How Soon Can You Sell a House After Buying It in 2024?

Anyone who’s ever bought a property begins to wonder at some point if they have made a profit from their investment – and if the time is right to sell.

In the case of quickly escalating prices, my real estate clients often wonder how quickly they can sell a house and still make money.

This article will help you understand the specifics of how fast you may want to sell your home and a few important items to consider when doing so. Let’s get started.

How Quickly Can You Sell a House After Buying It?

Legally speaking, once your name is on the property title and you are the legal owner of a property, you can sell it whenever you want. In the case of a quick turnaround between buying a home and selling it, as a real estate agent, I typically see 2 basic scenarios:

- You’d like to sell to make a profit by selling your home fast;

- You have to sell fast due to life changes such as a job transfer, divorce, or market forces.

If you’d like to sell for a profit, you have more flexibility in your timing. If you have to sell, then you’re most likely going to set your timing based on external influences.

How long you should own a house before selling it depends solely on your situation and financial goals. Let’s look at the specific factors that you will percolate on when deciding to sell.

What Factors to Consider When Deciding on When to Sell Your Home?

Whether or not to sell a property at any given time is an individual decision. Your personal circumstances will determine the timing of a sale. Here are the most important items to consider prior to selling:

1. Your Equity Position

“Equity” means how much money you will actually get to walk away with after the sale. Your equity in a property simply means what percent of the property you own versus the percent that your lender owns.

The greater your equity stake – the more of the proceeds from a sale will go into your pocket.

When prices are rising, your equity is growing most quickly over time. If the increase in home values stays relatively constant, you will have gained some more equity after 6 months, even more after a year and even more after 2 years.

Remember too that as long as you are making mortgage payments, you are gradually paying down your loan. Therefore, every month, little by little, you are gaining more equity in your home.

You also need to calculate when it’s more profitable to sell the house than if you rented it all this time. This point is referred to as “breakeven horizon”.

When buying a home, you invest more money than just the down payment. This includes closing costs, out-of-pocket expenses like inspections and appraisals, moving expenses, etc.

So before selling your property and having these expenses paid off, you need to build enough equity in it first.

Depending on your location, mortgage terms, property price, local market dynamics, and other factors, the breakeven horizon can be generally achieved in about five years after buying the property.

2. The Relative Position of the Local Real Estate Market

Is your local real estate trending up in value, down in value or staying level? As just mentioned, rising prices usually buy you more time to sell while lowering values reward a quicker sale.

External factors affecting property value in your location may be changing crime rates, commercial real estate developments either causing inconveniences or making the area more comfortable, etc.

For those who want to learn more, Porch.com give a rundown of external factors affecting your property’s market worth.

Internal factors include the technical condition of your home, its appearance, and features. To increase your home value, make it more desirable, and sell it quicker, you can make repairs or improvements.

Be careful with improvements though. Some features may seem a valid value add while they will not necessarily help you sell your house faster.

For example, do solar panels increase home value? They do. But do the majority of buyers want a house with them installed? No, because they present restrictions on your energy consumption and require maintenance.

3. Federal Capital Gains Tax

Taxes play a large role in real estate transactions. If you decide to sell a home fast, you’ll end up paying taxes on any profit you have made.

I’m not a CPA, and tax laws vary by locality in the U.S. Plus they are constantly being updated by the government. So, you should always review your individual tax situation with a tax professional.

But now, we’ll take a look generally at Federal Capital Gains Taxes since they apply nationally in the United States.

Primary Residence

Living in a home during the two of the last five years gives you a BIG tax advantage: you get to keep more of your profits or sometimes not pay the CGT (Capital Gains Tax) at all.

Capital Gains Tax generally means the tax on any profit from selling your property at a higher price than it was bought for (cost basis).

We will not get into calculating your capital gains tax, but keep in mind that the improvements and closing costs are also involved in the calculation, reducing your tax basis.

If you have owned the home as your primary residence for the last two years, you may exclude $250 000 from the taxable income as a single owner. If you are married and filing taxes jointly, you may exclude $500 000.

There are certain requirements that must be met, however. For example, when filing jointly, both you and your spouse must have lived in the home for at least two years without long-term absence.

In this is not the case, a $250 000 exemption is given to each spouse separately.

Consult with a licensed tax attorney for the details. But we already see that selling your primary residence after a minimum of two years lets you save a considerable amount of money.

Investment Property

For investment property, such as a rental home, other laws apply. If you are planning on selling your home after you have owned it for less than one year, you will be subject to Short-term capital gains tax.

The rate will be roughly equivalent to the tax rate you pay on your ordinary income. Hold onto your home for more than 1 year, and you get a tax break from the Federal Government.

Your profits will be taxed at the much more favorable Long-term capital gains tax rates. These rates are usually in the 15-20% range. And if you get up to $40 000 in profits (in 2020), you don’t have to pay the long term CGT at all.

While not directly related to the topic of this article, it’s important to note that if you are selling your investment property in order to reinvest all the proceeds in another investment property, you may want to benefit from a 1031 tax deferral exchange on a second home.

This mechanism allows you to defer the capital gains tax completely or most of it when completing the exchange by following certain rules defined by the IRS.

4. Loan Prepayment Penalty

You should always check your payoff balance with your lender prior to selling your property. While it’s currently rare, there are some lenders that may charge you for paying your loan off early.

Even if they don’t charge you a prepayment penalty, you should check with the lender to understand the final payoff balance at around the date you expect to sell.

5. What Will You Do with the Money?

If you are fortunate enough to be earning a profit from your home sale, you’ll want to consider what to do with that cash. Is there a compelling alternative investment that will be a better place to park your money than your current home?

For example, you might have come across an attractive and rare investment opportunity that doesn’t wait. You can sell your house at a loss now and invest the proceeds, which would make more sense than waiting until selling your home itself becomes profitable.

How Much Equity Should I Have in My Home Before Selling It?

The amount of equity you need to have when selling your house depends on the market value of your home and your financial goals. For example, if you need to sell your house and move to another one, you need to:

- Subtract the loan balance amount from the estimated selling price of your property.

- From the received amount, subtract all expected expenses related to the sale of your house (renovations, closing costs, realtor fees, etc),

- From the received amount, subtract all expected moving expenses.

- From the received amount, subtract the Federal and State Capital Gains Tax amounts (if applicable).

- From the received amount, subtract all expenses related to a new home purchase (down payment, inspections, estimated closing costs, etc).

If the final figure is negative, it means that proceeds from selling your house will not cover the cost of your relocation plan. Therefore, you need to accumulate more equity.

In other words, to understand if you have enough equity to sell your house, you need to estimate the cash amount you will walk away from the sale with, and see if it will cover your further expenses and needs.

When Is It Better Not to Wait to Sell Your Home?

Selling your home fast after buying it may make sense for certain situations, even despite the benefits described above. For example:

- You think the market has clearly peaked and want to lock in profits.

- The real estate market has suffered a shock and prices are dramatically falling.

- Your income can no longer support the loan payments and upkeep.

- You have added significant value to the home and can sell for a large profit over your investment.

- You’ve undergone life changes such as a relocation or divorce.

Let’s take a closer look at the least obvious of the aforementioned reasons to sell your property as soon as possible.

“Flipping” as a Timing Strategy

During the real estate boom in California from 2002-2006, prices were escalating so quickly that simply buying a home and living in it for a year while doing NO improvements could yield a 20% price increase upon sale a year later.

A more common scenario with quick turnarounds on properties is purchasing a property which needs repairs or updating. By taking care of the deficiencies of the home, the buyer has now added value to the original property.

Similarly, if a home is smaller and the buyer adds square footage, this is also adding value. This is the strategy behind “flipping” a property.

In the case of a house flip many real estate investors (also referred to as rehabbers) prefer to sell quickly to capture short term gains. This is a clear example of adding significant value and then opting for a quick sale.

The Dynamics of a Rising or Falling Market

If prices are rising quickly (considered a “seller’s market”), then selling later rather than sooner yields more profit. In the case of a rising market time is on your side. One note of caution here: prices can move from rising to falling rather quickly.

So trying to time the “peak” is very difficult. If prices are rapidly falling (“buyer’s market”), then time is of the essence and a quick sale might be the best solution.

That’s because every month prices are falling and you’ll only get a lower price by waiting to sell.

How to Sell Your House Fast

If you are in one of the situations mentioned above and looking for advice on selling your home ASAP, here are the factors that make a sale more straightforward.

The absolute quickest sales are usually all cash sales with no contingencies—when the buyer has cash so they don’t need to get a loan from a bank. This type of sale can close escrow in as fast as 10-15 days.

Any time that a loan is involved, the sale will take longer. That’s because the lender will request the buyer to order a formal appraisal (which is why getting an appraisal before selling your home isn’t a good idea: the lender will do their own and won’t accept yours anyway) and will want to properly vet the borrower by pulling tax documents, pay stubs, credit scores and other financial records.

A normal time period for a quick sale requiring a mortgage plus appraisal and loan contingencies is 30 days for close of escrow.

A cash sale can take just about two weeks. If you are in a situation where you need to sell your house fast, consider selling to reputable companies that buy houses for cash near you.

The longest potential sale happens when the buyer has to sell another property in order to buy your property. This will mean an escrow period for the buyer to sell their own property and then a standard escrow to buy yours.

However, what if their home doesn’t sell quickly? Maybe it’s priced too high. Perhaps it’s in an undesirable neighborhood. Maybe it has deferred maintenance and needs repairs. This can potentially delay the sale of your property.

For this reason, most sellers in a healthy real estate market won’t consider a sale which is contingent on the buyer selling another property first, except as a last resort or if there is a significant price premium to compensate for the risk.

Remember too that if you can deploy your capital more efficiently elsewhere, sometimes selling at a loss now is preferable to selling at a larger loss later. Warren Buffet, one of the most astute investors of our age, famously said:

Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.

How to Calculate When It Makes Sense to Sell Your House?

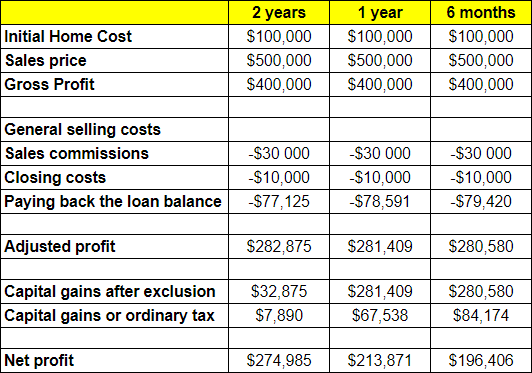

Here are 3 examples to help you understand the basic differences between selling a house in 2 years versus 1 year or 6 months.

In our example you have purchased a home for $100,000 as your primary residence, have lived in the home continuously since purchase, and you are single.

You put down 20% as a down payment and borrowed $80,000 for 30 years at a fixed 4% interest rate. We’ll assume that the home has increased in value to $500,000 for each time period.

For this example we’ll assume that you are in the 30% federal tax bracket.

Here is a simplified spreadsheet to summarize the outcome of selling your property after 2 years, 1 year or 6 months. The profit numbers are exaggerated to clearly illustrate the differences.

Selling Your House After 2 Years

After 2 full years of living in the home and selling it for $500,000, you get to keep $274,985. Well done!

You avoided almost $80,000 of capital gains tax by living in the home for 2 of the past 5 years. You’ve also paid down more of the money you borrowed, so you get to keep that too.

Selling Your House After 1 Year

Is it bad to sell your house after one year? Generally, it’s definitely worse than after at least two!

You can clearly see from our financial example above that after one year you haven’t yet qualified for the capital gains benefit of having lived in the house for at least 2 or the past 5 years.

Since this benefit yields $250,000 in saved capital gains, you are pocketing significantly less money. Just $213,871 versus the $274,985 you would make if you waited another year before selling.

Selling Your House After 6 Months

Just 6 months after buying you have sold your home. As mentioned previously, you are now subject to short-term capital gains tax, so any profits will be taxed the same as your ordinary income.

You also won’t qualify for the $250,000 deduction that you would get if you had lived in your home continuously for at least 2 years.

That means you’ll be pocketing around $196,406. However, if you had waited another 18 months to sell at the same price, you would be keeping a full $78,579 more.

How Soon Can I Sell My House After Purchasing It with an FHA Loan?

One final note about selling quickly if your home was purchased using an FHA loan. The FHA is designed for longer term home ownership and the government has built in restrictions on resale to prevent “quick flips”.

Specifically, the FHA holds “a property that is being resold 90 days or fewer following the seller’s date of acquisition is not eligible for an FHA-insured mortgage.”

In other words you simply cannot sell a home in 90 days or less if it was purchased with an FHA loan.

Conclusion

I hope now you have a better understanding of how long after buying a house you should wait to sell it with the maximum profit or at least minimum loss in your particular situation.

Selling your home quickly can yield great profits and benefits if timed well. There are many reasons to sell a home from locking in profits to profound life changes.

Taxes are a big consideration and a well qualified tax professional can help you save big money by outlining the tax implications of the timing of your sale.

For many people, the purchase or sale of a home is one of the biggest financial decisions of their lives. Be sure to go into the process armed with all the knowledge you can!

___

About the Author

Derek Vaughan lives in Los Angeles and is a seasoned realtor in South Pasadena. Known for his expert knowledge of digital marketing and the local real estate market, Derek has lived in South Pasadena for the past 20 years. Derek has also worked for the Walt Disney Company where he was responsible for digital marketing for both the ESPN.com properties and the NASCAR online store. He also holds degrees from the Indiana University School of Music, Purdue University and an MBA from Vanderbilt University.

___

If you too want to contribute your expert advice on a topic of your expertise, feel free to apply to our Expert Contributor Program.