6 Best Realtor Accounting & Bookkeeping Software Tools (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate agents and brokers to share their expertise on the best bookkeeping and accounting software tools for realtors to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best realtor accounting and bookkeeping apps and evaluated them based on critical factors that are important for real estate agents and brokers. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

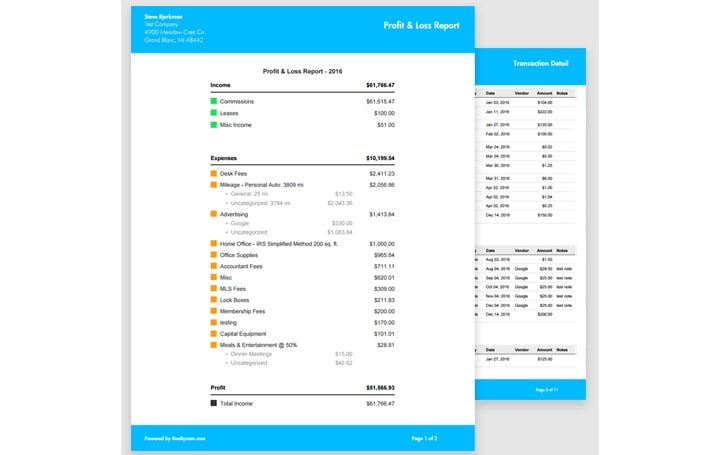

Realtyzam — Best Real Estate Agent Accounting and Bookkeeping Software

Realtyzam is powerful, easy-to-use accounting software designed specifically for real estate agents.

One of the software’s distinctive features is its ability to automate real estate bookkeeping, including tracking income and expenses and generating reports.

This realtor accounting and bookkeeping software also offers seamless integration with bank and credit card accounts, allowing users to download data from those accounts and categorize each transaction.

Features

Automatic Receipts Scanning

This feature simplifies the process of recording and organizing receipts for real estate professionals.

It allows users to upload and categorize receipts by leveraging OCR technology to extract relevant information from scanned or uploaded receipts.

Income and Expense Tracking

This feature helps real estate agents track their income and expenses by automatically organizing and categorizing transactions.

Agents can import property financial data from various sources such as bank accounts, credit cards, or manual entry.

They can then use the data to access metrics in real time and track their performance over time.

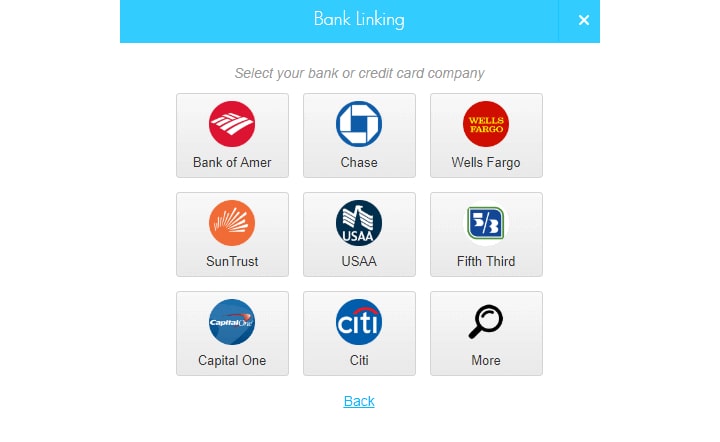

Bank and Credit Card Integration

The bank and credit card integration feature allows real estate agents to import transactions from their bank and credit card accounts into the software.

This feature also allows agents to generate financial reports reflecting imported transactions.

Learn about these functions and other features of the tool from our detailed Realtyzam review.

Plans and Pricing

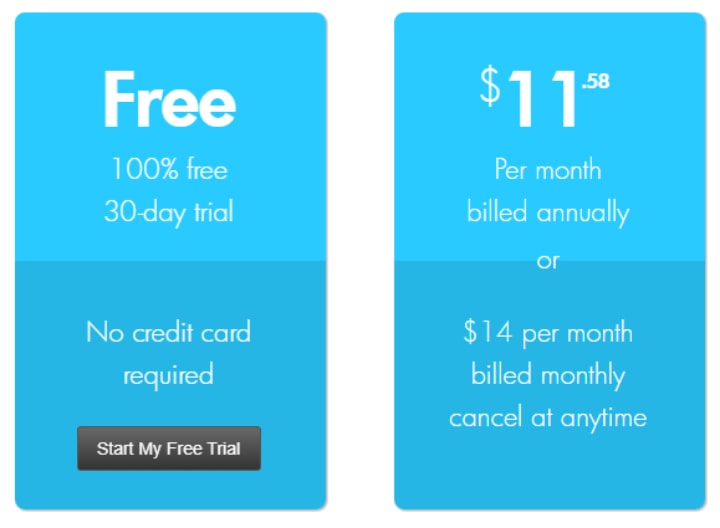

Realtyzam is free for 30 days with no credit card required.

After 30 days, you can pay $14 monthly, or $139 annually. This real estate accounting software also offers a free package for new real estate agents.

This allows them to use some of the best bookkeeping and accounting software for real estate agents for free until they sell two properties or log $3,000 in income and expenses.

Pros and Cons

Pros

- Free trial. The software offers a free trial for 30 days. This is ideal for beginner real estate agents, who can use it free of charge until they close two deals.

- Easy bank feed setup. You can easily set up the software to import bank feeds, which makes it easy to track and categorize expenses and income.

- Includes a handy mobile app. It has a handy mobile app version to capture expense receipts and keep track of mileage. The mobile version allows you to perform basic accounting functions on the go.

Cons

- Not designed for teams and brokers. Realtyzam is suitable for single agents or small teams. It is not designed for teams with multiple members as it has limited collaboration tools.

- Cannot track assets and liabilities. The software has limited functionalities. While it can track income and expenses, it cannot track assets and liabilities, which inhibits balance sheet compilation. It also has no invoicing feature.

- No integrations. Data must be manually downloaded and imported into other tools, as Realtyzam doesn’t integrate with any other software.

Integrations

Realtyzam doesn’t integrate with any third-party software.

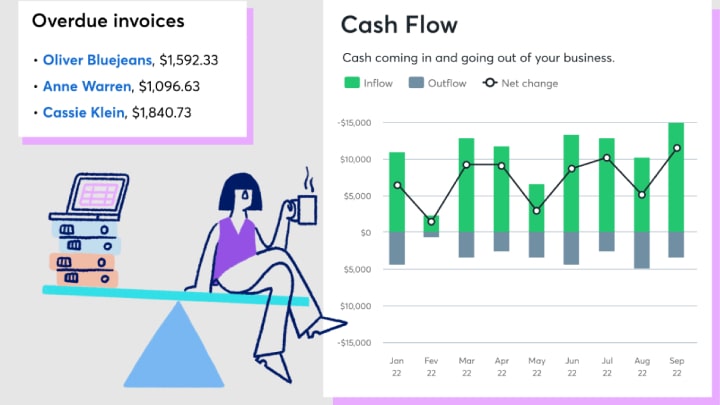

Wave Accounting — Best Free Accounting Software for Real Estate Agents

Wave Accounting Software is a cloud-based accounting solution for small businesses. It’s designed to make bookkeeping easier and more efficient for entrepreneurs.

One of its best features is its double-entry accounting system, which ensures every transaction is recorded twice.

This provides a more accurate and comprehensive view of a real estate business’s financial health.

With Wave Accounting, you can easily import bank transactions directly into the software and streamline your realtor accounting and bookkeeping process.

Features

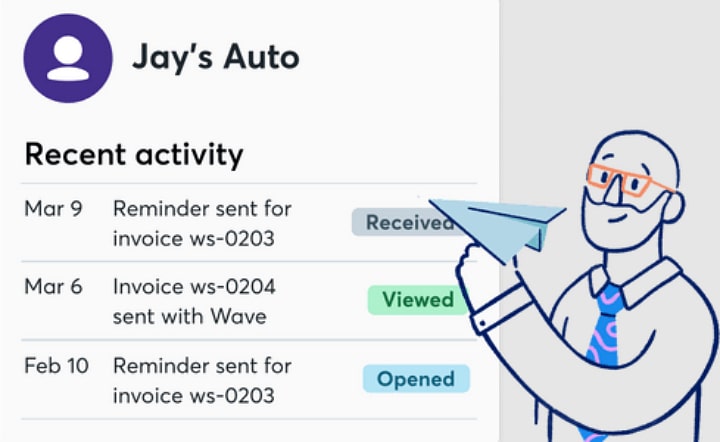

Invoicing

The invoicing feature allows real estate agents to create and send customized invoices to their clients.

They can add their business logo, personalize the invoice with their own color scheme, price, and more.

The invoicing feature also allows for easy payment tracking, with users able to see when an invoice has been viewed or paid.

Payment

This feature enables customers to pay their invoices directly from within the software. Clients or customers can use the payment options provided on the invoice to remit the invoice amount directly.

This feature also allows real estate agents and business owners to automatically mark invoices as paid, track payment status, and send payment reminders to clients.

Payroll

Wave Accounting’s payroll feature helps small businesses with payroll and taxes. With this feature, users can easily manage employee payments and tax withholdings and remittances to the government.

The Wave Payroll feature also allows users to generate payroll-related reports, such as payroll summaries and expense breakdowns.

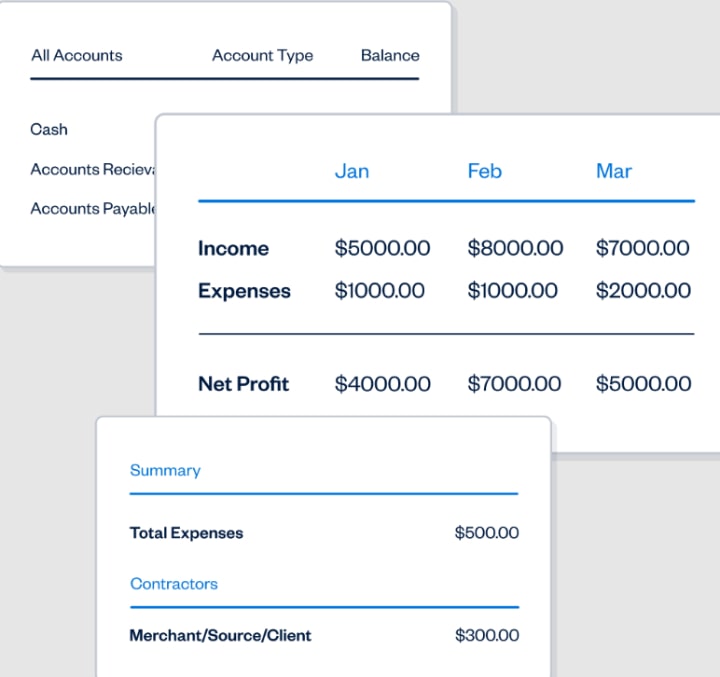

Accounting

Wave’s accounting feature helps realtors and small businesses manage finances with numerous tools for tracking income, expenses, and cash flow.

Users can categorize transactions, generate invoices and estimates, and record financial transactions with ease.

Wave’s accounting tools simplify accounting entries and promote active financial management.

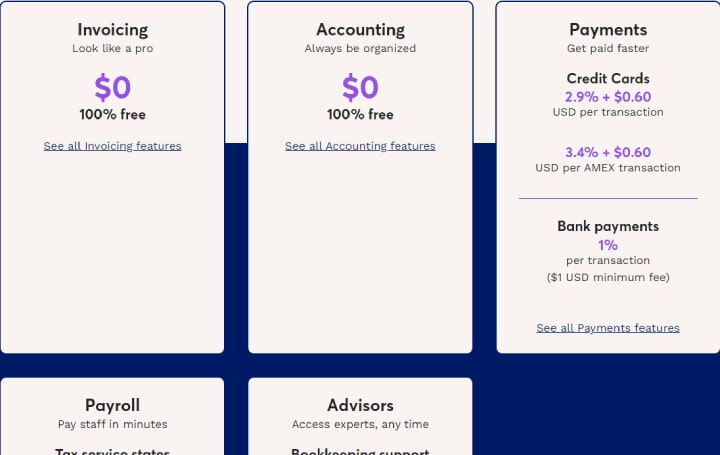

Plans and Pricing

Wave Accounting offers different features and pricing based on what you need.

The accounting and invoicing features are free, but the payment feature costs $2.95 + 0.6 cents per transaction for credit cards, or $3.40 + 0.6 cents per American Express transaction.

Bank payments cost $1 per transaction.

The payroll feature costs $30 monthly, plus $6 per active employee and $6 per independent contractor for tax service.

For self-service states, the payroll feature costs $20 monthly for self-service states, plus $6 per active employee and $6 per independent contractor for tax service.

Advisor features include bookkeeping support for $149/month and accounting and payroll coaching for $379/month.

Pros and Cons

Pros

- Unlimited invoicing with customizable templates and payment terms. Wave Accounting offers a wide range of invoicing tools that let you customize your invoices with your logo and payment terms. You can also send recurring invoices and set up automatic payment reminders to ensure timely payment.

- Unlimited users with varying permission levels. This platform gives you the ability to share access with multiple team members. You can also limit their access and customize what they can see based on their roles within your organization.

- “Forever free” version is available. The software offers a free-forever version, with basic features such as invoicing, expense tracking, and receipt scanning.

Cons

- Extra payment for phone support while live chat support is only included on paid services. Paying extra for phone support may be a disadvantage for some users, who prefer talking to customer service representatives over the phone. Additionally, live chat support is only included on paid services such as Wave Payments and Payroll.

- No month-to-month reports. While you can generate a number of financial reports, customization options are limited. Reports are per quarter. Users are unable to view monthly records of accounts receivable and payables.

Integrations

- Square

- Shoeboxed

- Zapier

- Stripe

- Etsy

- PayPal

FreshBooks — Best Accounting Software for Real Estate Teams

FreshBooks is a web-based accounting software designed for real estate agents, small real estate brokerage firms, and self-employed professionals.

One of its most appealing features is its user-friendly invoicing system, which allows businesses to easily create professional-looking invoices, track payment statuses, and set up automatic reminders.

FreshBooks also offers time tracking and expense management tools that help users track their project hours, keep their finances in order, and collaborate with team members.

Features

Double-Entry Accounting Reports

This feature makes it easy for small businesses, real estate agents, and freelancers to manage their finances by generating accurate financial statements, such as balance sheets and income statements.

It also allows users to customize these reports and export them in PDF or Excel format for further analysis or sharing with stakeholders.

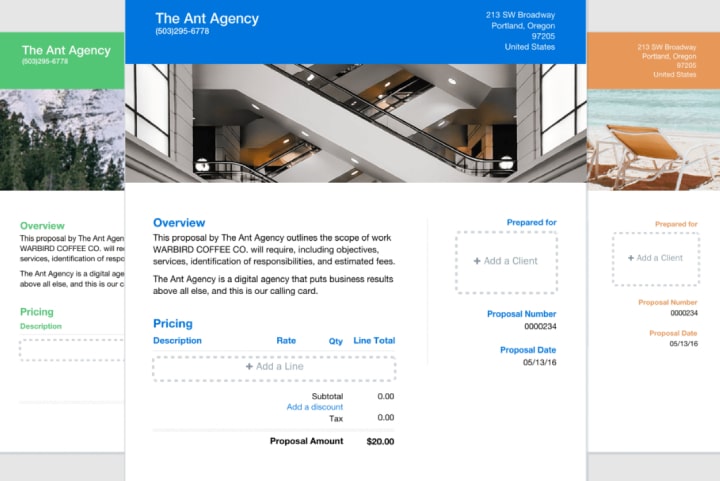

Proposals

FreshBooks ranks as one of the best accounting software tools for real estate agents because it streamlines the process of creating and sending proposals.

Users can either build proposals from scratch or select from pre-built templates.

They can then customize the proposal with their company logo, branding, message, pricing, and payment terms.

Users can also send the proposal to clients within the platform and convert it to an invoice.

Projects

The project management feature allows users to track time, expenses, and invoices related to a specific project.

Users can create a new project, add team members, set a budget, and add tasks to be completed.

This feature also allows users to share files and images from within the software, assign hourly rates or billable hours to a specific project for a client, and control what team members can access within the project.

Plans and Pricing

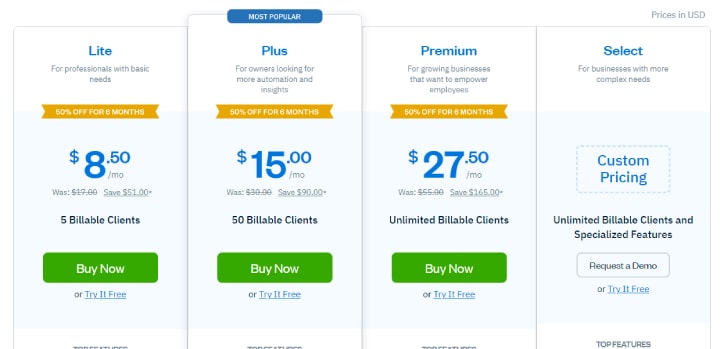

FreshBooks offers four major plans. They include the Lite, Plus, Premium, and Select plans.

The Lite plan costs $8.50 per month, or $132.60 per year. It allows you to send unlimited invoices and estimates to up to 5 clients.

It also includes unlimited expense tracking and sales tax reports.

The Plus plan costs $15 monthly, or $234 annually. It includes all the features of the Lite plan for up to 50 users.

Users also get access to features like mobile mileage tracking and client retainers.

The Premium plan costs $27 monthly, or $429 annually. It includes all the features in the Plus package, along with additional features like business health reports and financial accounting reports.

You can try any of the three plans for 30 days without obligations.

The Select plan (a custom option for businesses with more complex needs and budgets) includes all the features of the Premium plan, plus additional features like automatic expense tracking, a dedicated account manager, and more.

Pros and Cons

Pros

- Double-entry accounting reports. This software uses double-entry accounting, which is the most widely used accounting system in the world. It ensures that every transaction is recorded in two accounts, reducing errors and improving accuracy.

- Simple to use for freelancers and small businesses. The software features a simple and intuitive interface, which makes it easy for non-accountants to use the program without much training.

- 8 a.m. to 8 p.m. phone support on working days. FreshBooks offers phone support from Monday to Friday. This makes it easy for users to contact the company if they have any pressing issues or concerns.

Cons

- Extra cost per month to add more team members. There is an extra $11 cost per new user when adding team members to an account. This pricing structure may not be ideal for businesses with a large team or who require multiple people to access and manage the accounting process.

- Lack of essential features on the Lite plan. The Lite plan lacks some essential features such as bank reconciliation tools, accountant access, and double-entry accounting reports.

Integrations

- Gusto Payroll

- G Suite

- PayPal

- Stripe

- HubSpot

- Zapier

- Shopify

- Salesforce

QuickBooks Online — The Most Popular Accounting Software for Small Real Estate Businesses

QuickBooks Online ranks as one of the best accounting software tools for real estate agents.

It’s a cloud-based accounting software that helps small to medium-sized businesses manage their finances.

The software has a variety of features, including automated bookkeeping, invoicing, and payment processing.

It also has customizable reporting, integration with third-party apps, and a mobile app for on-the-go financial management.

In addition to basic accounting features, QuickBooks Online offers advanced inventory management tools, time tracking, and project profitability analysis.

Features

Payroll

QuickBooks online payroll simplifies payroll management for small businesses.

It allows users to set up and run payroll, calculate and file payroll taxes, and maintain accurate and organized payroll records.

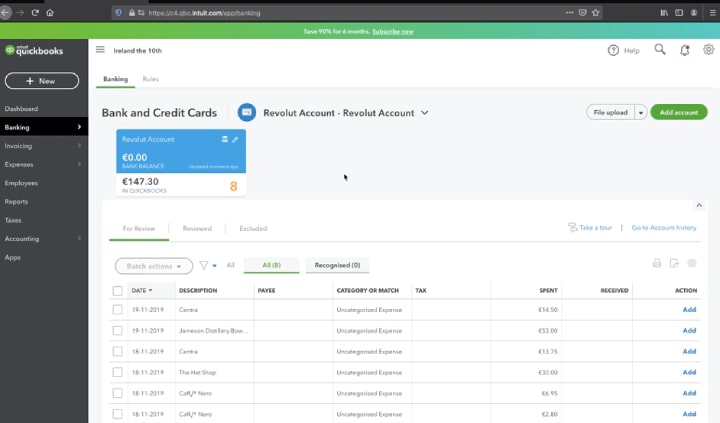

Expense Tracking and Bank Feeds

The expense tracking and bank feed feature simplifies expense management and helps you monitor your finances.

Users can record, edit, delete and track expenditures, as well as connect their bank and credit card accounts to the platform, which allows them to import transactions automatically.

This also comes with robust reporting capabilities, such as generation of expense reports, tracking spending trends, analyzing vendor payments, and monitoring cash flow.

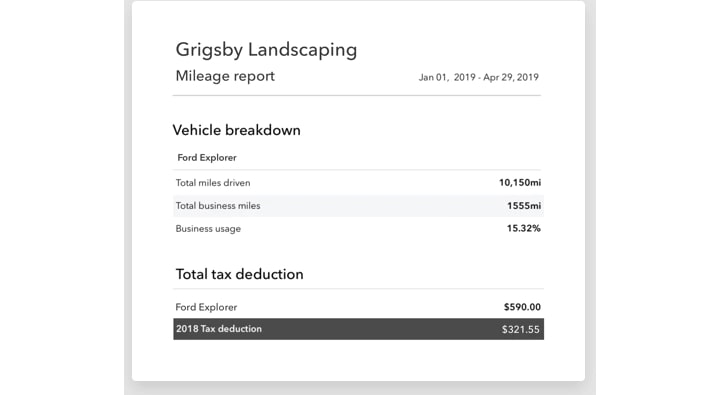

Mileage Tracking

The Track Miles feature helps users track business mileage.

Users can automatically track mileage by using their phone’s GPS and synchronize the data directly to their QuickBooks account.

This feature also allows them to categorize trips as business or personal, add notes, and attach receipts to each trip. This can be used for billing clients or calculating tax deductions.

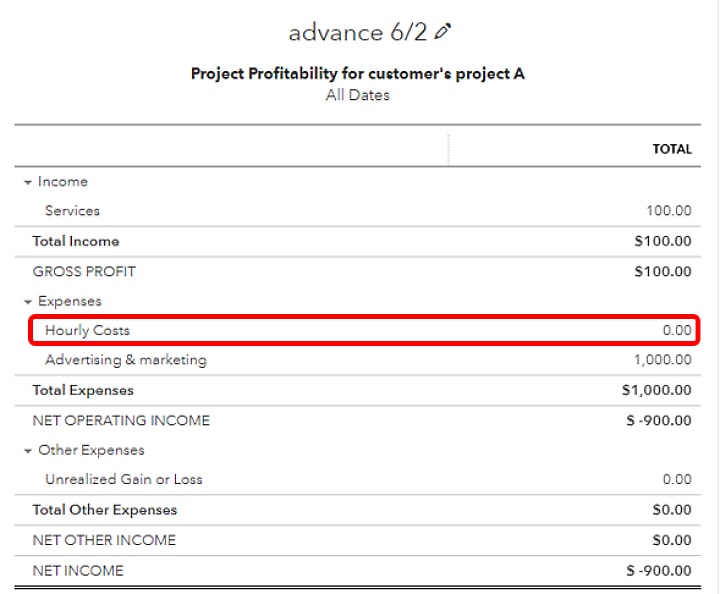

Project Profitability

With this feature, businesses can create projects within QuickBooks Online and assign them to specific customers or clients.

They can then track the time, expenses, and revenue associated with each project.

This feature also allows businesses to generate reports that provide insights into each project’s financial performance.

Plans and Pricing

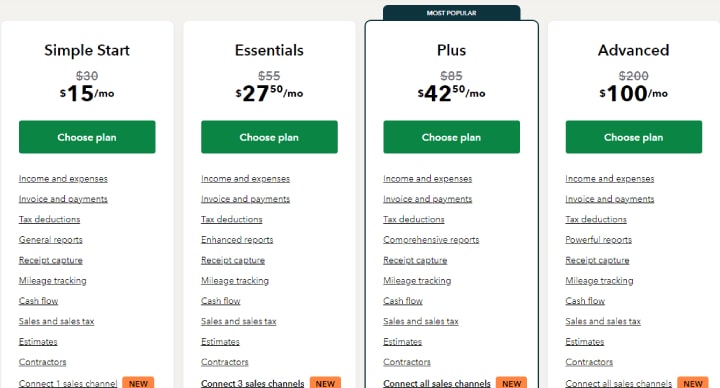

QuickBooks Online has four pricing plans and offers 50% off for the first three months. The plans are the Simple Start, Essentials, Plus, and Advanced.

The Simple Start plan is $15 per month for the first three months and $30 per month from the fourth month.

It includes features like income and expenses, tax deductions, general reports, and more.

The Essentials plan costs $27.50 per month for the first three months, and $45 per month after that.

It includes all of the features in the Simple Start plan, plus additional features like bill management and multiple user support.

The Plus plan costs $42.50 per month for the first three months, then increases to $84 per month.

It includes all of the features in the Essentials plan, plus additional features like inventory tracking and project profitability reports.

The Advanced plan is the final tier for $100 per month for the first three months, then reverts to $200 per month.

This plan includes all the features in the Plus plan, plus others like workflow automation and data restoration.

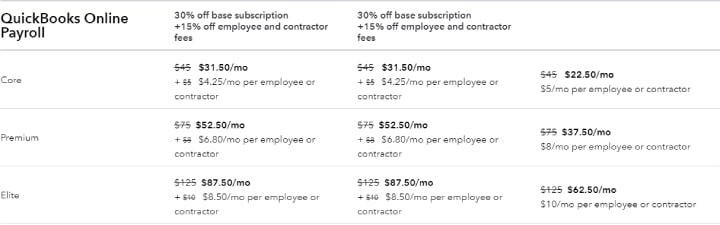

Payroll plans include Core, Premium, and Elite. The Core plan is currently $31.50 per month + $4.25/month per employee/contractor.

The Premium plan is $52.50 per month + $6.80 per month per employee/contractor. The Elite plan costs $87.50 per month + $8.50 per month per employee/contractor.

All plans allow automated tax payments and filing in all 50 states, paychecks and tax calculations, auto-payroll, and payroll reports.

While the Elite plan allows unlimited state filings, there is a $12 fee per additional state on the Core and Premium plans.

Both Premium and Elite plans offer same-day direct deposits. On these plans, you can also have an expert review your payroll setup.

Pros and Cons

Pros

- Comprehensive features. QuickBooks Online offers invoicing, expense tracking, payroll management, and inventory tracking, among others.

- Wide integrations. The software integrates with over 200 third-party applications, including payment processors, real estate agent CRM systems, and e-commerce platforms. This allows users to streamline their workflows and improve efficiency.

- Easy to use. The software is very easy to use both on desktop and mobile. There is also an array of support documents to help new users.

Cons

- There is a limit to the number of users per account on each plan. Each plan has a set number of users per account, which can be particularly challenging for businesses with multiple departments or teams. This may require purchasing multiple subscriptions or choosing a more expensive plan.

- Limited customization. Some users may find QuickBooks Online’s templates and customization options limited. While it is possible to customize invoices and reports, users may not be able to tailor the software to their specific customization needs.

Integrations

- PayPal

- Stripe

- Square

- Salesforce

- HubSpot

- Zoho CRM

- Gusto

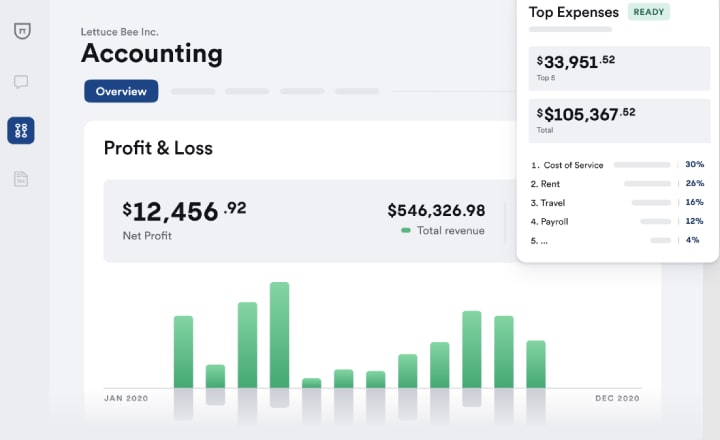

Xero — Accounting Software with the Best Analytics and Insights

Xero is a cloud-based accounting software tailored to small and medium-sized businesses.

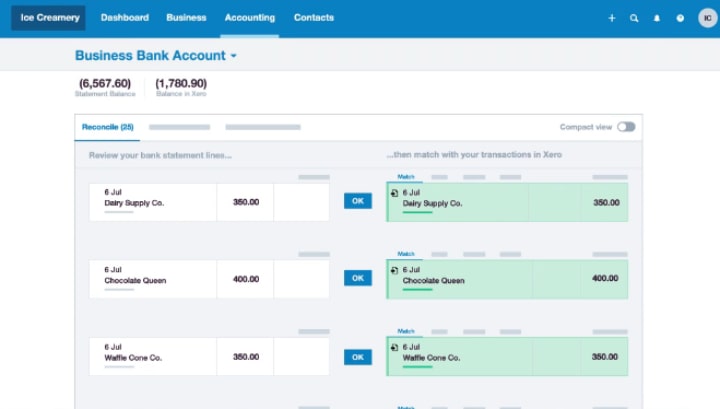

One of Xero’s most notable features is its machine learning algorithm that automates the reconciliation of bank accounts.

This learning algorithm matches bank transactions with invoices and bills, making bank reconciliation faster and more accurate.

Xero also offers invoicing capabilities that let you track payments in real time, create professional-looking invoices, and accept payments online through integrations with payment processors like Stripe and PayPal.

Features

Bank Reconciliation

This feature allows businesses to efficiently manage and reconcile bank transactions with accounting records.

This is done by using bank feeds, intelligent transaction matching, and reconciliation reports.

This real estate brokerage software also provides tools to investigate and resolve discrepancies between recorded and bank transactions.

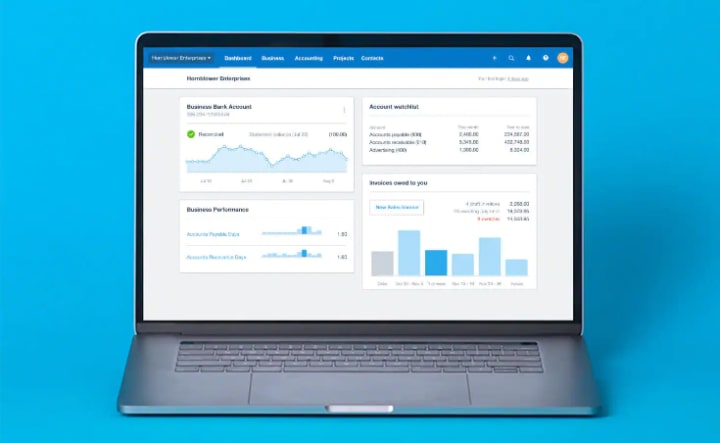

Accounting Dashboard

The accounting dashboard is designed to provide realtors with an efficient way to manage financial information.

The dashboard gives real estate agents access to key financial information such as bank balances and outstanding invoices, reports on bills paid, and a summary of income and expenses.

Agents can customize the dashboard to display the specific financial information they want to see.

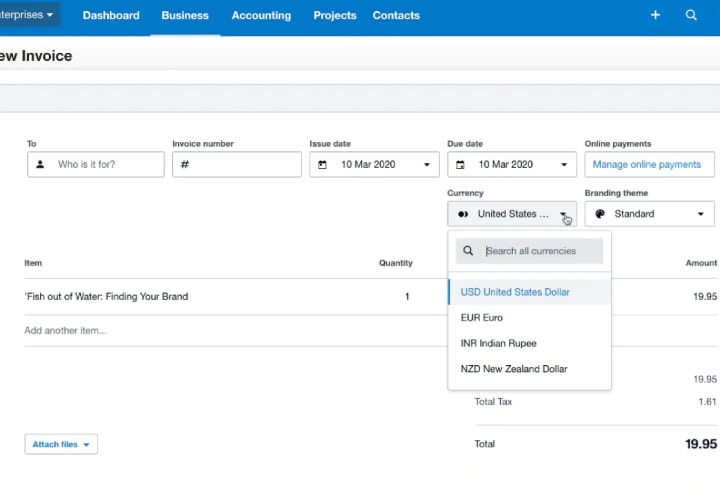

Multicurrency

Xero’s multicurrency feature allows businesses to transact with customers and suppliers in foreign currencies by giving users access to the latest exchange rate hourly from multiple sources.

You can use this feature to send invoices, bills, and quotes in foreign currencies.

Additionally, Xero’s multicurrency feature allows users to view reports and track their financials in foreign currencies by providing a comprehensive view of their international transactions.

Plans and Pricing

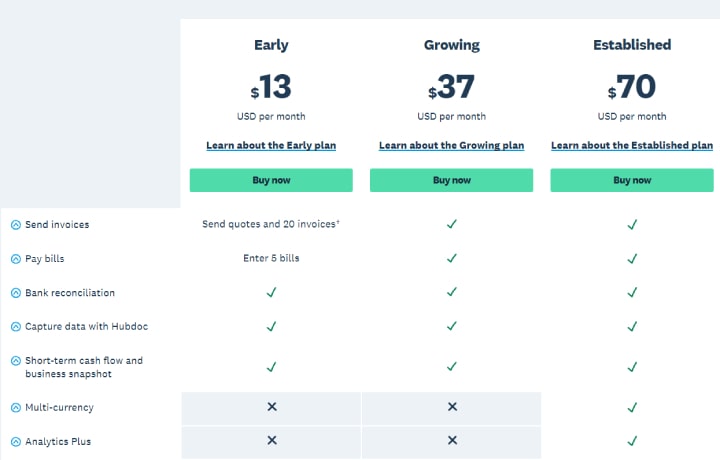

Xero provides three basic plans: the Early plan, the Growing plan, and the Established plan.

The Early plan costs $13 per month, and it includes features like the ability to send 20 quotes and invoices per month, enter five bills each month, reconcile bank transactions, and more.

The Growing plan costs $37 per month and includes all the features of the Early plan.

It also includes additional features like the ability to send unlimited quotes and invoices, enter unlimited bills, and reconcile transactions in bulk.

The Established plan is for established businesses. It costs $70 per month, and it includes all the features of the Growing plan, plus additional features like multicurrency, advanced analytics, project tracking, and more.

Pros and Cons

Pros

- Free 30-day trial. Xero offers a 30-day free trial that allows users to access all software features. Users can try out different functionalities to see if they meet their business needs.

- All plans support unlimited users. This allows you to invite as many team members, real estate accountants, or bookkeepers as needed at no additional cost.

- Hundreds of third-party app integrations. Xero integrates with a wide range of business applications, such as inventory management systems, payment processors, and customer relationship management (CRM) software. Agents can streamline workflows, reduce data entry, and improve productivity with these integrations.

Cons

- Quotes and invoices are limited to 20 per month. This may be a concern for small businesses that need to create more invoices regularly.

- Multiple currencies are only available on the highest subscription tier. This is a major drawback for small businesses that frequently deal with foreign currencies or have international clients.

- There is no telephone support. While Xero offers customer support through email, live chat, and an extensive help center, it does not offer customers telephone support.

Integrations

- Salesforce

- Shopify

- WooCommerce

- TSheets

- Harvest

- Gusto

- Zoho CRM

Bench Accounting — Best Outsourced Accounting Service for Realtors

Bench Accounting is a cloud-based bookkeeping and accounting software designed to help small businesses keep track of their finances.

One of Bench’s key features is that it provides users with a dedicated team of bookkeepers to manage their finances.

The team is made up of experienced professionals who provide personalized, expert advice, and support to help businesses stay on top of their finances.

Another standout feature is its custom reporting. This helps businesses generate customizable financial reports, including balance sheets, income statements, and cash flow statements.

Bench also offers other capabilities, such as account reconciliation and reporting.

Features

Monthly Bookkeeping

This feature helps small businesses manage their finances by providing monthly financial statements and expense overviews.

It gives users access to a bookkeeping team that reconciles bank and credit card transactions, categorizes expenses, and provides monthly financial statements.

Business owners can communicate with the bookkeeping team through the platform, making it easier to ask questions or get information.

Tax Advisory and Filing

Tax Advisory and Filing helps small business owners stay compliant with tax regulations and avoid penalties.

This is done by analyzing financial data from their business and preparing tax returns and statements.

This feature also provides personalized tax insights and advice, as well as filing services.

Catch Up Bookkeeping

The Catch Up Bookkeeping feature is designed for realtors and small businesses that have fallen behind on bookkeeping.

With this feature, they can outsource their bookkeeping work to Bench Accounting, which will then try to catch up on missing transactions.

Once all transactions are categorized, Bench Accounting prepares financial statements for the business, including a balance sheet, income statement, and cash flow statement.

Overall, this feature is useful for businesses behind on bookkeeping by less than two years.

Plans and Pricing

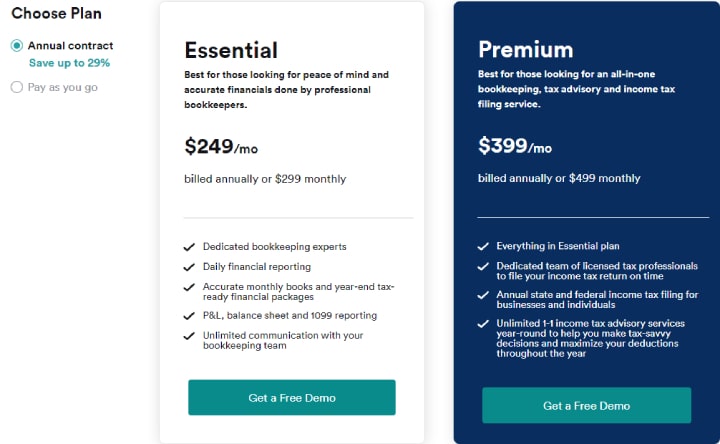

Bench Accounting offers two subscription plans: Essential and Premium.

The Essential plan costs $349 per month, or $2,988 annually. It includes features like dedicated bookkeeping experts, financial reporting, accurate monthly books, and year-end tax-ready financial packages, P&L, balance sheet, and 1099 reporting, among others.

The Premium plan costs $499 monthly, or $4,788 annually. It includes all of the Essential plan features, plus a dedicated team of licensed tax professionals to file your income tax return on time.

It also includes unlimited one-on-one advisory services year round to help you make tax-savvy decisions and maximize your deductions throughout the year, annual state and federal income tax filing for businesses and individuals, and more.

Pros and Cons

Pros

- One-month trial. Bench Accounting offers a free 30-day trial of its services to new customers. This allows users to test the platform’s capabilities before signing up.

- Unlimited in-app messaging and calls with your bookkeeper. This means you can ask questions, get advice on financial matters, and make payments anytime through the app.

- Access to booking experts. Bench Accounting is one of the best accounting software for realtors offering a team of dedicated bookkeeping professionals to help you with your accounting needs. Its trained staff can provide guidance and answer questions, ensuring your financial records are accurate and up to date.

Cons

- Lack of integration with some financial services. While Bench Accounting integrates with most major banks, it does not integrate with smaller, local banks or credit unions.

- Their categorization process requires multiple corrections. There have been several complaints from different users about their auto-categorization. Some customers have complained about the software not categorizing transactions based on their recommendations or instructions.

- No mobile app. Although the platform is accessible via mobile web browsers, there is no mobile app. Without an app, users may find it harder to manage their finances on the go or stay on top of bookkeeping tasks while away from their computer.

Integrations

- FreshBooks

- Gusto

- Xero

- Square

- PayPal

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.