5 Best Commercial Mortgage Loan Servicing Software Platforms (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading lenders and mortgage brokers to share their expertise on the best commercial loan portfolio management software to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best commercial mortgage lending management platforms and evaluated their features, plans, and pricing information. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

Mortgage Automator

Mortgage Automator is an advanced, end-to-end loan servicing and mortgage origination system designed specifically for private and hard money lenders.

It specializes in residential, commercial, and construction lending, including complex ventures like rehabs and fix and flips.

This hard money lending software offers several unique features, such as the ability to auto-generate custom documents and a borrower upload portal that allows borrowers to easily upload files, images, and videos for review by lenders.

It also offers unlimited document handling, user access, and comprehensive training and support. Mortgage Automator maximizes team efficiency by minimizing manual work.

Features

Payments and Extensions Management

Mortgage Automator offers a suite of tools to help you manage payments and extensions efficiently.

Features include post-dated checks, check printing, auto-generated ACH/EFT, automated warnings, credit card payments, extensions with multiple payment options, custom extension conditions, and prepayments at renewals.

These capabilities give you a streamlined approach to managing payment collection and loan extensions.

NSF Tracking

Mortgage Automator’s Non-Sufficient Funds (NSF) tracking feature allows you to track batch or individual NSF transaction entries easily.

By using the software, you can send automated SMS notifications and emails to borrowers with a signed NSF letter attached. You can also set custom NSF fees.

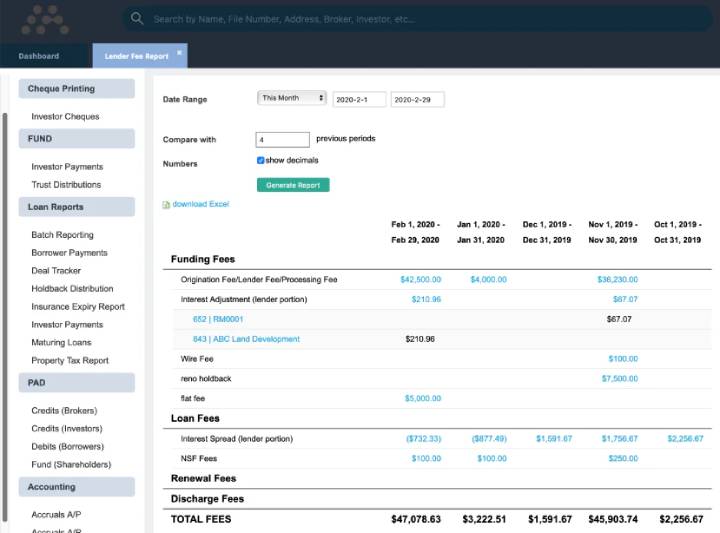

Accounting and Reporting

This residential and commercial loan origination software offers a myriad of accounting and operational reports for a complete overview of your operations.

Compliance and trust reinvestment reports can be automated; trust and operating account ledgers provide deep insights into your numbers.

The platform also syncs with QuickBooks automatically, simplifying bookkeeping.

Document Automation

Instead of spending time creating new documents, you can auto-generate key business documents such as custom documents, compliance reports, ACH/EFT payments, and more.

Plans and Pricing

Pricing for Mortgage Automator is customized based on your business needs. Options include:

- Standard Origination and Servicing: This plan provides essential features to automate your private lending business processes. It includes origination and servicing features, document management, CRM databases, standard reporting, loan status tracking, and operations management.

- + PRO Origination: This plan encompasses all the features of the Standard plan, plus key additional tools for enhanced loan origination. These additions include manual and automated communications, manual task creation, automated tasks, a borrower portal, a lead intake form, and credit card processing capabilities.

- + PRO Servicing: This comprehensive package is specifically aimed at businesses that service their own deals. The plan includes all the features of the + PRO Origination plan, as well as features for ACH (Automated Clearing House) transactions and a Bank Account Module.

- + Fund: The most advanced option, this plan includes all offerings from the Standard and + PRO plans. It adds shareholder ACH capabilities, an upgraded fund dashboard, shareholder statements, trust accounting, compliance and reporting, multiple ways of recording management fees, and share/unit price tracking.

Pros and Cons

Pros

- Exceptional customer service. As the product offerings rapidly expand in both features and ease of use, Mortgage Automator also maintains a strong focus on excellence in customer service. They are responsive to user concerns and take prompt action, demonstrating their dedication to addressing challenges and optimizing the overall user experience.

- Efficient onboarding and training process. Mortgage Automator provides a comprehensive onboarding and training process, designed to streamline users’ transition to the platform.

- Flexible and customizable. Mortgage Automator is a flexible and customizable platform that can be adapted to meet the specific needs of any lender or mortgage broker.

Cons

- Borrower application feature could be more intuitive. While the borrower application is customizable in Mortgage Automator, some users find it to be the least user-friendly feature of the product, citing it as clunky.

- Tricky document creation process. While Mortgage Automator offers document auto-generation, users have reported that the process of creating custom documents isn’t as straightforward as expected, particularly due to the coding involved in proper formatting.

- Hard to keep up with updates. Mortgage Automator frequently releases new features and improvements to the software. Although these changes aim to enhance the user experience, it can sometimes be difficult for users to stay updated and understand how these updated features or changes may impact their existing loans.

Integrations

- Creditco

- CoreLogic Matrix

- Lightning Docs

- Filogix

timveroOS

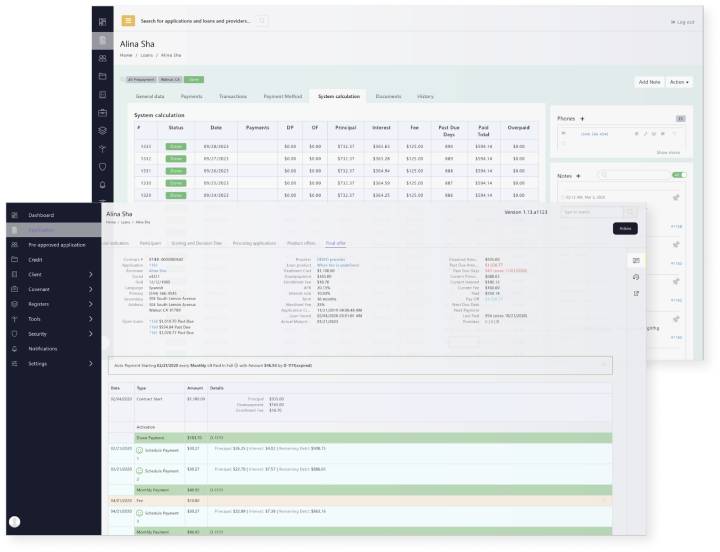

timveroOS is a sophisticated commercial loan servicing platform designed to proficiently unify various critical functions such as loan origination, financial analytics, and commercial loan portfolio management, all into an efficient and user-friendly workflow.

Its primary strength lies in its advanced AI analytics and lending automation features which revolutionize the way banks and loan businesses handle their credit processes.

timveroOS automates all aspects of loan servicing such as disbursements, calculations, notifications, overdue loan management, and collections.

Features

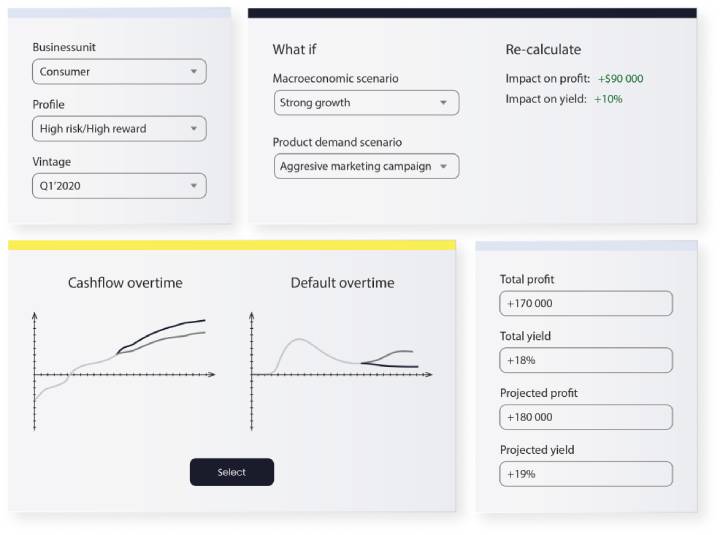

Automated Cash Flow Projections

By utilizing predictive analytics and machine learning technology, this commercial lending servicing software offers automated cash flow forecasts.

This feature enables real-time calculations, helping lenders optimize investments and meticulously measure the health of their commercial loan portfolio.

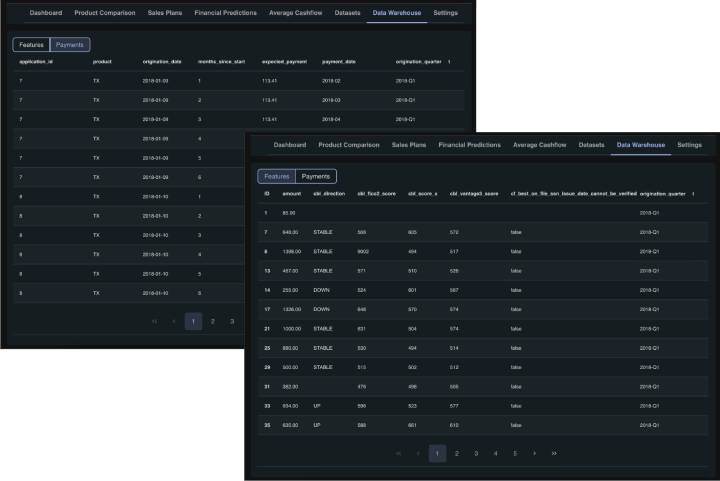

Data Warehouse

timveroOS’ Data Warehouse comes ready to use, integrating with 90+ banks and financial institutions, including credit bureaus, accounting systems, and external collection agencies.

All of the data is organized into tables and consistent formats, so that you can significantly enhance your analytics efficiency.

CRM System

Another key feature of timveroOS is its integrated mortgage CRM system. The CRM offers a 360-degree customer view.

From onboarding clients to managing relationships and transactions, the CRM system helps uphold customer-centric operations for your lending business.

Analytics XAI Engine

By using XAI (Explainable AI), each department within your institution gains access to processed and refined data.

The Analytics XAI engine, by using this data, generates authentic recommendations, including process improvements, repayment, collection analysis, and more.

XAI enables profitable business decision-making 12 times faster than traditional methods.

Plans and Pricing

timveroOS’ pricing details are not publicly available. However, if you’re interested in learning more about Timvero’s commercial servicing software before purchasing, fill out the form on their website to schedule a demo.

Pros and Cons

Pros

- Integration capabilities. As a comprehensive commercial mortgage management software, timveroOS seamlessly integrates with various third-party software. These can include accounting systems, CRM, and other pivotal business management systems to ensure uninterrupted information flow across multiple departments.

- Customizable workflows. timveroOS allows financial institutions to create and customize loan workflows, ensuring better organization and streamlined loan servicing.

- Comprehensive reporting features. timveroOS includes a wide range of customizable reporting features, allowing lenders to easily analyze their portfolios, track loan performance and compliance, and make informed decisions.

Cons

- Long setup time. It takes up to 3 months to fully set up Timvero’s loan servicing system for a bank or financial institution.

- Not built for small-scale lenders. Although timveroOS is robust commercial loan portfolio management software, it is primarily designed for large financial institutions. Consequently, it might be an expensive solution for smaller organizations with limited budgets.

Integrations

- Plaid

- Plumery

- Experian

- Zoho Remotely

- Equifax

- TransUnion

- SCHUFA

- Tink

- Yapily

- LexisNexis

- QuickBooks

The Mortgage Office

The Mortgage Office is a versatile commercial loan servicing platform designed to cater to the diverse needs of businesses of all sizes.

With a wide range of modules addressing loan origination, trust accounting, escrow administration, mortgage rate management, and more, this platform is an ideal solution for lenders, financial institutions, and non-profit organizations.

The Mortgage Office is a popular choice across the US and Canada, handling various loan types, including complex loans like bridge loans, gap funding, and mezzanine debt.

Features

Graduated Terms Mortgage Management

The Mortgage Office incorporates a specialized Graduated Terms Mortgage Module.

This module enables users to effectively service complex loan types, including step loans, GPM (Graduated Payment Mortgages), GTM (Graduated Terms Mortgages), GPARM (Graduated Payment Adjustable-Rate Mortgages), and deferred principal pay downs.

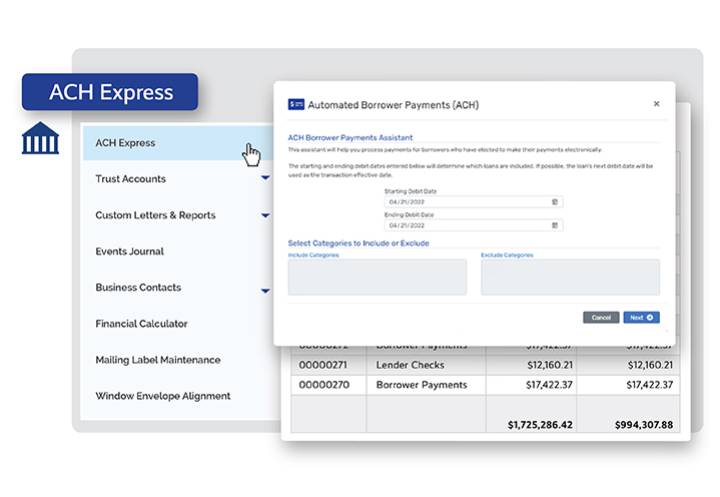

ACH Express

The ACH or Electronic Funds Transfer (EFT) module helps you electronically process loan payments and interest disbursements.

By using this feature, you can collect borrower payments electronically and directly deposit funds to lenders, simplifying transaction processing.

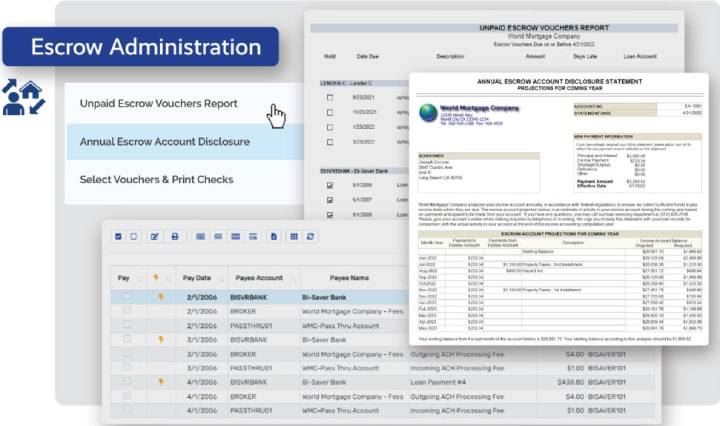

Escrow Administration

The Mortgage Office automates the process of maintaining escrow accounts.

It generates instant disclosure statements, handles diverse scenarios such as unexpected disbursements, shortfalls, and surpluses, and ensures timely insurance and tax payments.

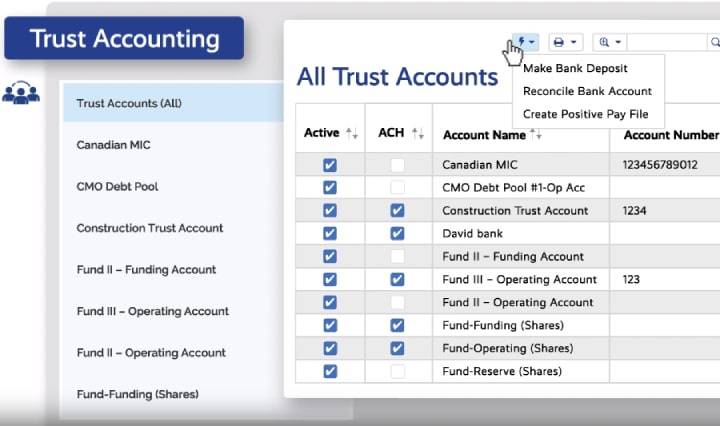

Trust Accounting

Adhering strictly to prevalent legal and accounting standards, this commercial loan portfolio management software enables businesses to effortlessly manage trust accounts, thereby ensuring regulatory compliance.

It is suited for both federal and state regulations—inclusive of CA-DRE and B&P codes—simplifying audits and enabling the management of an infinite number of trust accounts.

Plans and Pricing

This mortgage lending software offers customizable pricing tailored to each user’s needs.

Prospective users can schedule a demo on their website to be introduced to the platform and receive a pricing quote. According to online sources, monthly rates start at $650.

Pros and Cons

Pros

- Easy setup process. The Mortgage Office software is easy to install. Its straightforward setup process lets users swiftly launch their loan servicing operations, accelerating the onboarding and implementation stages.

- Customizable views. The Mortgage Office stands out by offering data display flexibility with its “Smart Views” feature.

- Comprehensive feature set. From establishing a loan to applying payments, conducting escrow analysis, handling adjustable interest rates, producing end-of-year statements and 1099/1098s, The Mortgage Office streamlines many mortgage servicing tasks.

Cons

- Reporting limitations. Generating advanced custom reports requires expertise in SQL or Crystal Reports, creating a hurdle for users without this knowledge. Businesses may need specialists or training to use this feature.

- Cost. Based on online sources, pricing for The Mortgage Office software starts at $650 per month. This makes it one of the most expensive commercial loan servicing platforms on the market.

Integrations

- Microsoft Office

- Lightning Docs

- Filogix

- GoDocs

- QuickBooks Online

- Salesforce

- Oracle NetSuite

FICS Commercial Servicer

FICS Commercial Servicer is a robust and user-friendly software solution built to streamline commercial loan servicing.

It automates complex tasks across various loan types, such as commercial real estate, multifamily, construction, and equipment loans.

Key features of this platform include flexible payment processing, robust collateral tracking, detailed investor reporting, and efficient escrow administration.

It also offers added functionality through integrations with FICS’ LoanStat and Commercial Accountant software.

Commercial Accountant provides automated general ledger postings and ACH distribution as well as bank reconciliations.

LoanStat provides a website where borrowers can track loan statuses and payments and set up recurring payments.

Features

LoanStat

LoanStat is a mobile-responsive web application integrated into the FICS Commercial Servicer platform.

This feature enables borrowers and real estate investors to access commercial loan information around the clock via your website. They can view loan statements and track payment history at any time.

Collateral Tracking/Asset Management

FICS Commercial Servicer allows you to record, track, and monitor an unlimited number of collateral types and properties. It includes built-in reports for superior asset management.

Commercial Accountant

Commercial Accountant is an automated mortgage accounting software feature that facilitates funds transfer between clearing, custodial, and company accounts.

It also manages bank account reconciliations and produces an automated general ledger in which all commercial transactions can be uploaded through an interface.

Commercial Accountant supports remittance programs for Fannie Mae, Freddie Mac, Ginnie Mae, and other loan investors.

Escrow Administration

The software automates and enhances escrow administration. It lets you set up escrow buckets and keep track of insurance policies and tax bills.

This streamlined handling provided by the platform ensures accuracy and timeliness in paying bills and premiums and streamlines tax reporting.

Plans and Pricing

FICS Commercial Servicer offers customized pricing based on each client’s specific needs. To receive a quote that reflects your unique needs, reach out to a member of their customer care team.

Pros and Cons

Pros

- 24/7 customer support. FICS Commercial Servicer ensures round-the-clock assistance through its customer service team, which is always accessible via live chat or email, providing immediate and effective support.

- Strong portfolio management capabilities. The software handles various investment types, including whole loans, MSRs, and MBS, and significantly optimizes portfolio management through automated workflows and decision-making capabilities.

- Automated reporting. FICS Commercial Servicer API integrates with automated document generation tools, allowing the generation of end-of-day and end-of-month reports, investor closeout, monthly loan statements, and bank/credit union core interface reports.

Cons

- High system requirements. The commercial loan software requires a system running on Windows 10 or 11 (64-bit), with an Intel Core i5 processor or superior, 8GB RAM or higher, and Microsoft .NET Framework 4.8 or higher.

- On-premise solution. FICS Commercial Servicer is basically an on-premise solution. However, cloud hosting is now offered at additional costs.

- Can be costly. The software appears to target larger institutions and may not be as beneficial or cost-effective for smaller lenders.

Integrations

- Fannie Mae

- Freddie Mac

- Ginnie Mae

- OpCon

- MISMO

- ValueLink

- FICS CFS Data Connector

- FICS Radstar

- Corelation

Bryt Software

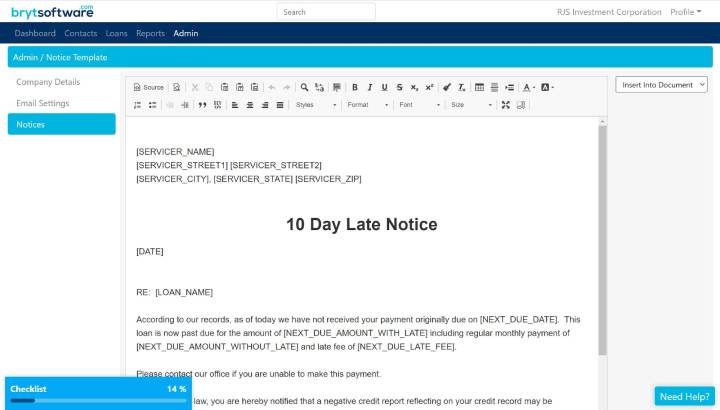

Bryt is a dynamic commercial lending servicing software that offers an array of unique features, including workflow and procedures configuration, notifications, task automation, and document management.

Its cutting-edge macro-based workflow automation and loan servicing toolset enhance adaptability, streamlining operations for various team sizes, from small admin groups up to large enterprises, helping you grow your lending business.

As a commercial loan management platform, Bryt Software is easy to use and configure, with a setup time of less than 30 minutes for its business version.

Features

Automated ACH Processing

Bryt Software includes a dedicated ACH module that enables both one-time and recurring electronic payments.

Clients can safely provide their banking information either online or over the phone for the transaction, and this data gets tokenized for increased security and saved for future transactions.

Custom Reporting

Bryt Software is equipped with a powerful reporting tool that generates standard reports to meet common business needs.

Additionally, if your organization requires specific reports, the commercial loan management platform caters to this need by allowing you to create complex, specialized reports from scratch through its Custom Reports Module.

Document Management

Create, store, and customize documents within Bryt Software’s platform and send them to clients for review and approval.

With easy organization and storage within the related loan file, managing documents has never been simpler. You can also create a loan notice from an existing loan notice template.

Web Portals for Borrowers and Lenders

The software provides dedicated web portals for borrowers and lenders or investors to manage their accounts, enhancing transparency, access, and communication for all parties involved.

Plans and Pricing

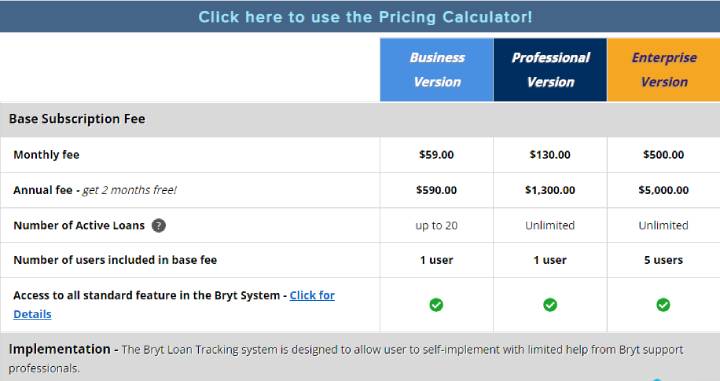

Bryt Software offers three versions with different pricing options for each. New users can enjoy a free 45-day trial of the software.

- Business: Priced at $59/month/user or $590/year/user, this version can manage up to 20 active loans. It includes standard Bryt Software features like customer relationship management, loan creation, custom reports, and fees management. Additional features include a custom user field module, custom document template module, and ACH module.

- Professional: At $130/month/user or $1,300/year/user, this version offers unlimited active loans, everything from the Business version, and boasts additional modules like impound/escrow, assets and insurance tracking, and data import.

- Enterprise: Priced at $500/month or $5,000/per year for up to 5 users, this plan includes everything from the Professional version and additional modules for lender service fee, borrower portal, draw disbursement, Nacha, and an accounting register module.

Pros and Cons

Pros

- Quick implementation. Bryt Software’s core system is designed for easy setup and can be installed in less than 30 minutes.

- User-friendly interface. Engineered to simplify your job, Bryt’s commercial servicing software offers an intuitive and easy-to-use interface that requires minimal training.

- Affordable pricing. Bryt Software offers a 45-day free trial and ongoing monthly fees starting as low as $59, making it a cost-effective solution.

Cons

- Expensive add-ons. To access advanced modules, users have to make additional payments for each module if it’s not included in their pricing plan. For instance, for access to a custom report writer module, you have to pay an additional $100/month fee.

- Lack of integrations. When compared to competitors, Bryt’s commercial lending servicing software falls short in terms of integrations with third-party software solutions. This could potentially limit seamless information flow and software flexibility.

Integrations

- Microsoft Excel

- Nacha

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.