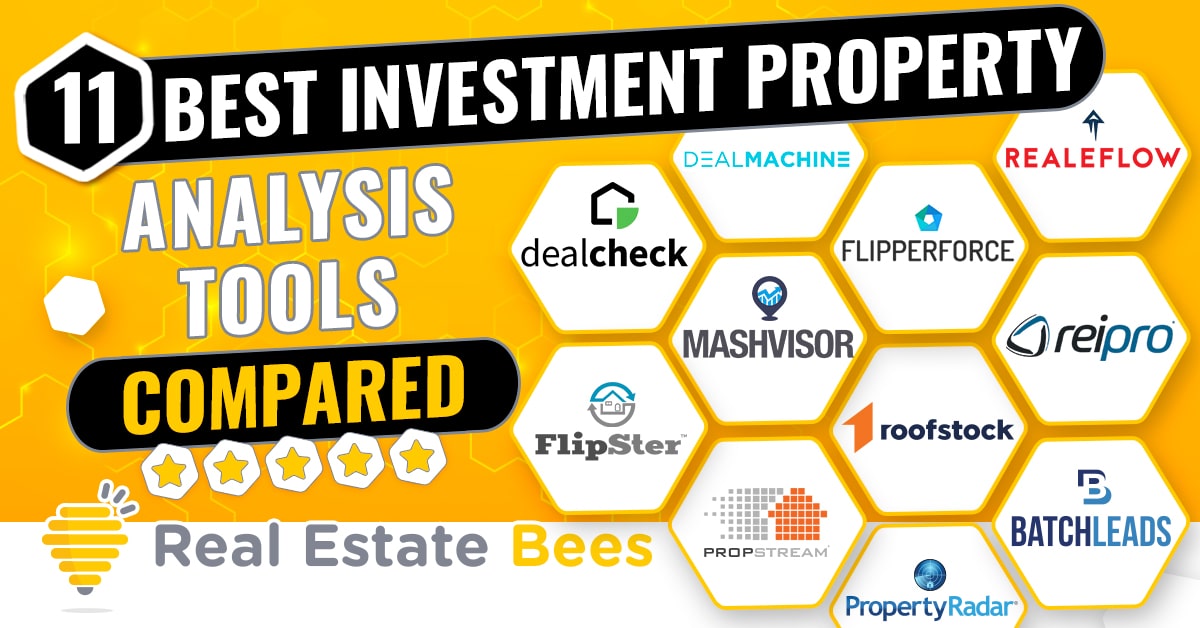

11 Best Real Estate Investment Property Analysis Software Tools (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate investors to share their expertise on the best investment property analysis tools to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best residential and commercial investment property analysis software tools and evaluated them based on critical factors that are important for real estate investors. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

PropStream

PropStream is a leading real estate lead generation and data provider with access to more than 150 million properties in the US.

The platform provides services for a range of real estate professionals: investors, brokers, property managers, and others.

PropStream offers one of the best property investment analysis software tools available.

Features

- PropStream analysis wizard helps you generate essential mortgage analysis, rental analysis, expense analysis, cash flow, and tax reports in an easy-to-read PDF format.

- Property comps. You can analyze comparable properties from public records and different local MLS platforms. The property comps feature provides data on recently sold properties in the same neighborhood, their average days on market and sale prices.

- Rehab estimator. Fix and flip investors will benefit from this tool since it estimates the cost of repairing a property. All you’ll need to do is enter the types of repairs and select the quality of materials you’ll want to use, and the tool will give an estimate of total project costs for your region.

If you already want to learn as much detail as possible about this tool, read our in-depth PropStream review.

Plans and Pricing

PropStream costs $99 per month with a 7-day free trial. The offerings at this price include:

- web and mobile app usage

- nationwide property data

- more than 120 lead filters

- county records + MLS Comps

- 10,000 property downloads per month

- daily list monitoring

Other offerings include the list automaton add-on for $27/month and $0.10 for skip tracing per property.

To compensate for your expenses, the company offers a real estate analysis software affiliate program.

Pros and Cons

Pros

- PropStream is one of the easiest property investment analysis software tools to use. It doesn’t require months of training to use as the interface of the software is made as simple as possible.

- With a database of more than 153 million properties, PropStream has some of the most accurate nationwide real estate data available. And its analysis reports are very comprehensive.

- The PropStream app is available on both iOS and Android devices.

Cons

- There’s a bit of a learning curve.

- It’s costlier than some of the other tools on this list.

- MLS and property owner data isn’t usually up-to-date.

Integrations

No known integrations.

Expert Insight

What do you like about this app?

PropStream is fast, and you can skipjack a list without exporting it from the software.

Given the amount of stale data across all services we’ve used, we believe there’s a lot of room for improvement in the world of skip tracing. Having said that, we prefer PropStream as we find it’s higher quality and more cost-effective. And since we use this service for property research, we also find it to be more convenient than other paid skip tracing software.

The data in PropStream has empowered my company to strategically communicate with our target audience.

BatchLeads

BatchLeads is one of the investment property and wholesale real estate lead generation services offered by BatchService. It is one of the leading real estate prospecting tools.

BatchLeads services a wide range of real estate clients ranging from different types of real estate investors to realtors and brokers, as well as mortgage lenders and property contractors.

It helps clients generate seller leads, conduct property evaluation as a part of the investment property due diligence checklist, real estate marketing, and works as one of the best driving for dollars apps.

Its investment property analysis tools rank among the best available in the market.

If this sounds like what you are totally looking for, we prepared an in-depth BatchLeads review for you.

Features

- Comps calculator. BatchLeads’ comping tool allows users to see the value of similar nearby properties by using a built-in value calculator that incorporates data from local multiple listing services.

- Reports. Generate professional comparable sales reports to share with buyers and sellers to validate offers.

- Owner profiles. Owner profiles offer a snapshot of the property owner’s or investor’s real estate portfolio, including valuation and equity data.

Plans and Pricing

- Personal Basic. This plan costs $99/month or $828 annually. It is for both casual and full-time real estate investors and professionals looking for more deals. The plan offers 1 workspace and 2 users.

- Personal Plus. This plan costs $299/month or $2,148 annually. The plan is for experienced investors, lenders, and other real estate professionals who want to engage in outbound sales and marketing efforts. It offers 1 workspace and 3 users.

- Team Basic. This plan costs $599/month billed annually. It is for investment, real estate brokerage, and property service teams that need larger lead demands. It provides separate workspaces, up to 5 workspaces, and 10 users per workspace.

- Team Plus. This plan costs $899/month billed annually. It is targeted toward organizations that support multiple teams or locations. The plan allows you to customize plans to fit your business needs. This plan allows up to 10 workspaces and about 20 users per workspace.

All the plans offer the same features, including cash investor search, MLS data, advanced property searches, skip tracing, comps, and more.

But SMS campaigns, lead scoring and, click-to-dial, mortgage rate & type filters are not available on the Personal Basic plan.

Also, only the team plans come with team features, including a dedicated customer success manager, team management, and business reporting features.

Pros and Cons

Pros

- Easy to use

- A+ customer service

- Real estate affiliate program to earn extra by bringing new clients to the platform.

Cons

- It is difficult to cancel subscriptions, judging from some BatchLeads real estate investment analysis software reviews.

- Expensive for solo investors and small teams.

Integrations

- Zapier

- Podio

DealCheck

Use REALESTATEBEES promo code during the checkout when signing up to any of the paid plans and get 20% off!

Anton Ivanov founded DealCheck in 2015 as a replacement for most of the out-of-date real estate investment analysis tools being used by investors at that time.

Presently, DealCheck is used by more than 250,000 real estate investors, realtors, brokers, and property wholesalers across the world as a property investment analysis software.

Whether you are using one of the real estate crowdfunding sites or other means to invest in real estate, it is one of the best and most popular real estate investment calculator apps to assess your potential investment’s success.

Features

- Sales & rental comps. The DealCheck app provides users with up to 20 sales comps, rental comps, and market statistics for any property to help them estimate ARVs and potential rents.

- Cash flow and investment returns. This residential and commercial real estate software solution assists users in analyzing potential cash flow and profits, as well as the required acquisition capital for traditional and short-term rental properties.

- Cash flow projections. DealCheck is a top commercial real estate investment analysis software, providing users with up to 35-year projections of cash flow, investment returns, equity accumulation, and tax deductions on investment properties.

If this sounds like what you need, study this tool closer by reading our full DealCheck review.

Plans and Pricing

- Starter. The starter plan offers access to the real estate investment analysis software for free. The plan offers up to 5 sales & rental comps, up to 5 property templates, 5 property photos, and 15 saved properties.

- Plus. This plan costs $14/month or $120 annually. This plan includes up to 50 saved properties, 15 photos, 10 sales & rental comps, and 10 templates. The plan also offers updated property records & listings and an offer calculator.

- Pro. This plan costs $29/month or $240 annually. It includes unlimited saved properties, unlimited sales, and rental comps, as well as unlimited property templates and property photos. It also includes property reports with custom branding and customized sales and rental comps.

Pros and Cons

Pros

- DealCheck has one of the best investment property analysis calculators. With a single click, you can transition from flip to BRRRR to wholesaling.

- DealCheck is a highly efficient property investment analysis software.

- There is a desktop-based version of the software as well as iOS and Android mobile apps.

Cons

- The software does not have tools for bulk batch analysis of investment properties.

Integrations

- RentCast, a software for tracking rent changes, rent statistics and rental property performance, owned by DealCheck.

REIPro

REIPro is a real estate investing solution founded by Chris Goff, one of the foremost REI educators in America, and Bo Manry, an expert software engineer.

It offers services ranging from real estate investor lead generation to direct mail, real estate marketing, and investment property analysis.

The workflow system of REIPro is the investment property analysis tool offered by the platform.

Learn all details about the tool from our REIPro review.

Features

- Property information: REIPro provides users with detailed property information, including current MLS sales comps for all 50 states.

- People finder: REIPro offers a real estate skip tracing feature that allows users to find the names of property owners, family members’ names, phone numbers, and emails.

- Repair cost estimator: REIPro also provides its users with property inspection forms and a cost estimator that helps users fairly and accurately determine the repair costs of properties.

- Sales comps: REIPro offers sales comps to help users determine the after repair value (ARV) of properties.

Plans and Pricing

REIPro offers a single-user plan that costs $69/month, billed annually or $99/month, billed monthly.

The standard plan offers access to nationwide lead sources, including absentee owners, vacant properties, cash buyers, pre-foreclosures, commercial properties, and more.

In addition to that, users get access to:

- an executable 10-step deal workflow system

- MLS Comps

- owner information

- deal analyzer

- real estate email marketing software features

- direct mail marketing for real estate wholesalers

- bulk skip tracing

and other features. It offers 2,500 monthly data exports.

For up to 5 users, REIPro’s Standard Plus plan costs $99/month.

This plan offers everything in the standard plan along with a couple of advanced features:

- 10,000 monthly data exports

- 100 premium phone credits

- 25% off all postcard prints

REIPro’s team plan allows for a maximum of ten users. It costs $167/month, billed yearly or $249 per month.

This plan includes all of the features in the Standard Plus plan and adds team management tools, including:

- impersonate feature

- admin-level permissions

- personal customization options

- ability to isolate users, and

- 20,000 monthly data exports

Pros and Cons

Pros

- REIPro offers a 10-step investment workflow system to guide new investors through the process of selecting, researching, and managing investments.

- REIPro is designed to be easy to navigate, making it a user-friendly software program.

- The REIPro software streamlines the direct mail marketing process for real estate investors by providing transcripts that can be easily customized.

Cons

- REIPro is a web-based desktop platform. There is no mobile version available.

- The software is expensive.

Integrations

- Zapier

- HubSpot Marketing Automation

- HubSpot CRM

- ClickFunnels

- Trello

- Squarespace

- Podio

- ClickSend

- WordPress

- Slack

- Microsoft 365

- Google Workspace

DealMachine

DealMachine was founded by David Lecko in 2019. One year after launching, the app recorded more than 30,000 downloads.

DealMachine is currently the highest-rated real estate investor app for lead generation on both the Apple App Store and Google Play Store with a rating of 4.8 and over 3,500 combined reviews.

Also, in 2021, they were ranked 36 on the Inc. 5000 America’s list of fastest-growing private companies.

Although DealMachine provides some important data, it isn’t primarily a real estate investment evaluation software.

DealMachine provides you with the following property data:

- owner’s name

- equity percentage

- each home’s last sale price

- tax assessed value

DealMachine is also a tech and data platform for real estate investors that provides skip tracing tools for real estate investors, driving for dollars app, and list building features.

Features

- Comps. DealMachine lets you compare recently sold properties that are similar to the ones you’re looking at. You can set the date range and mile radius for more accurate estimates.

- Street pics. This feature is for investors who want to include pictures with their postcards. It automatically adds images of properties to the postcards you send out.

- Enhanced Search. This feature gives you access to additional mailing addresses, phone numbers, and email addresses for a contact.

Plans and Pricing

- Starter plan is targeted toward part-timers and beginners. The plan costs $59/month or $590 annually. It allows only one user. The plan offers up to 10,000 leads for those trying to find houses to wholesale or buy cheap, a driving for dollars feature, MLS & county comps, and direct mail tools for as low as $0.64.

- Pro is for the run-of-the-mill real estate investor. It costs $99 per month or $990 annually. The plan allows up to 5 users per subscription. It offers 100,000 leads to help you with buying distressed properties, a driving for dollars service, daily data updates, 10,000 exports per month, and mailing for as low as $0.59. The plan also features 10 custom fields and custom pipelines.

- Team. This plan is designed for teams or individuals with 20 or more deals. It costs $299 per month or $2,990 annually. The plan allows up to 10 users. It offers up to 500,000 leads. It also includes 100,000 exports per month, as well as mail for as low as $0.54.

DealMachine offers a free 7-day trial for any plan of your choice.

Pros and Cons

Pros

- Easy to use.

- Very accurate property data. The platform claims to have 96.5% accurate owner information data.

- Top-notch customer support.

Cons

- DealMachine charges extra for property comps and street photos.

- Aside from the comps tool, it has no other feature for deal assessment.

Integrations

- Zapier

- Email by Zapier

- Mailchimp

- Mojo

- Podio

- Slack

- Google Sheets

- Keap Max Classic

- Asana

PropertyRadar

In 2007, Sean O’Toole, a real estate professional, launched ForeclosureRadar after sensing a foreclosure crisis.

By 2013, the company was relaunched as PropertyRadar. The company helps real estate professionals and investors transform public records into opportunities.

PropertyRadar offers a variety of real estate analysis information, including property data, owner information, and community data.

Features

- Heat map. The PropertyRadar heat map is a quick way to identify opportunities in a local market by using various filtering criteria. Once you’ve found a location with opportunities, you can use the Draw tool to draw a box around it and select it for further analysis.

- Interactive Property Profiles. If you enter the subject property address in the search bar, you can access a plethora of information on the property. You can even print out a one-page overview of this information for negotiation purposes.

- Comps. PropertyRadar’s comparables tool displays the most recent sales and listings in your area, giving you a perspective on what comparable properties have sold for recently, and getting you amazing insights into local area trends.

Read our full PropertyRadar review to learn more detail.

Plans and Pricing

- Essential. The plan costs $59/month or $588 annually. The plan features nationwide property and owner data. It also features 1,000 property detail exports via csv files. It costs $0.05 per additional export.

- Complete. The plan costs $99/month or $948 annually. The plan features everything in the essential plan plus premium property and owner data, Zapier integration, and 10,000 property detail exports via csv files. Additional exports to Excel costs $0.01 per export.

- The custom package allows you to structure your package. You can contact the PropertyRadar sales team to inquire about this package.

Pros and Cons

Pros

- PropertyRadar offers a vast array of market lists.

- PropertyRadar uses heat maps to help users identify target markets with huge potential. Data is easy to read and visually appealing.

Cons

- The software doesn’t give room for many comps filter options.

- Users cannot easily remove duplicate entries from different lists.

Integrations

PropertyRadar integrates with over 4,000 applications through Zapier, and some of the most common integrations include:

- Print and direct mail services for real estate investors: PRINTgenie, Addressable, YellowLetterHQ, Click2Mail, PostCardMania, Handwrytten, Thanks.io, and Lob.

- Phone dialers, voicemail, and SMS text message marketing for real estate investors: Slybroadcast, Mojo, ClickSend, and CallFire.

- CRM for real estate investors: Salesforce, Pipedrive, Freshsales, Zoho CRM, Follow Up Boss, Wise Agent, LionDesk, and Realvolve.

- Email marketing & marketing automation: HubSpot, Mailchimp, Klenty, and AWeber.

- Productivity & project management: Trello, Podio, monday.com, and Asana.

FlipperForce

FlipperForce was founded in 2018 by Dave Robertson, an expert house flipper. The software was created from the House Flipping Spreadsheet, which Dave had created earlier in 2013.

In 2022, the software was acquired by Fund That Flip.

The FlipperForce software is currently being used by over 100,000 house flippers and real estate investors across the US.

The software offers a variety of features, and its flip analyzer is one of the best real estate investment analysis tools available in the market.

Features

Some of the features of FlipperForce include:

- House flipping calculator allows users to calculate the maximum purchase price they should offer for a property by analyzing project costs.

- BRRR calculator helps users analyze the short-term and long-term returns on BRRR deals.

- Rehab estimator. With FlipperForce’s rehab estimating software, users can estimate rehab costs without a contractor.

- Real estate comps tool. Users can choose the best comparable sales for a property and use them to accurately predict its after-repair value.

- Investment report builder. FlipperForce helps its clients build professional investment reports to gain credibility and get funding for their rehab projects.

For those who wants to look into this software, we wrote a comprehensive FlipperForce review.

Plans and Pricing

- Rookie is targeted toward those who are only getting into flipping houses. It is free for your first five projects. The plan features 1 user account, allows up to 5 projects, and it features deal analysis and repair estimation tools.

- Pro is targeted towards solo flippers. It costs $33/month, or $300 annually. The plan allows 1 user account and 50 active projects. It offers the same deal analysis and repair estimation features as the rookie plan plus nationwide property and owner data, project management, and project accounting.

- Business focuses on project management and accounting software for small real estate business. It costs $50/month, or $480 annually. The plan allows up to 5 user accounts and 100 active projects. It comes with everything in the Pro plan plus team features and access controls.

- Enterprise is targeted towards large teams. It costs $80/month, or $720 annually. It features unlimited users, unlimited projects, and everything offered in the business plan.

FlipperForce offers a free 30-day trial for whichever plan a client chooses.

Pros and Cons

Pros

- FlipperForce offers a variety of flipping and wholesale real estate software tools, including the Rehab Estimator and the House Flipping Calculator.

- Reports produced by the software are easy to read.

Cons

- It is solely web-based which makes it hard to use on mobile devices.

- To change a single piece of data during a flip analysis, you must go through all of the questions, thus making the process quite cumbersome.

Integrations

- Zapier

- QuickBooks

- Google Calendar

Flipster

Flipster is another property investment analysis software worthy of mention. This house flipping app was created by the real estate investor Jerry Norton as a tool for locating, funding, and flipping houses.

The software offers access to property data for more than 150 million properties nationwide. The data includes:

- absentee and out-of-state owners

- cash buyers

- mortgage and hard money lenders

- foreclosures

- pre-foreclosures

- MLS leads

- Craigslist leads

- REOs

- vacant houses, etc.

Features

Some of the features of Flipster that relate to investment property analysis include:

- Comps: Flipster offers a list of comparables on every property so that users can estimate their property’s value. There is also additional information available in the comps report, such as photos, year of construction, and price of comparables.

- Property workflow: The software features a workflow system that guides newbie real estate investors through every step of real estate investing.

- Flipper score: This feature is based on a proprietary algorithm that ranks discounted MLS properties according to their property value.

- Instant deal analyzer: A deal analyzer that presents the numbers on any house, and calculates the best offer price for users.

- Offer generator pro: This allows you to make offers within minutes. You’ll need to enter some basic information about a property, and Flipster generates a purchase & sales agreement that you can print out or send out to sellers or team members.

Learn more about these and other features of the tool from our Flipster review. Also, read about its real estate affiliate program through which you can earn an affiliate fee by referring new users to the platform.

Plans and Pricing

- Basic: This plan costs $97/month, and it features 10,000 leads per month for those trying to find cheap homes to flip, motivated seller leads, cash buyers, private lenders, deep skip tracing, Flipster comps, and instant deal analyzer. It also features marketing tools such as ringless voicemail drops for real estate, SMS marketing, email marketing, and marketing templates. The basic plan also contains the flipper score feature and the offer generator pro.

- Pro: This plan costs $197/month and it offers 25,000 leads per month. The Pro plan contains every feature of the basic plan plus access to a 24/7 answer service, Jerry Norton’s proof of funds letter template, and access to a private funding network.

- Prime: This plan costs $397/month and it gives you 50,000 leads per month. The plan offers everything in the Pro plan plus a motivated seller leads website, 4 cash buyer magnet websites, an LLC flipper kit, an asset-based lender network, and multiple user logins.

Pros and Cons

Pros

- Flipster’s Rehab Estimator is a handy tool for people interested in the fix-and-flip business. It allows them to determine an estimated repair cost for a property in minutes.

- A unique selling point of Flipster is its website for finding motivated sellers.

Cons

- Flipster is quite expensive, especially for part-time real estate wholesalers.

- Every service in the software is based on the “Flipster credits”. Also, there is a limit to how many Flipster credits a user can have per month.

Integrations

No known integrations.

Mashvisor

Mashvisor was founded in 2014 to help short-term real estate investors find investment properties and optimize their rental performance.

The company provides real estate data analysis, automation, and optimization tools for investors.

Mashvisor’s rental property analysis is one of the most comprehensive real estate investment analysis tools available in the market.

Features

Some of the features of Mashvisor’s rental property analysis tool include:

- Heat map tool: Mashvisor allows you to search for and quickly assess rental properties by using their neighborhood analytics and heat map tool.

- Rental strategy: The rental property analysis offers a rental strategy for achieving the highest return on investment. The indicators in the rental strategy are based on the various return rates for both traditional rental properties and Airbnbs.

- Rental property types: The analysis features information on the different types of properties. The property types include single-family homes, multi-family homes, condos, townhomes, luxury homes, and vacation homes. With Mashvisor, you can filter out properties based on their type, size, age, and number of bedrooms/bathrooms.

- Rental income calculator: Another feature of Mashvisor is the rental income calculator. The tool allows users to locate all the data that impacts a property’s profitability and cash flow, including the pre-calculated rental income, cash on cash return, cap rate, and cash/mortgage figures.

Plans and Pricing

- Lite plan costs $39.99/month billed annually or $49.99/month billed quarterly. The plan features long-term and short-term rental rates and projected rental ROI. By using investment opportunity scores, users will be informed of properties with the best chance of generating a high return on investment.

- Standard: This plan costs $74.99/month billed annually or $99.99/month billed quarterly. It features all the offerings of the Lite plan plus 20 exports to Excel monthly and the most profitable properties & markets.

- Professional: This plan costs $99.99/month billed annually or $119.99/month billed quarterly. The plan features everything in the standard plan plus 60 exports to Excel monthly, property PDFs, and multifamily & foreclosure properties.

Pros and Cons

Pros

- Mashvisor has iOS, Android, and web versions ensuring cross-platform usability.

- This short term rental analytics software uses a heat map to give investors a clear understanding of the markets at any given time. The data provided is visually friendly and easy to understand.

Cons

- It’s difficult to cancel subscriptions.

- Mashvisor has been subject to several customer complaints regarding poor customer service.

Integrations

- iGMS

- Auction.com

- Vacasa

- Roofstock

Realeflow

Realeflow is an all-in-one real estate investing software that has been used by more than 200,000 real estate investors and has helped close more than $10 billion worth of real estate deals.

Realeflow offers a variety of services, including direct mail campaigns and development of real estate investor websites.

Also included are email automation, real estate wholesaler CRM, and deal analyzer, as well as a repair estimator.

Realeflow’s real estate comps tool is a top-rated property investment analysis software.

Features

- Property value estimator. The software uses comparable sales data to help you determine a property’s current value and potential ARV.

- Hammerpoint allows you to estimate rehab costs for potential property flips.

- Professional comps report. Users can build free real estate comps reports in one click. Users can customize the report by selecting properties they would like to include.

- Deal analyzer. You can see at a glance if a property is a good deal as this feature calculates your potential ROI and profits for any deal by using whatever data you enter into the system. It offers a spreadsheet pre-filled with formulas needed to analyze any deal.

Plans and Pricing

- Lite plan costs $125 per month or $1,200 annually for just one user. It features 8 lead types, nationwide lead access, and all the property analysis features of Realeflow.

- Pro plan costs $195 per month or $2,004 annually. It allows 3 users and includes all the offerings of the Lite plan. The plan offers 18 lead types, 3 AI zips, 500 skip tracing credits per month, and 15,000 property downloads per month.

Realeflow also offers a 30-day, money-back guarantee if you change your mind about the software.

Pros and Cons

Pros

- Realeflow offers all the property investment software tools you need — from motivated seller lead generation to marketing to sales comps in one platform.

- Many clients have rated the software high for ease of use.

Cons

- Occasionally, the software has difficulty obtaining public record data on properties.

- Some customers have also complained about limited email marketing templates and limited integrations.

Integrations

- Zapier

Roofstock

Roofstock is an online marketplace specializing in single-family rental homes.

Roofstock provides you with a team of certified professionals to help you find and manage your property, including a mortgage broker, property manager, and real estate agent.

Roofstock currently serves 25 markets and is adding new locations rapidly.

The company operates in Atlanta, Greater Tampa, Jacksonville, Las Vegas, Miami, North Carolina and Orlando, Riverside-San Bernardino, and San Francisco – East Bay as well as Southwest Florida.

Features

- Roofstock’s property analyzer spreadsheet is a quick and easy way to forecast the potential financial performance of a given property. To view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate, simply enter some information into the spreadsheet provided by Roostock.

- Roofstock’s Neighborhood Rating tool is an innovative algorithm that allows you to compare investment properties on an even footing. It measures a dozen key attributes including school district quality, home values, employment rates, and income levels.

- Roofstock’s Inspection Report will tell you everything you need to know about the property you’re buying. The inspection report provided by this home inspector reporting software is usually 12-15 pages long. It examines all major components of the property.

Plans and Pricing

Roofstock charges a flat 0.5% fee when you purchase a property on its platform. This means that if you purchase a property for $200,000, your total fee will be $1,000.

There are no additional monthly account fees or opening deposit requirements to worry about.

Roofstock One is a real estate crowdfunding platform that requires a minimum investment of $5,000 and charges 0.5% of the monthly profit in exchange for rental property management services.

When you sell your property through Roofstock, the company charges 3% or $2,500 of the sale price — whichever is greater.

Pros and Cons

Pros

- Vetted agents, sellers, and listings.

- Low fees for both buyers and sellers.

- A comprehensive property inspection report is available.

- Integrated property management and financing solutions.

Cons

- Only available in 25 states across the US

- Inspection reports may not be detailed enough to account for all of the problems with a property.

- No mobile app.

Integrations

- Stessa

- New Direction Trust Company

- Homes365

- American Leasing & Management

- Stack Source

- Visio Lending

- Lima One

- Figure

We went over the digital tools to analyze an investment property. The next step in the analysis process is physically inspecting the home. Learn what home inspection tools and equipment you need for this.

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.