7 Best REO Online Auction Websites for Foreclosed Homes (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate agents and investors to share their expertise on the best foreclosure auction sites to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best free and paid online foreclosure auction websites and evaluated them based on critical factors that are important for real estate agents and investors. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

Auction.com

Since its launch in 2007, Auction.com has facilitated an impressive $42B in sales, with over 30,000 exclusive listings to its credit, making it one of the best foreclosure auction sites.

The platform has a particular focus on foreclosed and bank-owned real estate, also known as REO (Real Estate Owned) properties.

Its diversity of real estate options, ranging from single family homes, condos, townhouses, duplexes, fourplexes to even land, caters to all 50 states and Puerto Rico.

Auction.com’s state-of-the-art mobile app equips prospective investors with robust search, bid, and win capabilities on the go.

With several search filters, it’s easy to discover properties by location, features, and auction dates, or explore local and national markets by using its interactive map.

Features

Online Bidding

This REO auction website exemplifies smooth online property auctioning. Users can leverage proxy bids to place automatic bids on bank-seized properties before the auction begins.

Through the mobile app, real estate investors can engage in remote bidding, where they can bid in advance from anywhere and await results at the end of the bidding period.

Market Analysis

This feature provides users with a detailed and holistic view of various aspects of a property, including property values, rental rates, historical sales data, school quality assessments, and an array of community amenities.

It equips users with the indispensable insights needed to make informed decisions about how to strategically position a property for maximum profitability.

Portfolio Interact

This is a business intelligence dashboard designed for sellers, offering invaluable insights into portfolio performance and pricing optimization.

This real-time tool enhances a seller’s capabilities by enabling them to monitor live competitive bidding, review asset-specific information and bid history, make instant reserve adjustments, and accept live bids with a single click, streamlining the selling process.

Foreclosure Interact

This feature provides real-time tracking of foreclosure homes. It enables filtering to view the number of properties up for auction at specific venues.

Users can search foreclosure auctions nationwide with three view options: condensed, expanded, or grid.

It also provides real-time updates on property statuses, including cancellations, postponements, and clearance for sale.

These and other features are described more thoroughly in our Auction.com review.

Plans and Pricing

Auction.com operates as an online auction marketplace, and as such, it deviates from the typical pricing or subscription model.

For sellers, the platform offers a straightforward and cost-effective approach. Sellers can sign up and list their properties on Auction.com for free.

However, for buyers, there are specific fees to be aware of:

- Buyer’s premium: If you are the highest bidder and your offer is accepted by the seller, you will be responsible for the total purchase price, as well as a 5% service fee or $2,500 (whichever is greater). This is known as buyer’s premium. However, not all properties listed on the platform require it.

- Earnest money deposit (EMD): To demonstrate your commitment to the purchase once your bid is accepted by the seller, an Earnest Money Deposit is required. This deposit typically amounts to 5% of the property’s purchase price or $2,500, whichever is greater. It’s worth noting that the EMD is paid to the seller, and can either be refunded or included in closing costs. It is not a service fee.

Pros and Cons

Pros

- Exclusive listings. As one of the best foreclosure auction sites, Auction.com offers exclusive listings not accessible to real estate investors outside the platform.

- Robust search filters. Auction.com offers a range of search filters to help buyers find different types of properties, including land for sale, single family homes, townhomes, duplexes, triplexes and fourplexes, condos, foreclosures, pre-foreclosures, REOs and more. You can also filter by condition, whether or not a house is vacant or eligible for financing.

- Educational resources. Auction.com offers resources to educate users on the property bidding and closing process. They have knowledge bases on finding foreclosures and bank-owned properties.

Cons

- Short window for fund arrangements. Auction.com imposes a tight time frame for buyers to secure the necessary funds to close a deal. This can add pressure and complexity to the purchasing process, potentially deterring some users from engaging in online foreclosure auctions.

- Unresponsive customer service. Users have reported complaints about unresponsive customer service, potentially leading to frustration or issues during bidding.

- Automated bidding. In some cases, Auction.com will bid against buyers until a seller’s reserve price is met. When properties fail to meet the reserve price, they are automatically relisted. This practice can result in some uncertainty and confusion for users eager to participate in online auctions for foreclosed homes.

Integrations

- Follow Up Boss

- DocuSign

- NetDirector

- Parsey

- Infusionsoft

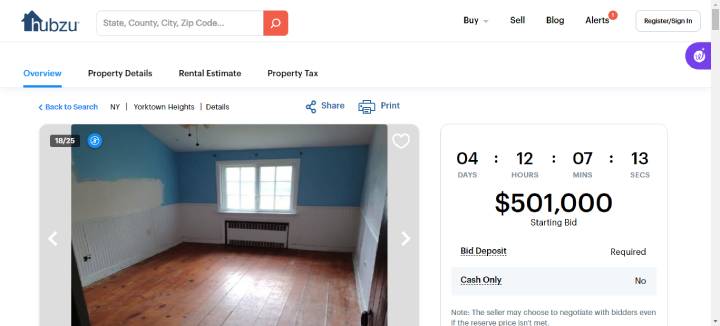

Hubzu

Hubzu.com, by Altisource, is a one-stop digital platform revolutionizing the real estate auction landscape through its comprehensive end-to-end disposition solution.

Offering a wide range of real estate opportunities, Hubzu features short sale properties, REO, deed in lieu and foreclosure, CWCOT auctions, and sales by asset management companies.

This REO auction website streamlines the home-buying process with transparent bidding and seamless transaction support.

Leveraging over 200 partner websites, premium advertising, data-driven marketing strategies, and extensive social media reach, Hubzu attracts a diverse audience of owner-occupants and investors.

Each property is showcased with 20 to 25 high-quality photos, ensuring a detailed visual representation for potential buyers.

Features

Property Details Page

Being one of the best house and land auction sites, Hubzu provides detailed information for all properties available on its REO online auctions platform.

This includes photographs, property specifications, and a wealth of information valuable to investors, such as rent estimates, vacancy rates, and resale AVMs.

60+ comparables are used to generate this information, providing online auctions for foreclosed homes an added layer of insight.

Autobid

This is an automated feature designed for bidders who want to stay competitive without constantly monitoring the auction.

Users can set specific monetary increments to automatically increase their bid whenever a higher bid is placed by another participant.

Bidders can set an upper limit they are unwilling to exceed during the auction.

Self-Showing

This feature offers users a convenient way to tour select properties without the need to schedule appointments.

Once a user has registered their Hubzu account, they have the option to request an access code at any time.

This code grants them hassle-free access to view the property at their own convenience.

End the Auction Now

This feature enables a bidder to conclude an auction instantly by paying a price specified by the seller.

It provides a streamlined option for both buyers and sellers to swiftly close a deal when mutually agreeable terms are met.

Plans and Pricing

Sellers can sign up and list their properties for free. However, for buyers, specific fees apply:

- Transfer tax: This fee is charged to the buyer for the transfer of the property title from the seller. Transfer taxes are paid to the county or state.

- Technology fee: This is a $299 fee that covers the cost of utilizing Hubzu’s advanced technology platform. It is included in the purchase price of properties acquired through Hubzu without an auction time limit. Not all properties come with a technology fee.

- Buyer’s premium: Buyers who acquire properties through Hubzu’s Auction Marketing format pay a buyer’s premium of 4.5% of the final sales price. This breaks down to 1.5% for the listing real estate agent and 3% for the buyer’s agent.

All fees are clearly outlined on the property details page under the Property Fees tab, ensuring transparency in the bidding process.

Pros and Cons

Pros

- Wide variety of properties. Hubzu offers a variety of properties such as foreclosures, bank-owned homes, short sales, and traditional sales. This makes it easier for investors to find exactly what they’re looking for.

- Bid from anywhere. Hubzu’s online platform and mobile app for real estate investors allow users to submit live bids 24/7 from wherever they are.

- Rental property ROI information. For each property listing, Hubzu delivers detailed information on number of beds, baths, lot sizes, location, year built, etc. Hubzu also offers various types of real estate investors pertinent information like resale AVM, gross yield, monthly cash flow, net yield, and monthly expenses.

Cons

- Long closing periods. It can take up to two months to close on a property with Hubzu.

- Technology fee. Aside from the buyer’s premium, Hubzu sometimes charges a technology fee of $299 to the winning bidder.

- Proxy bidding. Hubzu’s auto-bidding system can cause automatic price increases, and the platform frequently relists properties that don’t meet reserve prices, potentially extending the bidding process.

Integrations

- Equator

- RentRange

- DocuSign

ServiceLink Auction

ServiceLink Auction is a real estate auction platform that provides end-to-end services for foreclosed, bank-owned, short sale, and newly foreclosed properties, helping you easily find homes to flip or keep as a rental.

This full-service solution is designed to enhance operational efficiency by reducing timelines and ensuring complete transparency throughout the sales process.

It integrates crucial offerings such as title services, valuation, and asset management, ultimately delivering unparalleled efficiency for buyers and sellers alike.

Features

Proxy Bids

This feature allows users to set a maximum bid as well as a starting bid and let the system automatically manage the bidding process.

The system will incrementally increase their bid, but only if they are outbid by another participant, maintaining their status as the highest bidder until their maximum proxy bid is reached.

Auction Calendar

ServiceLink Auction provides users with access to a schedule of upcoming property auctions, including foreclosure and bank-owned auctions.

It keeps users informed about the dates and details of these auctions, making it easier for them to plan and participate in real estate auctions that match their interests and requirements.

Foreclosure and Trustee Sale Home Search

ServiceLink Auction streamlines the search for foreclosure and trustee sale homes, providing easy access to a nationwide network of properties.

The platform provides advanced search filters (occupancy, property type, auction date, and more) as well as the convenience of downloading results.

Saved Listings

This feature enables users to conveniently monitor properties of interest. By adding favorited properties to their dashboard, users can easily keep track of listings they’re interested in.

Plans and Pricing

Creating an account on the platform is free for both buyers and sellers. A free account allows you to bid on any property.

If you’re accepted as the highest bidder, you’ll have to pay a buyer’s premium to ServiceLink Auction.

This can either be a predetermined percentage or a flat fee, depending on the specific property.

To obtain detailed information about pricing and fees, interested parties are encouraged to contact the ServiceLink Auction team directly.

Pros and Cons

Pros

- Efficient bidding process. ServiceLink Auction’s innovative dashboard enables users to bid on multiple properties simultaneously, providing a highly efficient process for online foreclosure auctions.

- Conventional financing options. ServiceLink Auction allows bids from buyers who are pre-approved for financing. It allows searches to be streamlined to show only “Financing Considered” listings.

- Faster auctions. ServiceLink Auction stands out for its swift auction process, often spanning just 2-3 days.

Cons

- Map mode search issues. Users of their mobile app have reported problems with search results in Map mode. This feature doesn’t work as expected, often displaying blank results or only showing the entire country, which can be frustrating for users looking for properties in specific locations.

- Buyer handles all closing costs. ServiceLink Auction places responsibility for covering all closing costs, including buyer’s premiums, transfer fees, and other associated expenses, on the buyer. This can add to the financial burden of purchasing a property through the platform.

- Proxy bidding. Like many other REO online auction platforms, ServiceLink Auction allows buyers to use proxy bidding, which automatically outbids manual bidders until a specified maximum bid is reached. This means that bids aren’t easy to win on the platform.

RealtyBid

RealtyBid is an online real estate auction platform focused on residential property.

The platform excels at expediting real estate sales through its innovative auction system, providing buyers with access to a multitude of live trustee auction opportunities.

These encompass a wide array of real estate classes, including bank-owned assets, conveyance without clearance of title foreclosures (CWCOT), land, pre-foreclosures, and more.

RealtyBid has established partnerships with over 100 national banks and mortgage servicers, ensuring listings at reduced prices.

Furthermore, the platform welcomes listings from real estate agents, home builders, and major corporations.

Features

My Properties

This is a convenient hub for bidders to track properties of personal interest and those they’ve already placed bids on.

It simplifies the process of viewing and bidding on these properties, particularly when dealing with multiple listings.

Post Bidding

This feature allows properties that haven’t met their reserve price to continue receiving bids after the initial auction.

While a countdown clock indicates the potential duration of this phase, it doesn’t guarantee the property’s availability. Sellers may review and approve bids daily, potentially leading to a deal.

Once a bid is accepted, the property may be removed from the site, regardless of the remaining countdown time.

Bid Assist

This is an ingenious automated bid system that enables users to participate in auctions, even when they are away from their computers.

The system ensures that it will bid on behalf of the user, incrementally increasing the bid to stay just above the competing bidder, all while ensuring it never surpasses the highest bid amount originally entered into the Bid Assist system.

Plans and Pricing

RealtyBid offers a transparent pricing structure, with closing costs varying based on property type.

To bid on a property, a $250 bid deposit is required to validate the account and confirm the bidder’s genuine intent.

If you win a property bid, the costs include the bid price, an Internet Transaction Fee (or buyer’s premium), and closing costs.

These costs differ between live trustee auctions, online county foreclosure auctions, and online REO transactions.

Sellers typically cover municipal services, public utility charges, past-due taxes, HOA liens, and municipal/utility liens up to the day of possession by the buyer.

Additionally, property taxes and HOA fees are prorated on the day of closing, with exceptions specified on individual property pages.

Buyers are responsible for the owner’s title insurance policy premium, notary fees, conveyance and recording costs, document preparation and recording fees, survey fees, title fees, and attorney’s fees.

This includes any recordation tax and state or local transfer tax. The platform ensures transparency in the cost structure to facilitate real estate transactions.

Pros and Cons

Pros

- No responsibility for back taxes or liens. One considerable advantage of using RealtyBid for locating online auctions for foreclosed homes is that the platform ensures buyers aren’t liable for back taxes or liens linked to their properties. This greatly simplifies the buying process and provides peace of mind to the buyer.

- Support for backend processes. RealtyBid offers a comprehensive solution for investors, handling both the online bidding process and the backend operations, including contract and closing processing, along with real-time reporting.

- Thorough property details. To facilitate the real estate investment due diligence process, each listing on RealtyBid comes with detailed information, including market analysis, valuation history, contingencies, valuation forecasts, and other investment property analysis tools.

Cons

- Limited listings. RealtyBid does not offer as many listings as some other real estate listing websites, potentially limiting the range of available properties for buyers.

- Extended post-auction bidding period. The extended post-auction bidding period could pose a disadvantage, as winning bidders may risk losing their winning bid after the auction concludes, potentially leading to uncertainty and missed opportunities.

- Quitclaim deed title transfers. Many properties on RealtyBid feature title conveyance only through quitclaim deed transfers. This may not be suitable for all types of investors or buyers as it offers the least level of buyer protection.

Williams & Williams Real Estate Auctions

Williams & Williams Real Estate Auctions is a renowned auction company with a focus on real estate.

Their expertise spans a wide range of property categories, including residential, commercial, and land, and they execute both live and online auctions.

Through their sister company, Auction Network, they host live, at-property auctions simultaneously with real-time, interactive bidding across various platforms, expediting home sales.

Features

Auction Search and Filters

Williams & Williams Real Estate Auctions allows users to search for properties currently up for auction by using different criteria, including city, state, zip code, and property ID.

Users can also use the map to search properties in neighborhoods they’re interested in. The platform allows you to filter results by property type, including luxury, land, residential, and commercial.

Absentee Bids

This is a convenient way for bidders to participate in auctions without being present at the auction event.

With this option, a bidder can submit a bid for a specific item prior to the auction. They instruct the auctioneer to place bids on their behalf during the live auction.

Accounting of Sale

This is a comprehensive report issued to the seller by the auctioneer. It meticulously outlines the financial aspects of the auction, offering a transparent and detailed account of the sale proceedings.

This serves as a crucial tool for sellers to gain a clear understanding of the financial outcomes of their auctioned property.

Live From the Lawn Auctions

These auctions feature real-time, competitive bidding conducted both at the physical auction site and online via AuctionNetwork.com.

The onsite auctioneer interacts with and accepts bids from participants present at the property location and those participating online, ensuring a dynamic and inclusive auction experience.

Plans and Pricing

Williams & Williams Real Estate Auctions employs a transparent pricing structure for property auctions, which includes two main costs in addition to the highest bid amount:

- Auction fee: Buyers will encounter one of two types of auction fee, but never both. The first option is a buyer’s premium, typically set at 5% of the highest bid amount with a minimum threshold. The second option is an Auction Service Fee, which is a flat fee of either $1,500 or $3,000, depending on the specific property being auctioned.

- Closing costs: These costs, which vary from property to property, are standard in real estate transactions and encompass a range of expenses. It’s imperative to note that closing costs are not solely determined by Williams & Williams, as they depend on the specifics of the property being purchased.

Pros and Cons

Pros

- Real-time inventory updates. Williams & Williams Real Estate Auctions ensures that their property listings are updated in real time. This guarantees that buyers are presented with the latest property information and availability.

- Buyer’s Choice auctions. Williams & Williams Real Estate Auctions offers group-style auctions for similar properties, allowing bidders to bid on multiple lots or homes within the group. The highest bidder can choose their preferred parcels and purchase them at the same winning price.

Cons

- Limited listings. The platform exclusively features real estate auctions conducted by Williams & Williams, potentially limiting the range of available properties.

- Owner-occupied auctions. Some auctions are not immediately open to all buyers. This is in line with HUD regulations. For the first 30 days, these listings will only be available to owner-occupant families or individuals who are eligible to bid. If after 30 days the property doesn’t close, it is then made available to all buyers.

- Reserve prices. Auctions with reserve prices may not result in bids being accepted immediately on the Williams & Williams platform because sellers can take weeks to make a decision.

Bid4Assets

Bid4Assets is a leading online auction platform where you can find distressed real estate and personal property.

Operating as a subsidiary of Liquidity Services, Inc., Bid4Assets has been one of the leading real estate auction sites since 1999.

The company caters to private investors as well as federal and local government agencies.

It serves notable entities such as the United States Marshals and the U.S. Department of the Treasury, along with over 100 counties across the United States.

Features

Bid and Assume Auctions

This is a unique feature that allows participants to bid on the down payment for properties and assume a balance on monthly terms set with the seller.

This means users can set up owner financing terms, creating win-win scenarios for both buyer and seller.

Search Functionality

Bid4Assets provides users with versatile search tools to find properties and auctions effectively.

By utilizing the “Search” tab, individuals can search in three distinct ways. They can use the interactive map and search by category or keywords.

The “Advanced Search” also allows users to create a custom property list based on asset status, zip code, search radius, category and sub-category, date, and other criteria.

Seller Ratings

This feature compiles feedback from Bid4Assets buyers, providing valuable insights into the seller’s reputation and performance.

The rating system employs a five-star scale, ranging from one (very dissatisfied) to five (very satisfied). It is displayed next to the seller’s username on the auction listing page.

Plans and Pricing

Bid4Assets offers a straightforward and cost-effective pricing structure. Registration is free, and there are no monthly fees.

The platform’s revenue model involves collecting 10% of the winning bid, with a minimum charge of $500, from the seller in all real estate auctions.

Sellers have the option to include this fee as part of their auction in the form of a buyer’s premium.

For auctions greater than $200,000 in listing price, it’s advised to speak to one of their customer care reps regarding auction completion fees.

Listing a property on the platform costs $10 per listing.

Pros and Cons

Pros

- Seller ratings. Buyers can provide feedback about sellers and rate them. This gives you insights about the ease of doing business with and the experience of the seller.

- Sealed bid auctions. Bid4Assets offers “Sealed Bid” auctions, which can prevent bidders from getting caught up in a bidding war. For eligible properties, these bids come with no minimum bid and no reserve price. The first bidder has more likelihood of winning these bids as competitors’ bids are not visible for two days. If the seller accepts the bid within this period, the bidder wins.

- Variety of property types. Bid4Assets offers various property types, including residential, commercial, land, and you can even find tax lien properties. You can also find auctions on artwork, jewelry, and financial instruments on the site.

Cons

- Limitations on county tax sale auctions. County tax sales on Bid4Assets appear to be limited to Western states, potentially narrowing the availability of these types of auctions to users in other regions.

- Non-performance fee. Bid4Assets requires a valid credit card for auctions that do not require a deposit. A $1 charge is applied for verification, and promptly refunded after authorization. If someone with a winning bid doesn’t perform this verification, a $250 fee for real estate auctions (or $100 for others) is charged to their card.

US Treasury Auctions

US Treasury Auctions is the official government website dedicated to promoting and hosting auctions for the sale of seized real estate properties across the United States and Puerto Rico.

CWS Asset Management & Sales (CWSAMS) is the primary contractor responsible for the nationwide Seizure and Forfeiture of Real Property Contract on behalf of the U.S. Department of the Treasury.

These auctions are open to the public, presenting a valuable opportunity to discover cost-effective real estate deals.

Features

My Bids

This feature provides an easy way for users to monitor their bidding activity.

By accessing “My Bids,” users can conveniently track and stay informed about the status of their submitted bids, ensuring a clear overview of their participation in the auction process.

Auction Soft Close

This feature enhances the integrity of the auction process and encourages timely bidding.

If a lot receives a bid within the last three minutes of the auction, it triggers an additional three-minute extension.

This extension timer will reset if further bidding takes place. In the absence of additional bids, the lot closes when the timer runs out.

Watch A Lot

This feature is designed to help users track specific properties and lots that pique their interest.

It provides a convenient way for users to stay informed about the status and developments of their chosen properties, ensuring they can actively monitor and engage with auctions that matter most to them.

Auto Bidding

This feature allows bidders to set a maximum bid amount, and the website will automatically place bids on their behalf in the predetermined bid increment.

The system continues bidding at the preset increment until the bidder’s maximum bid is surpassed. If this occurs, the bidder will receive a notification (if opted for during registration).

Plans and Pricing

US Treasury Auctions, managed by CWS, offers a buyer-friendly pricing model, ensuring transparency and accessibility.

The platform offers free online foreclosure auctions, enabling interested buyers to explore available properties without associated costs or buyer’s premiums.

To qualify for bidding, participants need to provide photo identification and a cashier’s check deposit (amount varies) at registration.

The successful bidder’s deposit serves as the initial payment for the property and is non-refundable.

In case of an unsuccessful bid, the deposit will be returned via certified mail within five business days.

For wired deposits, it will be sent back to the originating bank account within the same time frame. This straightforward model simplifies the auction process for buyers.

Pros and Cons

Pros

- Special warranty deed. Properties acquired through US Treasury Auctions come with a special warranty deed. This deed ensures that the Government will defend the title against any defects or claims arising from the forfeiture process. This provides buyers with a level of legal protection.

- No buyer’s premium. Unlike some other foreclosure websites, there is no additional buyer’s premium fee when participating in US Treasury Auctions. This leads to a more straightforward and transparent pricing for buyers.

Cons

- Limited payment methods. US Treasury Auctions accepts only cashier’s or certified checks as payment methods. Other common payment methods such as personal or business checks, money orders, cash, credit cards, bank letters, or letters of credit are not accepted.

- Automated bidding. If a user opts to use automated bidding, the website will automatically increment the highest bid until their set maximum bid is reached, at which point they’ll be notified that they’ve been outbid. This gives bidders that use this feature an advantage.

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.