6 Best Commercial Real Estate Property Appraisal Software Tools (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate appraisers to share their expertise on the best commercial property appraisal tools to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best commercial real estate valuation software and evaluated them based on critical factors that are important for real estate appraisers. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

Valcre

Valcre is powerful software designed to streamline the commercial real estate appraisal process.

It offers a centralized platform for organizing, accessing, and maintaining up-to-date data across various asset types.

Unique features include purpose-built templates, strategic integrations with external data sources, and Valcre Assist — a concierge system of experienced assistants and researchers to handle tasks like property research and local area analysis.

With its efficient and comprehensive approach, Valcre significantly reduces manual work and enhances the overall commercial property valuation experience.

Features

Online Database

The online database provides users with a secure cloud-based platform to manage and access commercial real estate appraisal data.

It allows appraisers to easily keep track of jobs, clients, properties, sales and leases.

The online database also allows appraisers to use customizable filters and search options to retrieve specific data within the platform.

USPAP & CUSPAP Compliant Reports

Appraisers can choose from a variety of professionally designed report templates that adhere to the Uniform Standards of Professional Appraisal Practice (USPAP) and the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP).

They can choose and customize these templates to suit their specific needs and the unique requirements of each appraisal assignment.

Automated Invoices and PSAs

This feature streamlines the billing process for commercial real estate appraisals by automating the creation of invoices and Preliminary Summary of Appraisal (PSA) documents.

With this feature, appraisers can easily create customized invoices and include branding (logos, contact information, payment instructions).

They can also generate professional service agreements (PSAs) or contracts between themselves and the client.

Custom Data Imports

The custom data import feature allows commercial real estate appraisers to add external data sources into their appraisal workflow.

With this feature, appraisers can import data from spreadsheets, databases, or CSV files. They can also define their own import rules and mappings to match the structure and format of the data sources they work with.

This feature also offers data cleansing, deduplication, and error handling tools.

Plans and Pricing

Valcre’s commercial real estate appraisal software offers four plans: Starter, Advanced, Professional, and Enterprise.

The Starter plan costs $67/user/month and includes features like a property and comps database, standard datasheets, mobile app, help center, and the ability to import data from multiple MLS sources.

The Advanced plan costs $133/user/month and includes all the features in the Starter plan.

It also includes additional features like job and billing workflow automation, automated invoices, and PSAs.

Users on this plan can also add custom fields to reports and export data to QuickBooks.

The Professional plan costs $333 per month per user and includes all the features in the Advanced plan, plus additional features like multi-level permission and 3-month audit logging.

It offers more customization options, including editable USPAP templates and custom data imports via CSV or XML.

It also supports DCF (Discounted Cash Flow) valuations through its integrations with ARGUS and Rockport VAL.

The Enterprise plan is a custom-priced option for organizations with advanced appraisal and management needs.

It includes all the features in the Professional plan, plus additional features like 6-month audit logging, API integrations, and premium onboarding.

Pros and Cons

Pros

- Comprehensive feature set. Valcre’s commercial real estate valuation software offers a wide range of features and capabilities specifically designed for real estate appraisers. This includes tools for report generation, data management, document storage, client management, invoicing, and more.

- Customization and flexibility. Appraisers can customize the system and tailor it to their unique needs. It offers configurable templates, report customization options, data importers, and customizations based on user preferences.

- Data security and compliance. Valcre places a strong emphasis on data security and compliance. The software has achieved ISO 27001 certification. It also ensures compliance with industry standards and regulations such as USPAP.

Feature-rich mobile apps. Valcre’s iOS and Android apps allow on-the-go property appraisals.

Cons

- Learning curve. Valcre software has many features and customization options, which may take some time to learn.

- Costly. Individual appraisers or smaller appraisal firms with limited budgets may find the software pricing plans high.

- Limited financial modeling tools. While Valcre integrates with other financial modeling tools, it doesn’t offer its own cash flow forecasting feature.

Integrations

- Rockport VAL

- ARGUS

- GraphQL API

- QuickBooks

- Bright MLS

- Flexmls

- Realist

- CoreLogic

- Google Maps

- Esri ArcGIS

LightBox

LightBox is comprehensive commercial real estate valuation software for appraisers and real estate professionals.

It provides a variety of data and information about properties, including commercial and geographical data, along with spatial data such as maps.

One of its major features is its location intelligence platform. This provides access to products such as broadband mapping, CanMap, and LandVision.

Another key feature of LightBox is its comprehensive suite of investment property due diligence solutions, which include products like the ERD, PZR reports, and valuation.

These allow professionals to appraise commercial real estate and generate professional reports.

LightBox also offers other solutions such as real estate brokerage software and tools for real estate investors, lending tools, and zoning data.

Features

Property Research

The research feature helps valuation professionals access and analyze relevant data for their appraisal assignments.

Appraisers can access an extensive nationwide parcel database with 300+ property and tax attributes covering 99% of properties and buildings nationwide.

The research feature also offers other capabilities such as verified zoning and assessment data, smart site selection tools, and more.

Cashflow Analysis

LightBox helps appraisers efficiently value various commercial property types.

The Cashflow feature allows appraisers to perform a host of activities, including exporting structured report data in Excel and PDF formats.

They can also import data from ARGUS reports, and share cashflow models with friends and colleagues.

Appraisers also have access to automatic error detection to reduce assumption errors.

Report Writer

This feature helps simplify appraisal report writing.

With Report Writer, appraisers can easily manage appraiser licenses and client contacts. They can also create custom tables and merge data with Word in a single click.

Other capabilities of the report writer include an automatic comparable map, standardized data capture, and more.

LandVision

This is a feature in LightBox’s commercial real estate valuation software that provides commercial real estate professionals with comprehensive mapping, management, and commercial real estate analysis software tools.

With this feature, appraisers can easily access and leverage different tools such as SmartFabric, CanMap, and Broadband Mapping to identify new properties, analyze market trends, and manage their assets.

LandVision also allows appraisers to create automated site profile reports and present properties to clients using different types of aerial imagery.

Plans and Pricing

LightBox’s website does not display prices. Interested users should contact a customer care representative for a quote.

Pros and Cons

Pros

- Ideal for large AMCs. This commercial real estate appraisal software allows easy report creation and offers appraiser and client management tools for appraisal management companies with thousands of clients.

- Acquisition of ExactBid. LightBox acquired ExactBid, a real estate due diligence company, offering additional services to appraisers. One of ExactBid’s offerings, RIMSCentral, allows appraisers to search for other properties owned by real estate professionals. Users can also search for properties by type and location.

- Powerful commercial real estate agent CRM. LightBox acquired the ClientLook CRM platform, which offers powerful automation features for commercial real estate professionals.

Cons

- Costly software. There is no pricing information on their website. Anyone interested in any of their products has to contact a customer care representative to get a quote. Products have to be purchased individually. Based on some user reviews, LightBox’s products are expensive.

- Outdated CRM user interface. Users have complained of bugs while using the ClientLook CRM platform and that the interface looks old.

Integrations

- Quire

- Esri ArcGIS

- ExactBid

- Microsoft Office

- Google Earth

- Real Capital Markets

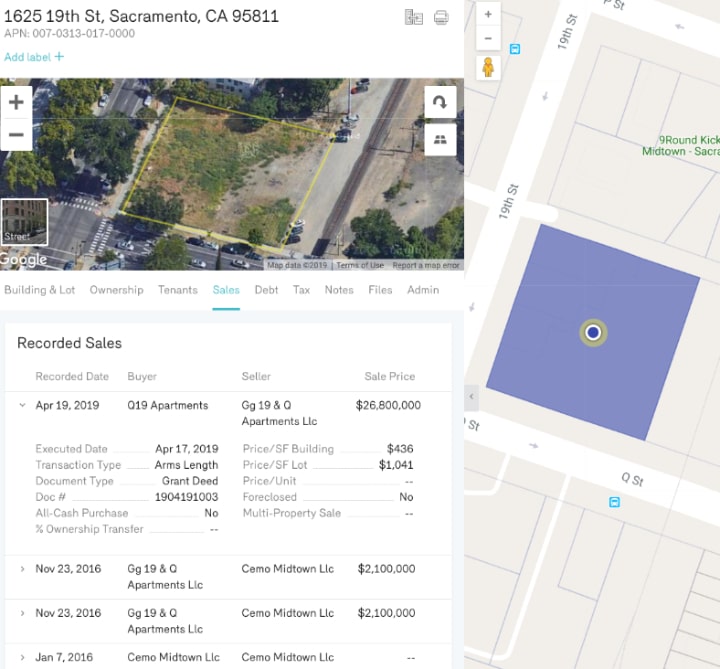

Reonomy

Reonomy is a data-driven commercial appraisal software platform. Its key features include advanced analytics and machine learning algorithms.

These provide professionals with deep insights into properties, ownership information, market trends, and more.

Reonomy also offers other capabilities, including advanced search and filtering options, market trends and analysis, portfolio analysis, and more.

The company was acquired by Altus Group in 2021.

Features

Advanced Search and Filtering

The search feature allows users to perform highly targeted searches to identify specific commercial properties that meet their desired criteria.

Users can search for and access property information such as ownership details, property features and amenities, transaction history, and more.

They can also apply multiple filters such as location, property type, size, ownership type, and history of sales or debt information to refine their search results.

Market Analysis and Trends

Reonomy users gain valuable insights into the commercial real estate market by capturing trends on a national scale and working with local county-level geographical attributes.

They can access historical sales and rental data to identify trends and patterns in the market.

Commercial Sales Comps

Users can choose or select relevant comps based on various criteria such as location, property type, size, sale price, and more.

They can then access comprehensive details about each comp, including property information and sales history.

This commercial property valuation tool also offers other capabilities such as visualization and reporting, customization, and analytics.

Plans and Pricing

The company’s website does not display prices.

Based on some online sources, Reonomy’s web-based commercial property software is priced between $159 and $499 per month and users are locked into yearly contracts.

First-time users also have access to a 7-day trial of the Reonomy web app.

Pros and Cons

Pros

- Extensive data coverage. Reonomy provides access to up to 100 data points on any residential or commercial property across the US. Information provided includes images, property history, legal, tax information, and more.

- Ease of use. Reonomy is designed with a user-friendly interface and intuitive navigation, making it accessible to both novice and experienced users.

- Off-market property searches. Reonomy provides access to a vast database of off-market properties.

Cons

- No commercial lease comps. Reonomy offers a comprehensive database of property information sourced from public records, but is lacking in commercial lease transactions. For appraisers and real estate professionals who specialize in commercial properties, this can be a major drawback when using Reonomy for valuation purposes.

- Non-transparent pricing. Reonomy does not make its pricing plans publicly available on its website. However, based on some sources, Reonomy costs between $159 and $499 per month with users locked into yearly contracts. This is relatively high for small-scale appraisers.

- Inaccurate data in smaller markets. Reonomy focuses primarily on larger markets, which means that data quality and accuracy may be less reliable in smaller or less-populated areas.

- No mobile app. While Reonomy offers a web-based platform that can be accessed through a web browser on mobile devices, it does not provide a standalone mobile application.

Integrations

- Salesforce

- Google Maps

- Dun & Bradstreet

- Altus

- CoreLogic

- Black Knight

Realquantum

Realquantum is an intuitive cloud-based commercial property valuation software solution designed to simplify the valuation process.

Its features include a comprehensive property database for storing and accessing property details, appraisal information, and multimedia attachments.

The platform automates mathematical formulas and calculations, ensuring USPAP compliance while minimizing errors.

Additionally, the mobile app enables professionals to capture notes, images, and diagrams on the go, seamlessly integrating with the web app for a streamlined and efficient appraisal process.

Features

Report Writer

Realquantum simplifies the report creation process by automating the generation of comprehensive appraisal reports.

The software automatically formats and structures data into professional reports. Users can also customize the reports to suit their brand and needs.

Property Analysis Tools

Realquantum’s commercial property valuation tool provides a comprehensive and adaptable solution for valuing properties by using both income and cost approaches.

In version 3.0, the software automatically adjusts income and expense categories based on property class and type, ensuring accurate and relevant data input.

The Expense Comparables is an investment property analysis tool that allows users to analyze and present expense comps in a clean, customizable table format and narrative.

Additionally, the software calculates Insurable Replacement Cost and other essential metrics, offering robust and efficient property analysis for commercial real estate professionals.

Comps Database

The Comps database gives appraisers a centralized and organized way to store and manage comparable property data.

Appraisers can search, filter, and compare properties based on various criteria such as location, property type, and transaction details.

They can also adjust comparable properties based on differences in characteristics, conditions, or other factors that affect value.

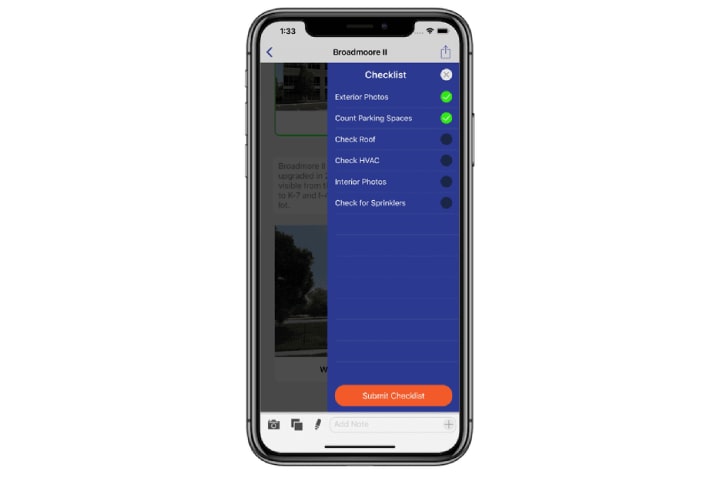

Mobile Appraiser Checklists

This feature allows users to create a checklist with their mobile device. They can also edit, add, and mark checklist items as completed using their smartphone.

The mobile appraiser checklist offers a customizable feature that allows users to configure their own checklist to reflect business processes specific to their organization.

Plans and Pricing

While Realquantum’s pricing is not publicly available on their website, some online sources put the price at $1,800 per year. Interested users can book a demo with one of their sales reps.

Pros and Cons

Pros

- Customization options. The software offers extensive flexibility and customization options that allow users to tailor reports to their specific needs.

- Easy report creation. The software automates report generation. It makes it easy to search for data and integrate sales and lease data into reports.

- Customer support. Realquantum offers reliable and helpful customer support to assist users with software-related issues or questions.

Cons

- No pricing information. Some sources claim that Realquantum costs $1,800 a year. But users generally have to schedule a demo to get a pricing quote.

- Blank pages. Some users have complained of blank pages being generated with their reports.

- Has a learning curve. Like any complex software, Realquantum’s interface can be intimidating for new users.

Integrations

- Rockport VAL

- Google Maps

PropertyMetrics

PropertyMetrics is a web-based software for commercial real estate valuation and analysis.

It has tools that help appraisers build proformas, run investment and credit metrics, and generate presentation-quality reports.

The software also has an educational platform that gives appraisers access to different courses and materials on real estate and appraisal processes.

Features

Proforma Creator

This tool simplifies commercial real estate valuation by automating proforma creation and analysis.

With this software, you can input property data, such as income, expenses, and financing details into the system.

The software then analyzes the data and generates cash flow projections and reports.

Publisher

The Publisher feature allows users to create high-quality, professional marketing materials such as offering memos, flyers, case studies, proposals and brochures for commercial real estate properties.

By leveraging its easy-to-use interface and customizable templates, users can quickly generate polished, professional documents to showcase their commercial real estate properties.

Investment Property Metrics

A feature useful for real estate investors, this allows evaluating the real estate investment potential by inputting various property details, such as purchase price and rental income.

The software then generates detailed financial projections, including IRR, NPV, break even occupancy, rent roll, and performs sensitivity analysis to assess the investment’s financial viability.

This feature also allows you to compare multiple properties and make informed decisions. You can export the data as an Excel or PDF document.

Plans and Pricing

PropertyMetrics offers three pricing plans: Monthly, Quarterly, and Yearly. All plans come with a 7-day free trial and offer the same features.

These include the ability to model complex leases, reimburse expenses, create detailed recovery structures and expense groups, and market leasing assumptions.

The Monthly plan costs $99. The Quarterly plan costs $279, while the Yearly plan costs $990.

PropertyMetrics also offers the same pricing plans for its publisher software. The Monthly plan costs $79 per month, the Quarterly plan costs $219, and the Yearly plan is $790.

All the plans include the same features: a drag-and-drop document builder, reusable design templates, Proforma data automatically pulled from the Proforma app, automated photo galleries, and more.

Pros and Cons

Pros

- Comprehensive analysis. The software provides a wide range of metrics and scenarios to assess property financials.

- Customizable reports. The software allows users to generate customizable reports and presentations based on their property analysis. Users can tailor the reports to include whatever metrics, charts, and visuals they want.

- Affordable alternative to ARGUS software. PropertyMetrics offers a cost-effective alternative to ARGUS software. It provides appraisers with access to property data, market insights, and basic financial analysis. Although PropertyMetrics may not offer the sophisticated financial modeling and complex cash flow analysis that ARGUS does, it provides an accessible option with features like cloud synchronization, customized reports, and more.

Cons

- Limited collaboration features. PropertyMetrics may have limited collaboration features compared to other appraisal software solutions. While it provides robust analysis and reporting capabilities, it does not offer extensive collaboration tools for team-based appraisals or sharing data and reports with clients.

- No third-party integrations. You can’t import or export data directly from external sources.

Integrations

PropertyMetrics doesn’t integrate with any third-party software.

Global DMS

Global DMS is comprehensive appraisal management software for lenders, AMCs, and appraisers.

One of its unique features is its Vendor Management Platform (VMP), which provides a centralized hub for managing the entire appraisal vendor network.

In addition, Global DMS offers a suite of solutions, such as eTrac® for residential valuation management and EVO-Commercial for commercial appraisal management.

It also offers robust compliance management capabilities that help users stay compliant with industry regulations and guidelines.

Features

eTrac®

eTrac® is an appraisal management solution within Global DMS software that streamlines the appraisal process for lenders, appraisers, and AMCs.

With this feature, users can automate workflows, manage orders, and provide real-time status updates, ensuring a seamless and efficient valuation process.

eTrac® also offers customizable features and integrations with third-party systems, providing a flexible and scalable solution for managing residential and commercial appraisals

Global Kinex®

Global Kinex® is a feature designed to automate appraisal compliance.

It ensures that appraisals meet regulatory requirements by automatically reviewing appraisal reports for compliance with the Uniform Appraisal Dataset (UAD) and submitting them to the Uniform Collateral Data Portal (UCDP) or Electronic Appraisal Delivery (EAD) portal.

SnapVal

This is a software feature added in March 2019. SnapVal provides lenders, appraisers and real estate professionals with instant, accurate and guaranteed pricing for entire lists of properties within a portfolio.

With this feature, appraisers can easily automate the insertion of the appraisal fee into the LE (loan estimate), expediting payments.

They can also order real-time appraisals from vetted appraisers using any of Global DMS’s software tools.

Report Builder

Global DMS’s eTrac® report builder offers a versatile and efficient solution for creating appraisal reports by using a variety of pre-built templates, including General Report, client report, client user report, status history report, appraiser report, and appraiser user report.

Users can also design custom reports tailored to their needs. The Auto-ERB and workflow engine enable report creation automation, streamlining the process.

Additionally, the platform allows for easy sharing of reports via email with multiple recipients.

Plans and Pricing

Global DMS doesn’t provide pricing information on its website. Users have to book a demo to learn more about the software and its pricing.

Pros and Cons

Pros

- Robust compliance features. Global DMS offers robust compliance management tools, ensuring adherence to industry regulations and guidelines. The software automates compliance checks and provides customizable rules, while maintaining an audit trail for enhanced regulatory compliance.

- Bias alert. This unique feature eliminates appraisal bias litigation by providing a comparison of an appraisal to data from lender-grade automated valuation models. Lenders choose a variance threshold and are alerted when discrepancies in an appraisal hit this threshold. This feature is only available in EVO-residential for now, but could soon be integrated into the commercial solution.

- Integrated workflow automation. Global DMS’s integrated workflow engine automates various appraisal-related tasks, such as order assignment, status updates, and document management. This automation improves operational efficiency, reduces manual effort, and enables smooth data exchange and communication between stakeholders.

Cons

- Customization complexity. While Global DMS offers customization options, configuring and implementing highly tailored workflows or compliance rules may require technical expertise or assistance from the Global DMS support team.

- Non-transparent pricing. Users have to book a demo to get pricing information.

Integrations

- ProxyPics

- OpenClose LOS

- CoreLogic’s LoanSafe Appraisal Manager

- Encompass

- Calyx Point

- Black Knight’s LoanSphere Exchange

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.