6 Best Commercial Real Estate Investment Analysis Software Tools and Property Data Sources (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate investors to share their expertise on the best commercial real estate analysis software to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best commercial property investment research tools and evaluated their features, pricing information, pros, and cons. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

PropertyRadar

One of the best commercial real estate data sources, PropertyRadar offers real estate professionals access to enhanced public records.

Apart from serving commercial real estate professionals, PropertyRadar is also used by residential real estate investors and real estate wholesalers to find homes to fix and flip or find properties to wholesale owned by motivated sellers.

The platform’s real estate investor skip tracing tool also allows users to quickly find or connect with property owners and identify opportunities in the industry by finding motivated sellers.

Users of this residential and commercial real estate ownership database can access detailed insights into target property data, such as location, mortgage and loan data, characteristics, vacancy, ownership history, and more.

Features

Property Lookup

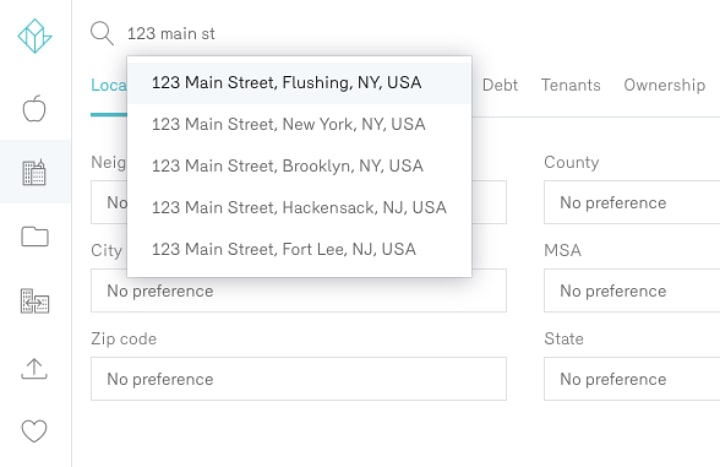

PropertyRadar offers different types of real estate investors a fast nationwide lookup of properties and allows skip trace real estate owners by company, name, address, phone number, email, or APN.

PropertyRadar, as one of the leading commercial real estate property data providers, allows users to quickly search and access reliable and accurate real estate data across the United States.

By using its tools, you can find distressed properties or high-performing investment real estate.

Transaction History

The software offers a comprehensive view of a property’s transaction history, showing the chain of title, and providing insights into the history of the property and its owners.

It provides information on property transfers, loans, loan assignments, and foreclosures in an easy-to-follow format.

This tool gives users the opportunity to see if there are any potential risks associated with a property.

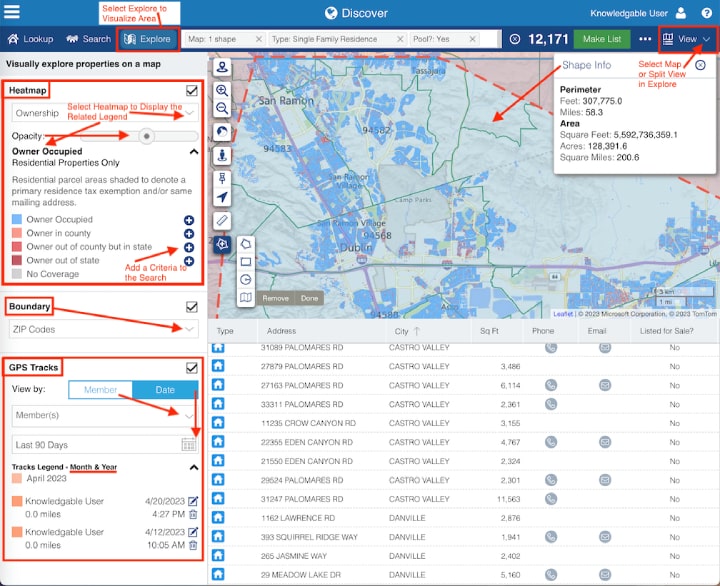

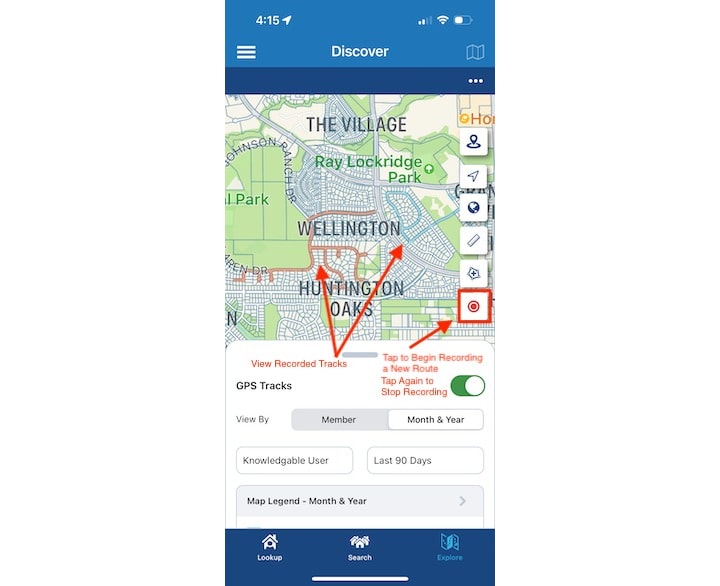

Driving for Dollars

The driving for dollars app feature helps real estate investors see details on every property around them as they drive with data visualization heatmaps.

It provides them with comprehensive property data, owner information, and the capability to collect and share off-market property data with their team.

It is a powerful tool for scouting and analyzing properties.

Investment Analysis

PropertyRadar provides a robust investment analysis tool that allows investors to quickly and easily perform rental and flip-investment analyses.

This tool allows them to view analysis on every property through a variety of lenses, including return on investment (ROI), cap rate, cash-on-cash returns based on current market value, or any value they enter.

You can export the investment analysis in PDF format and share this directly with team members or investors.

These and other features are described in detail in our PropertyRadar review.

Plans and Pricing

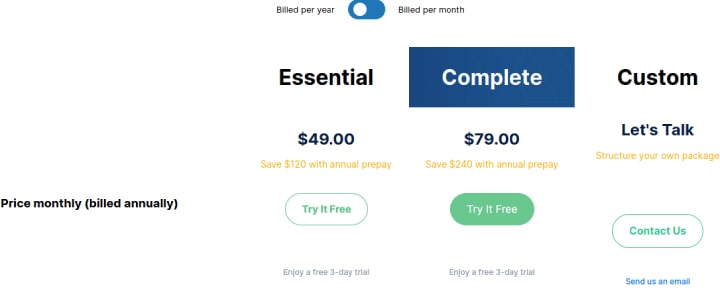

PropertyRadar offers three pricing plans: Complete, Essential, and Custom.

The Complete plan costs $79 per month billed yearly, or $99 per month.

It includes property lookup and search, a list builder, standard property and owner data, list monitoring, insights, investment real estate due diligence tools, alerts, and automation.

The Essential plan costs $49 per month billed yearly, or $59 per month. It includes all the features of the Complete plan, plus premium property and owner data.

It allows integration with over 4,000 applications and registration of new users for $50/month.

The Custom plan has no fixed price; it is structured according to each investor’s needs. This plan includes all the features of the Complete and Essential plans.

First-time users have access to a 3-day free trial of the software which excludes features such as downloads, phone/email appends, document images, and parcel maps.

Pros and Cons

Pros

- Mobile app. PropertyRadar has a real estate investment app version for mobile devices. It allows users to access property data on the go.

- Third-party integrations. PropertyRadar offers a vast array of third-party integrations, with over 200 to choose from.

- Intuitive software. The platform is easy to use.

Cons

- Additional fees. Users must pay additional fees for select services such as parcel maps and more.

- Some information could be outdated. Sometimes the information provided in their database could be inaccurate.

Integrations

- Zapier

- PRINTgenie

- Addressable

- Click2Mail

- PostcardMania

- YellowLetterHQ

- Slybroadcast

- Handwrytten

- Lob

- Pipedrive

- CallFire

- ClickSend

- Mojo

- LionDesk

- Wise Agent

- Follow Up Boss

- Zoho CRM

- Freshsales

Reonomy

Reonomy is a leading commercial real estate investment analysis software that crowdsources and aggregates ownership and sales data from multiple public and proprietary sources.

As one of the best commercial real estate data companies, it provides market intelligence for real estate developers, real estate investment consultants, investors, brokers, real estate asset managers, and anyone else involved in the commercial real estate industry.

Its commercial real estate sales and comps database uses artificial intelligence and machine learning to provide insights that help users access deeper levels of information.

This allows them to quickly identify potential opportunities, benchmark performance, and deepen their understanding of the real estate market.

Features

Property Records

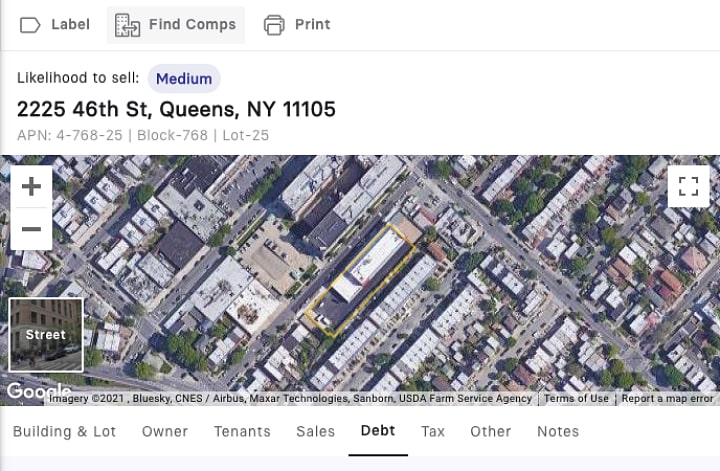

Reonomy, as some of the top commercial real estate database software, provides a consolidated view of real estate property records on a single platform.

This makes it easy to find all the information needed about a particular property.

The commercial real estate analytics platform enables searching for property records by address, owner, or limited liability company (LLC).

These property records include building and lot information like the size of the building and lot, the age of the building, its metropolitan statistical area (MSA), whether it sits in an Opportunity Zone, and more.

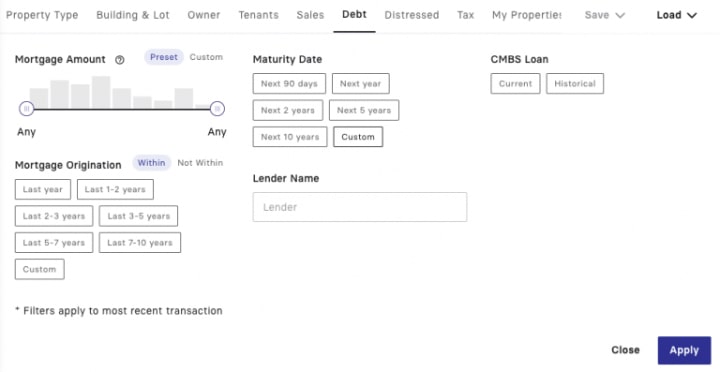

Debt Research and Analysis

Reonomy offers commercial debt and lender analysis on real estate properties. The commercial property owners database platform analyzes a property’s present and past debt standing, as well as that of its owner.

This provides actionable financial insights into these properties. It helps investors understand commercial lender and borrower portfolios, so they can make more informed decisions about properties, prospects, competitors, and the market as a whole.

Real Estate Comparables

Reonomy’s broker listing database provides commercial real estate comparables to investors, which help them better understand market trends and make more informed decisions when researching commercial real estate investments.

By using layers of property, building, and transactional data, it identifies properties with similar data points to an investor’s target property.

Plans and Pricing

This real estate brokerage software platform offers a free trial of its web application but does not offer pricing details.

However, by browsing through some online sources like the BiggerPockets forum, we found that the Reonomy platform costs $149 per month for 250 property information downloads.

To get detailed pricing information, users should contact one of their customer care reps.

Pros and Cons

Pros

- Intuitive interface. Reonomy offers an easy-to-use interface for real estate investors to access data and analyze portfolios.

- Comprehensive property search. Reonomy provides a comprehensive nationwide property search tool with access to over 50 million properties and over 200 search filters.

- Artificial intelligence tools. Reonomy’s commercial real estate analytics software uses artificial intelligence (AI) tools to quickly predict and analyze market data, as well as identify potential investment opportunities.

Cons

- No mobile app. Reonomy does not have a mobile app, which means users cannot research properties on the go.

- No transparent pricing. The exact cost of using the platform’s commercial real estate data services is not disclosed on their website. This makes it hard to budget for the software.

Integrations

- Silverline CRM

- Salesforce

- Data Axle

PropertyMetrics

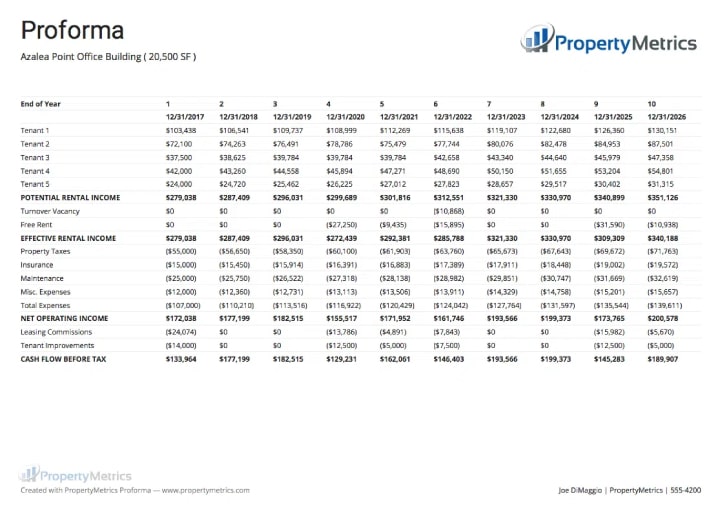

PropertyMetrics is a web-based commercial real estate investment analysis tool.

It allows professionals to create proformas, calculate investment and credit metrics, and produce high-quality reports to use in a commercial real estate marketing campaign.

By using PropertyMetrics, investors and agents can quickly generate comprehensive analyses of select properties and share investment analysis reports with team or real estate brokerage members.

Features

Proforma

This feature allows investors to quickly and accurately calculate the projected cash flow associated with income-producing properties, taking into account numerous intricate factors, such as:

- rent escalations

- tenant reimbursements

- leasing commissions

- market lease assumptions

- potential renewals

It provides a detailed analysis of complex lease terms and a comprehensive assessment of the lease agreements involved.

Financial Metrics

PropertyMetrics automatically calculates valuable financial metrics, including Internal Rate of Return (IRR), Net Present Value (NPV), Cash-on-Cash Return, Gross Rent Multiplier, and more.

These metrics are essential for accurately evaluating real estate investments.

Financial data can be conveniently exported to an Excel or PDF report package, fully customizable with a logo and contact information.

Reporting

PropertyMetrics provides real estate professionals with comprehensive reports for rent roll, sources and uses, market leasing assumptions, construction loan budget, loan draw schedule and maps, and more.

These reports are tailored to the real estate professional’s needs and provide a detailed overview of the current state and potential of a property.

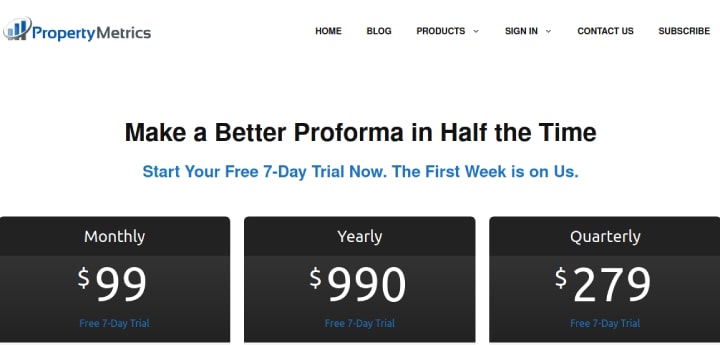

Plans and Pricing

PropertyMetrics offers different pricing plans for monthly, yearly, and quarterly billing cycles.

The monthly plan costs $99, the yearly plan costs $990, and the quarterly plan costs $279.

Each plan offers access to the same features. There’s also a 7-day trial for users interested in trying out the software before committing.

Pros and Cons

Pros

- Multi-platform compatibility. PropertyMetrics allows users to easily access its CRE analysis software from multiple platforms, operating systems, and mobile devices including Windows, Mac, iOS, Android, and more.

- Collaboration tools. This commercial property software offers excellent collaboration tools for real estate teams and investors, enabling them to easily share commercial real estate information and analysis data.

- Affordability. PropertyMetrics is more affordable than most other CRE investment property analysis tools.

Cons

- No third-party integrations. PropertyMetrics offers no integrations with other tools. This makes it difficult to exchange data with other systems, which in turn makes it harder to automate processes.

- No property data research feature. PropertyMetrics doesn’t offer property data and property search features. Its feature sets are primarily focused on helping investors assess property financials and potential returns.

Integrations

No supported third-party integrations.

TheAnalyst® PRO

TheAnalyst® PRO is one of the most sophisticated commercial real estate research tools, designed to help real estate professionals and investors perform complex property investment analysis.

Users can quickly evaluate opportunities, generate detailed reports, and access a nationwide market database.

The user-friendly interface streamlines intricate analysis and reporting tasks.

Features

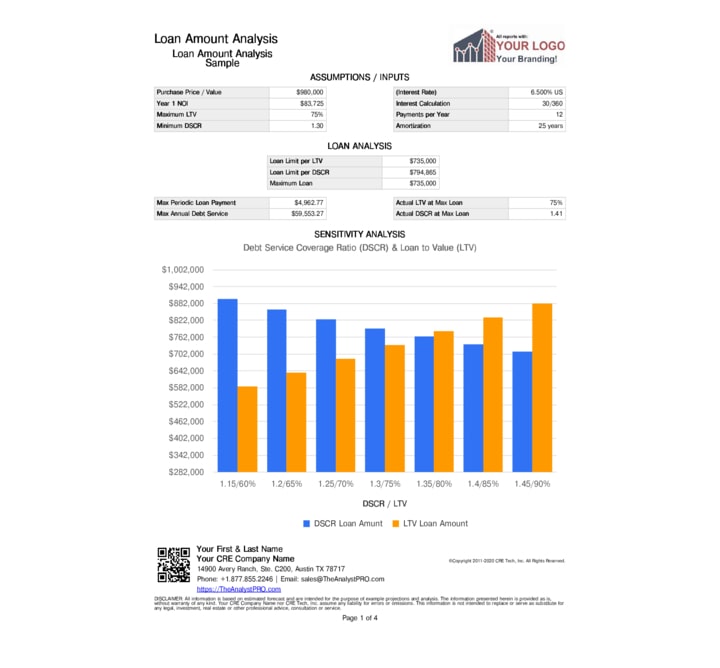

Loan Amount Analysis

This helps real estate investors calculate the maximum loan amount available to them for their next deal.

Based on the loan-to-appraised value ratio (LTV) and debt service coverage ratio (DSCR), the report provides multiple tables and graphs.

They illustrate how even the smallest change in loan variables, such as interest rate, amortization, and net operating income, can significantly affect their loan amount.

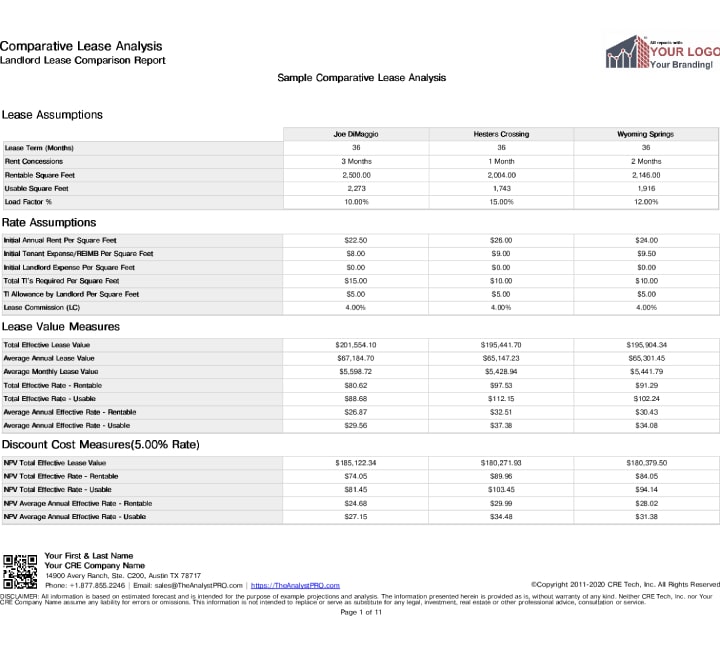

Lease Analysis

TheAnalyst® PRO allows users to analyze a single lease, or compare up to five leases side by side.

It provides a detailed analysis of a lease, as well as a comparison of different leases.

The program will generate an extensive summary and detailed PDF report from both tenant and landlord perspectives.

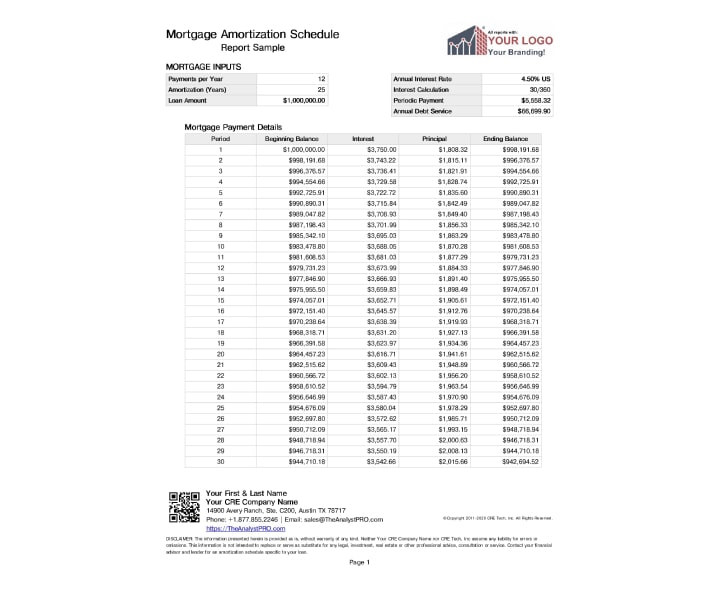

Mortgage Calculator

The mortgage calculator allows users to generate a full monthly loan amortization schedule.

In addition, users can view an annual summary of principal and interest paid on their mortgage.

It is an effective tool for managing a mortgage, providing users with a complete overview of their loan payments and helping them plan for the future.

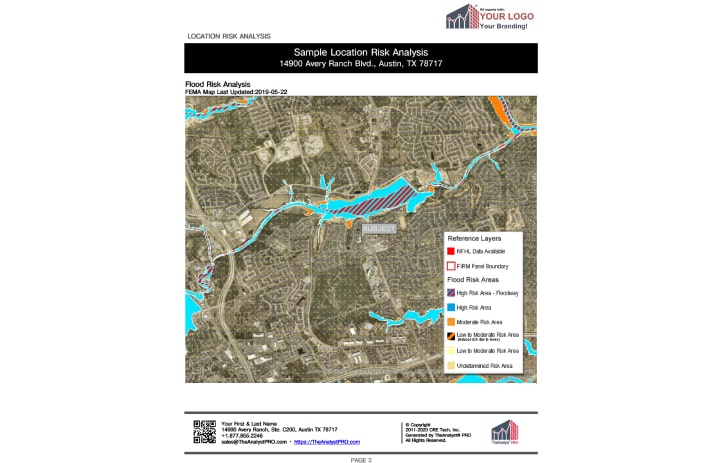

Location Risk Analysis

TheAnalyst® PRO provides real estate professionals with the ability to generate a comprehensive location risk report for a selected property.

These reports contain a FEMA Flood Map, FBI Crime Index, and Environmental Location Analysis.

It also includes up to 25 reported environmental records within a half-mile radius of the subject property.

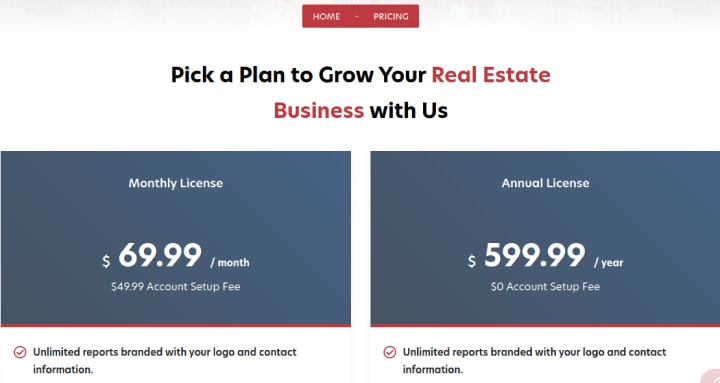

Plans and Pricing

TheAnalyst® PRO offers two types of licenses: monthly and annual.

The monthly license costs $69.99 per month, plus a $50 account setup fee. The annual license costs $599.99 per year with no setup fee.

Pros and Cons

Pros

- Quick property analysis. With TheAnalyst® PRO, users can scout properties, get all the details, perform a risk analysis, and much more in less than 30 minutes.

- Marketing tools. TheAnalyst® PRO offers commercial investors tools to quickly create customized infographics, flyers, one-page websites for real estate investors to market properties, and offering memorandums for their properties. With its ChatGPT integration, users can also quickly create compelling property descriptions.

- Affordable software. It is the cheapest commercial real estate investment analysis software on the market.

Cons

- Limited training information. The software has a lot of features but there isn’t enough training provided for new users on navigating the different tools.

- Poor mobile compatibility. The platform’s mobile compatibility is poor, which can negatively affect user engagement, especially if users access the website from mobile devices.

Integrations

- ChatGPT

- ClientLook

Mapzot

Mapzot is a software company that offers AI-powered solutions designed to help businesses make better location decisions.

The platform combines data from multiple sources, including Census data and property data, to generate insights about site selection, retail void analysis, and market research.

These insights help businesses identify growth markets and gain competitive advantage.

Features

Trade Areas

Mapzot combines artificial intelligence and human analysis to give users information about trade areas.

It helps businesses find excellent locations for retail and commercial properties.

Its technology helps assess the impact of future store openings in an area, enabling businesses to make informed decisions when choosing a location.

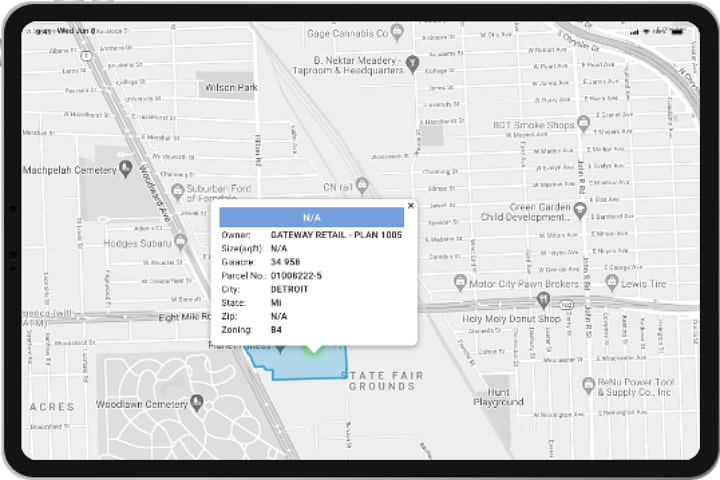

Parcel Information

Mapzot tracks over 150 million parcel boundaries, covering 98% of Americans across 2,900+ counties.

It provides detailed boundary information such as parcel numbers, street addresses, and more.

The tool updates its nationwide dataset in near real time, helping businesses make informed decisions.

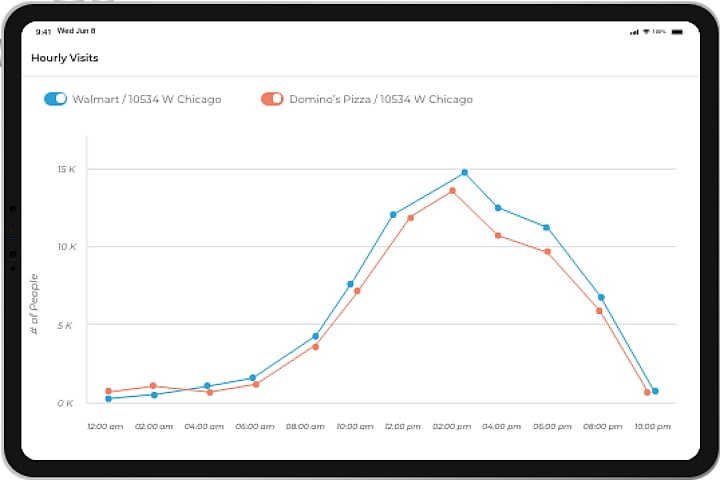

Customer Visitation

This tool analyzes customers’ aggregate foot traffic and shopping patterns. It helps businesses understand customer behavior and make decisions about product placement and store layout.

This data can also be used to track customer trends and loyalty, as well as to identify areas for improvement.

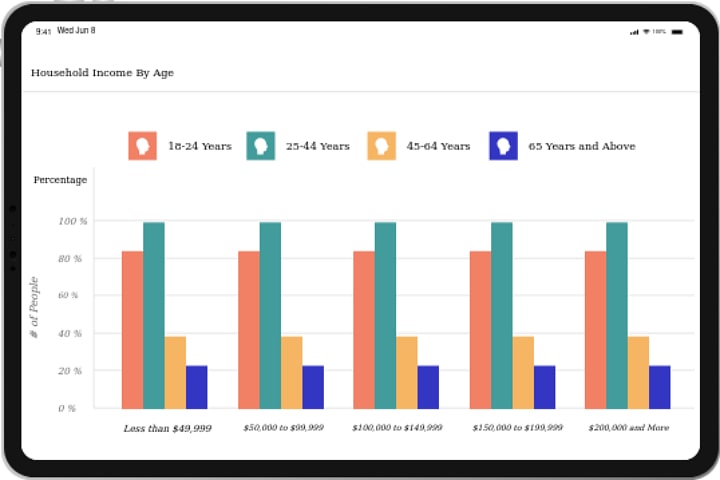

Demographics

Mapzot identifies hundreds of demographic factors that influence a store’s success in a submarket. This data helps businesses make better decisions about store location and design.

Plans and Pricing

Mapzot does not offer pricing information on its website. Interested users have to request a demo and speak with a customer care rep.

Pros and Cons

Pros

- National coverage. Mapzot tracks data from more than 8 million locations and more than 40 billion square feet of retail properties throughout the United States.

- Detailed metrics. Mapzot offers detailed metrics about store saturation, pull rates, and more with anonymized data from users who share their location data.

Cons

- Doesn’t consider all retail property variables. Mapzot doesn’t take into account all factors important to a business when selecting a retail location. For example, it does not consider rent costs or labor availability.

- No supported third-party integrations. Mapzot doesn’t integrate with third-party tools. Hence, data from Mapzot can’t automatically be synced with any other tool.

Integrations

Mapzot does not integrate with any third-party software.

ARGUS Enterprise

ARGUS Enterprise is the most comprehensive property valuation and portfolio management solution. It offers leading commercial property valuation and cash flow forecasting tools.

By using ARGUS Enterprise, real estate agents and investors can construct detailed cash flow forecasts, conduct stress tests, and generate comprehensive commercial property valuations.

The platform also provides users with the tools to manage asset performance and risks efficiently.

Features

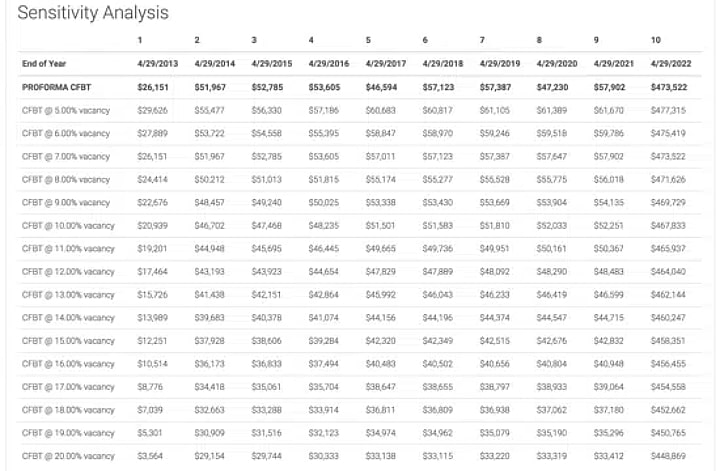

Sensitivity Analysis

ARGUS Enterprise helps investors stress-test their portfolios through sensitivity and scenario analysis.

By creating a sensitivity matrix that identifies how different assumptions affect their KPIs, building sensitivity assumption sets and applying them across their portfolio, standardizing and organizing their assumptions for effective collaboration, investors can gauge the impact of changes across specific properties.

Cash Flow Forecasting

The platform allows investors to build detailed cash flow forecasts and create an accurate cash flow model.

This cash flow model allows investors to anticipate potential risks and opportunities, while monitoring portfolio performance to ensure optimal outcomes.

Asset Budgeting and Forecasting

ARGUS Enterprise offers an asset budgeting and forecasting module that allows investors to plan and optimize their budgets.

It helps them create detailed, long-term budget plans and monitor budget performance in real time, enabling them to make the most strategic decisions for their business.

Plans and Pricing

Based on online reviews, pricing for the software can range from $2,600 to $4,000 per year.

However, the ARGUS Enterprise software website does not offer pricing information. Interested users have to book a demo and speak with a sales rep.

Pros and Cons

Pros

- Intuitive user interface makes the platform easy to use.

- The platform offers excellent audit reports with the lease audit section, providing detailed breakdowns of every lease to help users understand valuation drivers.

- Excellent customer service with quick response times and personalized solutions.

Cons

- High cost. ARGUS Enterprise is one of the most expensive CRE real estate investment analysis software tools on the market.

- Steep learning curve. The program requires a level of technical expertise to use it.

Integrations

- ARGUS API

- ARGUS ValueInsight

- Yardi Voyager

- BrightAnalytics

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.