43% of Homebuyers Postponed Buying Due to COVID-19 — Survey Shows

The effects of the pandemic are not limited to the medical field. COVID-19 has also significantly influenced the financial market and every individual’s financial situation and plans.

For instance, at the beginning of the year, many people were eager and excited about buying a home and making the transition from renter to homeowner. But now, a survey conducted by RENTCafé shows how the pandemic has changed many homebuying plans.

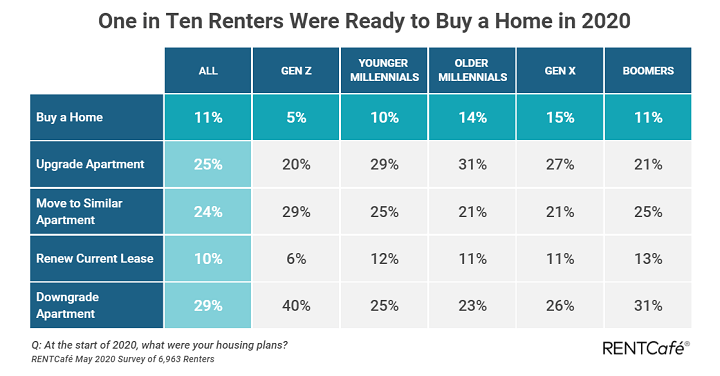

Home Buying Plans in Early 2020

At the beginning of the year, the majority of survey respondents were planning to downsize their apartments. In particular, this trend was driven by Gen Zers and Baby Boomers, both of whom are being cautious about their housing plans and adopting renting as a lifestyle.

However, when looking at the in-between generations, we see that 15% of Gen Xers were ready to buy a home, as were 14% of the older Millennials and 10% of the younger Millennials. All in all, one in 10 renters was ready to buy a home this year.

Change of Plans During the Pandemic

However, when asked if they had recently reconsidered their plans, as many as 43% of respondents said they no longer planned on buying a house. This number includes:

- 50% of the older Millennials

- 43% of the younger Millennials

- 42% of Gen Xers.

On the other hand, Baby Boomers were the least concerned — only 37% of them had reconsidered their plans.

The driving force for this change in plans seems to be economic uncertainty, followed by job loss. Apparently, people are choosing to err on the side of caution and wait a little while longer until things settle down and the economic future becomes clearer.

Another factor affecting Millennials’ plans is the gap between their expectations and reality when it comes to buying a home. According to the survey by Point2Homes.com, most Millennials tend to greatly underestimate the amount of money they will need for a down payment. 61% of Millennials surveyed have less than $10,000 in savings when the national average down payment is about $62,000.

Looking to the Future

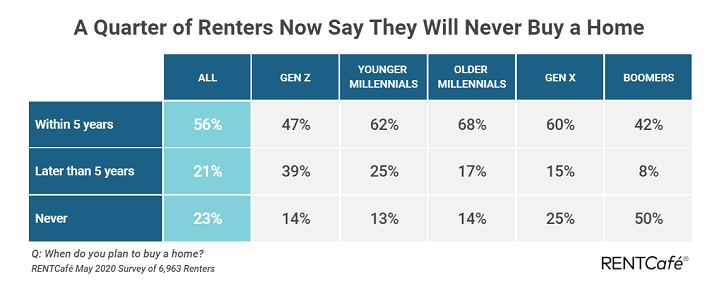

As part of the survey, RENTCafé also asked respondents about when they see themselves taking the leap to home ownership. Notably, up to 23% said they would never buy a home, including 50% of Baby Boomers and 25% of Gen Xers.

At the other end of the spectrum, 68% of older Millennials expected to buy a home in the next five years, as did 62% of younger Millennials and 47% of Gen Zers.

Granted, there are a variety of reasons — which apply both individually and generationally — that may influence the decision to buy a home. For example, financial issues like student debt or life choices — such as living in an expensive city — can both delay the ability to purchase a home.

Meanwhile, others simply prefer renting to owning a home, as is the case with Baby Boomers. In that case, the choice is less about finance and more about lifestyle.

However, it’s still unclear how things will evolve and what other industries will be affected by the pandemic. As such, it appears that most people are avoiding taking any risks at this time.

And, although the generational breakdown shows slightly different attitudes, everyone appears to be treading more cautiously with their individual financial situations and waiting to make more economically safe decisions.

___

If you want to contribute your expert advice on a topic of your expertise, feel free to apply to our Expert Contributor Program.

___

About the Author

Kristina Morales is a REALTOR® with over 20 years of professional experience. She actively practices real estate in Ohio but also has practiced real estate in California and Texas. Conducting her real estate business in three states has allowed her to gain unique experiences that make her a well-rounded realtor. She obtained her Bachelor of Arts in Business Management and her MBA with a concentration in Banking and Finance. Prior to real estate, Kristina had an extensive corporate career in banking and treasury. She ended her finance career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX.