7 Best Rent Guarantee Insurance Companies for Landlords & Tenants Compared

Real Estate Bees’ editorial team asked a number of industry-leading real estate investors to share their expertise on the best lease guarantor companies for landlords and tenants to help our readers make a more informed decision when choosing a service provider for their needs.

With the help of the experts, we identified the top-rated rent guarantee insurance services and evaluated them based on critical factors that are important for landlords and tenants. We never receive any compensation for the inclusion of products or services in our articles. Read our editorial guidelines to learn more about our review and rating process.

TheGuarantors

TheGuarantors is a rent guarantor insurance company offering innovative risk management and financial solutions for landlords, leasing staff, renters, real estate brokers, and tenants.

TheGuarantors was named among CNBC 2018’s Upstart 100 list of promising startups to watch.

They raised $50 million in Series C funding in April 2022. With over 2 billion dollars in rent guarantees and deposits covered, the company was also listed among Deloitte’s Technology Fast 500 in 2022.

Rental Guarantee Insurance Solutions

TheGuarantors offers three basic insurance solutions: rent coverage, deposit coverage, and rental insurance.

- Rent coverage is a type of landlord insurance that protects your rental income. You can require renters to purchase this policy to enable them to rent an apartment they may not otherwise have the opportunity to rent. The policy insures the landlord for the monthly lease payment, paying him regardless of whether the renter defaults on payment or not.

- Deposit coverage is a form of rent guarantee insurance for tenants. It’s a smart way for renters to protect themselves from financial loss due to unpaid rent or damages. It works by allowing renters to pay a small fee to keep their security deposits, and protect against lost rent and legal fees.

- Renter’s insurance. Renter’s insurance covers personal property damage, medical liabilities, and personal liabilities in the rented apartment at an affordable rate of $13 per month.

To enjoy these coverages, simply sign up on TheGuarantors’ website and enroll your property.

Invite your applicants for coverage and track the progress of your prospective tenant applications.

We analyze this company in more detail in our TheGuarantors review.

Plans and Pricing

TheGuarantors charges rent guarantee fees to tenants. They offer three pricing plans for renters: the low risk renter plan, medium risk renter plan, and high risk renter plan.

The price for each plan varies depending on the gross rent, length of coverage period, and individual renter’s risk profile.

Below is a sample of the pricing plan based on a $2,000 monthly rent.

- Low risk renter plan. A low-risk renter plan is a one-time payment of $154 to cover one month of your deposit, plus zero coverage for rent.

- Medium risk renter plan. The medium risk renter plan offers 1 month of deposit coverage and 5 months of rent coverage for a one-time payment of $920.

- High risk renter plan. A one-time payment of $2,510 covers 1 month of deposit coverage and 11 months of rent coverage.

Rent insurance costs between 35% and 85% of one month’s rent for a one-year lease. The cost is per lease, not per renter.

Pros and Cons

Pros

- No hidden fees. When you use TheGuarantors’ rent guarantor service, you don’t have to worry about hidden fees.

- Good customer service. Their customer service team is efficient and always available to help.

Cons

- Non-refundable payments. Fees are non-refundable.

- High cost. On the high risk renter plan, the guarantee fee is quite high.

Insurent

Insurent is a lease guarantor company that operates in New York and Virginia, as well as some parts of the United States.

Creditworthy renters who do not meet their landlord’s financial requirements can be approved for Insurent’s lease guarantee program.

This landlord rent guarantee company currently has over 400,000 units and 3,500 buildings in its rent guarantee program.

Rental Guarantee Insurance Solutions

Insurent offers rental guarantee insurance solutions for both tenants and landlords. As a renter, you can use Insurent to get approval for houses you might not otherwise qualify for.

This approval will be issued within 24 hours.

To apply for this insurance, fill out the online lease guarantee rental application form and submit other details, such as your income verification, employment verification, and identity card.

Also, submit other relevant documentation, and you will receive a reply within 24 hours. Landlords can enjoy faster lease closing and protection against rent defaults by signing up also.

Plans and Pricing

For US parties, the guarantee fee usually ranges between 70 and 90 percent of a month’s rent for a one-year lease guarantee.

For non-US parties without a credit history, the fee can be 98 to 110 percent of a month’s rent for a one-year lease guarantee.

The fee can be higher or lower depending on the duration of the lease.

Pros and Cons

Pros

- Efficient customer service. The customer service team at Insurent is highly professional and efficient.

- Fast and easy process. No strict tenant qualification requirements. Approvals are issued within 24 hours.

Cons

- Only available in NY, NJ, MA, MD, IL, NV, CA, and FL.

- Fees for non-US residents are high.

Steady Rent

Steady Rent is a lease guarantor company that provides tailored financial and insurance products for property managers.

Founded by John Higgins and Vik Sarkissian in 2018, the company aims to reduce risks, eliminate non-performing debt, and increase revenue for its clients.

Steady Rent provides property managers with products that benefit their owners while giving them a competitive edge in the market.

These include rent protection, rent advance, and legislative updates.

Rental Guarantee Insurance Solutions

Steady Rent provides rent protection service as part of their Owner Benefit Package.

This package includes rent protection, rent advance, and real-time legislative updates that deliver consistency and stability to property owners at a low monthly cost.

The Rent Protection guarantees you up to two rental payment amounts in case a tenant defaults.

To qualify an existing lease for the Owner Benefit Package, you must have it assessed and scored by Steady.

They will measure how often rent has been paid on time and other factors to assess a renter’s reliability.

To use the Owner Benefit Package, landlords must use one of the property management companies partnering with Steady.

Plans and Pricing

Steady Rent’s rent default insurance is priced based on several factors, including property type, location, and coverage amount.

To obtain a quote for any of Steady’s insurance solutions, you will have to reach out to their customer care and provide relevant information about the apartment or lease you wish to insure.

Pros and Cons

Pros

- Convenient and fast E-signatures. E-signatures are fast and easy. They eliminate the need for physical signatures, making agreements more convenient.

- Integrates with major property management software platforms like Buildium and Avail.

Cons

- Lack of a fixed quotation or estimate. Insurance quotes can vary greatly depending on location, amenities, and other factors.

- Only available in 36 states.

Rent Rescue

Rent Rescue is a division of Next Wave Insurance Service, which offers rent default insurance.

The company reimburses landlords for up to 6 months’ lost rental income due to abandonment or eviction.

Its rental guarantee insurance is available for all types of residences except in Kentucky and Alaska.

Rental Guarantee Insurance Solutions

Rent Rescue’s rent default insurance protects landlords from unpaid rent and includes up to 6 months reimbursement of lost rent when the tenant defaults to pay.

It also includes payment of $1,000 for legal expenses and much more.

To qualify for lease guarantee insurance coverage, you must show that your tenant has not been evicted or filed for bankruptcy in the last 5 years.

You must also prove that your tenant doesn’t have any rent payments in arrears for 30+ days in over a year.

Plans and Pricing

Rent Rescue’s rental guarantee insurance can be purchased for an average annual premium of $300 per unit.

That’s $25 per month per unit. This cost can be passed along to the tenant as a slight increase in monthly rent or taken as a tax deduction.

Pros and Cons

Pros

- Adequate screening and background checks. Rent Rescue provides you with a thorough tenant screening and background check service.

- Quick reimbursement of rental income. You can easily get a quick reimbursement of your rental income when you file a claim.

Cons

- A bit expensive. The monthly coverage rate of $25 per unit is expensive for small landlords.

Tenantcube

Tenantcube is a property management platform that gives landlords the ability to manage rental property remotely without the need for expensive third-party agencies.

Tenantcube also offers a rental guarantor program that protects landlords against late payments or non-payment of rent, as well as legal fees involved in the eviction of tenants.

This software for real estate investors makes their work easy by sorting out applications and conducting background checks and credit checks on potential tenants before approving them for your rental property.

Rental Guarantee Insurance Solutions

Backed by insurance company Pensio Global, Tenantcube offers a lease guarantor service that protects landlords in situations where a tenant defaults or refuses to pay rent.

This program can provide a full year of guaranteed rent, up to $60,000 for an insured tenant.

In addition, it provides other features such as protection against damage and vandalism to property, legal fee reimbursement, automatic rent collection, and much more.

To get started with this program, you must provide a credit report for each tenant, as well as their proof of income.

This can be in the form of a bank statement or an employment letter. You must also submit a signed lease agreement.

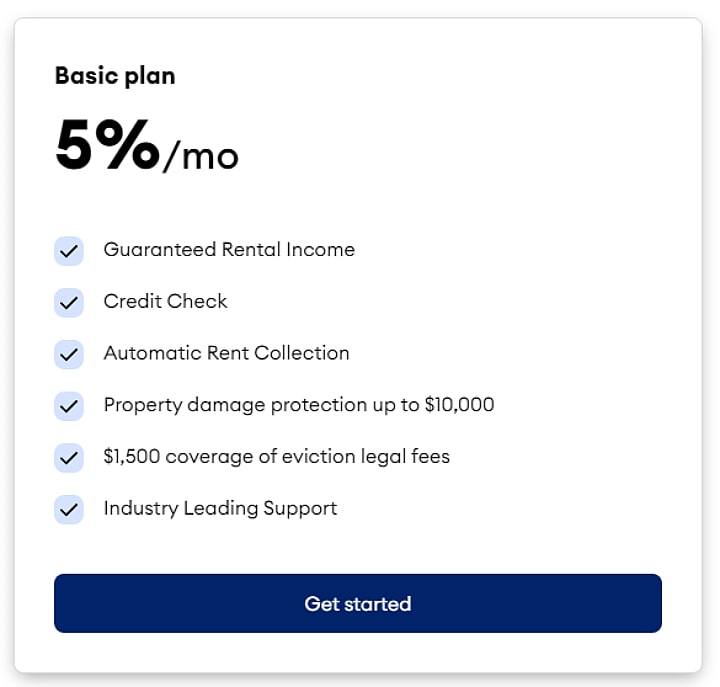

Plans and Pricing

The Rent Guarantee Program costs 5% of your monthly rent.

It includes credit check, automatic rent collection service for landlords, and guaranteed rental income, among other benefits. You can pay monthly or annually with a credit card.

Pros and Cons

Pros

- Legal fee reimbursement. You will enjoy legal fee reimbursement of up to $1,500 in case of an eviction.

- Free expert consultancy. Tenantcube offers landlords the chance to freely consult with industry experts on the troubles they might be having with their tenants.

Cons

- It is a relatively new platform.

Nomad Lease

Nomad Lease is a property management and lease guarantor company. Rent is guaranteed for 1 to 3 years depending on the duration and pricing plan you choose.

Once you sign a lease with Nomad Lease, they handle all the details of leasing your property to subtenants while you receive monthly payments from them.

In addition to the rent, you will also receive a property protection plan that offers up to $10,000 worth of insurance against property damage caused by the tenant placed in your property.

Nomad processes over $15 million worth of rent annually.

Rental Guarantee Insurance Solutions

Nomad Lease offers a guaranteed rent solution that lets real estate investors enjoy a steady or fixed amount of rent each month, regardless of their tenant’s payment.

Once your house is valued and you sign the lease with Nomad, they become your tenant and lease the house to a subtenant.

You will then receive a guaranteed monthly rent regardless of whether the tenant pays. If your tenants move out, Nomad will find a replacement for you.

To list your property on Nomad, simply go to their website, register and enter your property address.

Nomad will calculate how much rental income you can make with them. If you like the amount, sign the lease and let Nomad handle the rest.

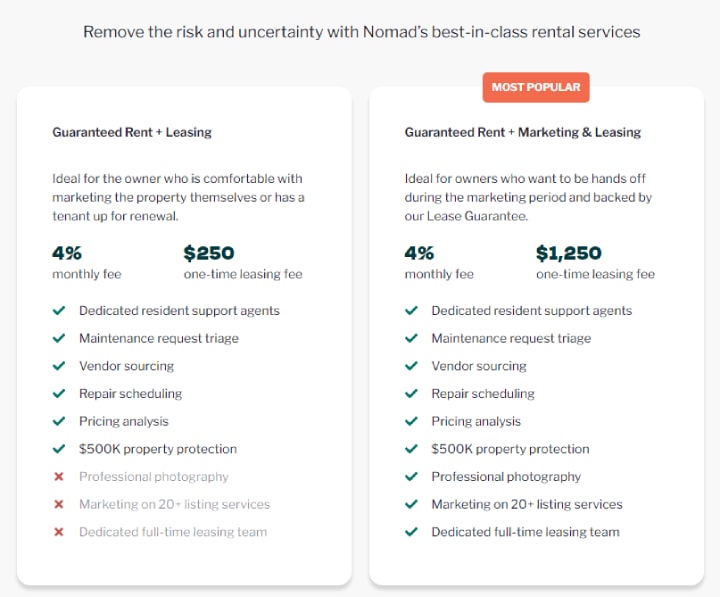

Plans and Pricing

Nomad Lease offers two basic plans. A guaranteed rent plus leasing plan, and a guaranteed rent plus marketing and leasing plan. Here is a breakdown of what each plan offers.

Guaranteed Rent Plus Leasing

This plan is suitable for landlords who want to market their property themselves. It includes a $250 one-time leasing fee and a 4% monthly fee.

You’ll enjoy features such as price analysis, $500,000 property protection, and repair scheduling.

Guaranteed Rent Plus Marketing and Leasing

This plan starts at $1,250 and includes a 4% monthly fee. It’s perfect for landlords who want a lease guarantee and don’t want to be involved in the marketing process.

You’ll get all the features in the $250 plan plus additional features like dedicated full-time leasing, professional real estate photographers, and more.

Pros and Cons

Pros

- 6 months rent advance. With Nomad, you can claim up to six months’ advance rent when you register your property.

- Home assistant for repair coordination. Nomad sends a home assistant to handle the repairs of your home if a tenant damages property or items in your home.

Cons

- High leasing fees. The one-time leasing fee of $250 and $1,250 + 4% monthly fee is relatively high when compared to other rental insurance companies.

World Insurance

World Insurance is an insurance company that offers top products and services to manage and secure your assets.

The company’s Rent Guarantee keeps renters up to date with their rent, covering them if they involuntarily lose their job and can’t pay rent on time.

Rental Guarantee Insurance Solutions

World Insurance offers a rental guarantee insurance solution that provides up to $60,000 of guaranteed rent, damage protection of up to $10,000, and eviction cost coverage.

To qualify for this insurance, you must have a rent-to-income ratio that does not exceed 45%.

You must also provide proof of income and proof of payment showing that you have not missed any recent rent payments.

To register, you need to fill in the online form on their official website. Fill in your tenant and unit information, as well as upload any required documents.

Your application will be reviewed and a rent guarantee agreement sent to you once approved.

Plans and Pricing

The default guarantee rent program offered by World Insurance costs 3.5% of the gross annual rent, paid monthly.

That is, if your monthly rent is $1,200 and your annual rent is $14,400, then the 3.5% guarantee fee will be $42 per month.

Pros and Cons

Pros

- $10,000 damage protection. Property owners can enjoy a tenant damage protection of up to $10,000.

- Over 170 offices across the states. Across the United States, there are over 170 offices to facilitate easy consultation.

Cons

- Approval takes time. It can take as long as one month to receive feedback on your application for rental insurance.

___

If you want to contribute your expert advice on a topic of your expertise, feel free to apply to our Expert Contributor Program.

___

About the Author

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.