in real time

- analyze variances

- create accurate general ledger, accounts payable, and accounts receivable records

Features

Loan Draw

This feature streamlines the process of preparing loan draw requests, speeding up their preparation.

It allows users to track multiple loans, update approved loan draws, and record cash receipts, as well as post general ledger journal entries.

General Ledger

The general ledger will automatically record entries from both accounts payable and receivable. This is a helpful tool for automating the process of logging transactions.

Project Cost Control

This powerful feature allows users to track and analyze the costs associated with each project to ensure that the project stays within the established budget.

It allows users to compare actual costs to estimated costs, compare costs between projects, and track future expenses to ensure that the project is completed within the budget.

Plans and Pricing

Anton Systems does not provide pricing information on its website.

Pros and Cons

Pros

- Detailed reporting tools. Anton Systems provides detailed reporting tools for real estate accounting that meet both internal and external reporting needs. These tools include simultaneous cash and accrual accounting, information on past, present, and future financial information, as well as time-sensitive percentage-of-ownership hierarchy tools, which support multi-entity ownership reporting needs.

- Excellent budget tracking. The software allows for real-time tracking of actual spending compared to the budget, providing users with a clear view of their financial performance throughout the year.

- Good customer support. Customer care team members are responsive, helpful, and have substantial knowledge of the product.

Cons

- Steep learning curve. The software can be hard to navigate for some users due to its complexity, number of tools, and reporting options.

- No mobile app. There is no mobile app to manage projects and accounts on the go.

- Limited integrations. The software doesn’t integrate with other software tools using API. Users have to import and export files in CSV format.

Integrations

- Acumatica

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.