Top 8 CRM Systems for Mortgage Brokers and Loan Officers (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading mortgage brokers to share their expertise on the best mortgage CRM software to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best CRM systems used by mortgage brokers and loan officers and evaluated their features, pricing structure, and pros and cons. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

SalesPype — Best Mortgage CRM Software for Sales Prospecting

Launched in 2018, SalesPype is a SaaS solution designed to augment sales pipeline management.

This platform comes with a mortgage CRM that offers automation capabilities to help lenders streamline and optimize their mortgage process.

SalesPype offers a variety of features, including drip marketing automation, campaign templates, video emails, and a call bridge.

These features streamline the lead capture and conversion process for loan officers and other mortgage professionals.

Features

Video Emails

By using SalesPype’s built-in video recorder, users can create personalized videos for prospects and clients.

They can edit the video by trimming, cropping, adding filters, and adjusting audio levels. Once the video is set, they can embed it in an email campaign.

This feature also allows you to track video engagement. You can see who has watched your video, how many times it was viewed, and how much of it was viewed.

Drip Marketing Automation

This feature allows you to set up and manage a series of timed micro-campaigns aimed at nurturing leads.

The drip marketing automation feature allows you to create and customize sequences of emails, mortgage social media posts, and other types of communications that can be triggered by various events.

Click and Drag Sales Pipeline

This is a helpful tool that allows you to simplify and visualize the sales process. This mortgage software solution allows you to visualize your entire sales pipeline at a glance.

You can also add deals and stages, associate values, project close dates, and more.

Campaign Templates

Users can choose from an array of pre-built templates based on their business requirements and customize them according to their needs to better resonate with their target audience.

The campaign templates in SalesPype simplify campaign creation, allowing for quick customization and deployment of marketing and follow-up campaigns.

Plans and Pricing

SalesPype costs $79 per month for one user and $25 for each additional user.

It includes features like text messaging, geo-farming, ringless voicemail, video email, call bridge, inbound/outbound calling, and marketing automation.

Pros and Cons

Pros

- Free 14-day trial. The platform offers a free 14-day trial of its software, allowing you to test its functionalities to see if it meets your business needs.

- Click and drag sales pipeline. SalesPype’s click and drag sales pipeline feature allows businesses to visualize their entire sales pipeline at a glance.

- Geo-farming. SalesPype offers a geo-farming feature that enables businesses to focus their marketing efforts on specific geographic areas or regions.

Cons

- Expensive enterprise plan. The enterprise plan costs $2,499 per year for unlimited users. It allows users to create branded mobile and desktop apps.

- Low number of user reviews. SalesPype is a relatively new platform and there aren’t many real user reviews of the platform.

Integrations

- Zapier

- Gmail

- LeadGen App

- Jotform

- Google Drive

- leadPops

- Realtor.com

- Nextgen Leads

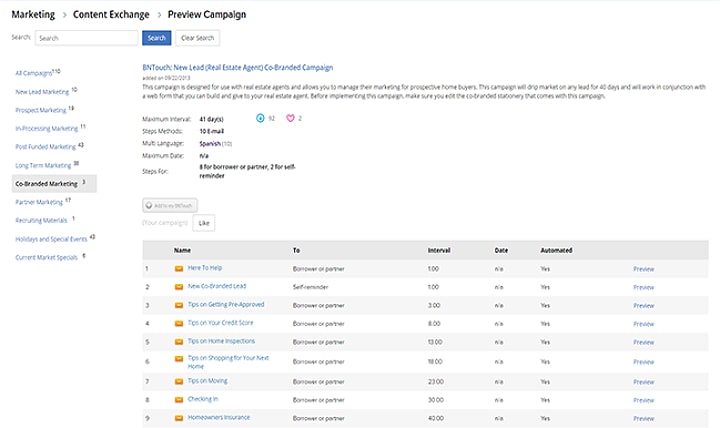

BNTouch — Best Mortgage CRM Software with Marketing Automation Features

Since its establishment in 2004, BNTouch has emerged as one of the best mortgage CRM software solutions, tailor-made to help mortgage companies grow.

A top CRM software for mortgage professionals with an automated lead follow-up system, BNTouch helps users maintain long-lasting relationships with borrowers, recruit new partners, and convert more leads.

A standout feature of BNTouch is its marketing automation tool.

Housing 180 prebuilt marketing campaigns, email/SMS automation, and personalized real estate email blasts, this tool caters specifically to the needs of mortgage lending companies and loan officers.

BNTouch also offers other capabilities, including lead distribution and management, a digital 1003 application, refinancing analysis tools, and integration with LOS tools, Outlook, and Zapier.

Features

Email and SMS Marketing Automation

Users can segment their contact list, merge data, and personalize emails with recipient names and other relevant information.

BNTouch allows you to create email and SMS campaigns with pre-recorded calls and text messages, and schedule them for automatic delivery at specific times or based on specific triggers.

Prebuilt Marketing Content

BNTouch offers access to over 180 premade marketing pieces, including email templates, flyers, postcards, and refinance analysis reports.

You can customize these marketing pieces with your own branding, messaging, and images to make them more relevant to your audience.

You can add the content to your marketing campaigns and schedule distribution for strategic times.

Digital 1003 Application

BNTouch allows you to streamline the loan application process. You can create and customize your 1003 application form and send it to anyone via a link.

Borrowers can fill out their 1003 application via their favorite mobile device by using the MortgageCircles App.

Websites and Landing Pages

For just $35 a month, users can easily create and customize their own websites and landing pages that integrate with BNTouch CRM and Google Analytics.

Website and landing page templates can be customized with a user’s own messaging, images, and colors.

BNTouch also offers a live chat option that allows users to engage with website visitors in real time and answer their questions.

Mortgage AI Assistant (Maia)

Users can leverage BNTouch’s AI to perform a variety of tasks, such as accessing borrower loan information, sending texts, and scheduling reminders.

By incorporating speech-to-text recognition, Maia also provides real-time, voice-enhanced communication.

Plans and Pricing

BNTouch offers three pricing plans: the Individual plan, Team plan, and Enterprise plan.

The Individual plan costs $148 per month, plus a $99 activation fee. It includes:

- 2,500 record limits

- Access to the digital 1003 platform

- Unlimited email campaigns

- Unlimited video marketing

- A lead conversion marketing platform

It also includes free access to text and voice add-ons offering 1,000 texts or minutes per month.

The Team plan is priced based on the number of people on your team. It costs $158 per month for 2 users and can go up to $3,450 for 50 users.

In addition, you pay a $69-$79 activation fee per user. It includes all the features in the individual plan, plus additional features like:

- Team collaboration

- Communication by using various channels

- An integrated lead distribution platform

- An automated marketing solution for the entire mortgage process

- Admin controls

- Reporting

The Enterprise plan is designed for large companies. It includes all the features in the Team plan, plus additional features like:

- Branding control

- Sales and marketing database management

- On-boarding for new teams and branches

- Multi-level analytics

- Unlimited records, and more

Pros and Cons

Pros

- Robust mobile app. With a fully functional mobile app, users can access BNTouch’s features and capabilities from anywhere with an internet connection. The app offers all web features such as task management, lead management, real-time updates, and more.

- Specialized for mortgage professionals. BNTouch’s specialization in the mortgage industry is a significant advantage. The software is finely tuned to meet the specific needs and challenges faced by mortgage professionals.

- Compliance tools. BNTouch offers features to assist with compliance, which is critical in the highly regulated mortgage industry.

Cons

- Complicated campaign trigger process. Several users have complained that the process of setting up a campaign and then triggers was clunky and not intuitive.

- Setup takes time. Setting up this software to your liking can take a lot of time. You might also need technical support.

Integrations

- Byte Software

- LendingPad

- Calyx Point

- Encompass

- Zapier

- LendingQB

- Adchemy

- Best Rate Referrals

- iLeads.com

- Outlook

- Optimal Blue

- RingCentral

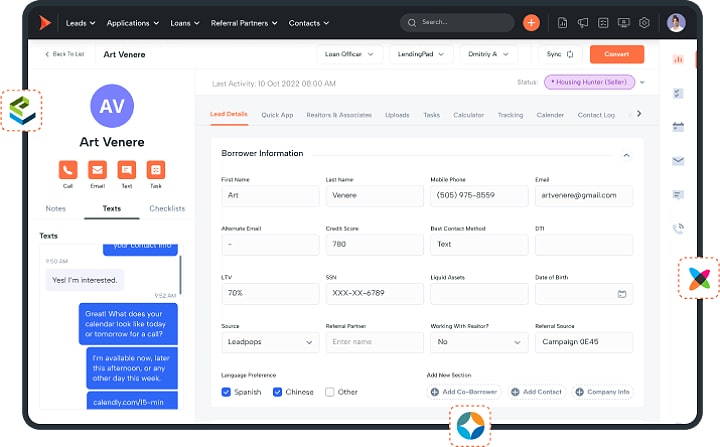

Shape Software — Best Loan Origination CRM

Shape has established itself as one of the best mortgage loan CRM software solutions in the market. Designed with intelligent features to bolster efficiency, it helps lenders close more loans with ease.

A key differentiator is its proprietary ‘Shape IQ’, an AI-fueled lead scoring module.

This advanced system sifts through your leads to evaluate and score them according to your ideal customer profile, delivering high-value and qualified leads for immediate follow-up.

It’s a game changer, turning data into informed decision-making in real time.

The Shape POS platform is equally impressive. It provides a customizable user experience with distinct capabilities.

Some of them are directing inbound calls, facilitating hassle-free appointment booking and designing interactive lead funnels for effective lead qualification.

Seamlessly integrating with thousands of third-party applications, Shape maximizes functionality and versatility, ensuring your tech stack capabilities evolve with your growing business needs.

Features

Lead Engine

Optimized for lead management, the Lead Engine helps you convert web traffic into valuable leads. With the Lead Engine, you can easily manage your leads and track their progress.

You can also build landing pages within the platform and maximize your conversions with predictive optimization and data-driven heatmaps.

The Lead Engine also offers other capabilities, including customizable lead funnels, automated distribution, follow-up automation, and retargeting.

Digital 1003 Application

Integrated into Shape’s borrower portal, this feature provides a secure platform for gathering information, uploading sensitive documents, and closing more loans.

By deploying Shape’s email and text automation capabilities, users can send automated reminders to borrowers to complete their loan application.

Borrowers can also fill out loan applications on their mobile devices.

LOS Integration

Shape integrates with Loan Origination Software (LOS) such as Encompass and LendingPad.

Users can reduce manual data entry and minimize duplicate errors, missing requirements, or errors in data.

Users can also enjoy real-time updates and automatic synchronization that keeps loan application statuses, contact information, and other relevant data synchronized between the systems they use.

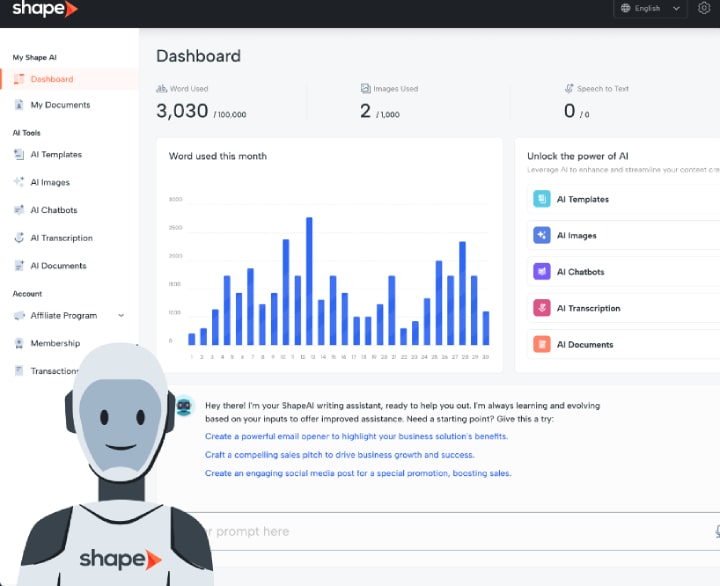

Shape AI

Shape AI is an advanced artificial intelligence technology with powerful automation capabilities made to help you in creating content for mortgage broker social media marketing, blogging, and other needs.

You can produce targeted blog posts, emails, and social media posts by using built-in AI templates. You can also leverage the AI’s extensive database and analytics to uncover insights and drive data-informed decisions.

Shape AI also has the ability to transmit audio files and generate images.

Customer Point of Sale

Shape allows users to manage sales transactions, customer interactions, and lead generation on one platform. Users can close deals 50% faster with responsive lead funnels and document collection.

They can also create customized document sets, provide e-signature solutions, and store documents in the cloud.

The customer point of sale feature also allows users to create a branded mobile-optimized digital portal with multi-lingual support.

Plans and Pricing

The Sales and Marketing CRM Plan costs $119 monthly per user, plus $199 activation fee or $1,188 annually with no activation fee.

It includes features like:

- Automated CRM

- Built-in calling

- Text messaging

- Video conferencing

- Picture messaging

- Access to more than 5,000 integrations

- A mortgage marketing software suite with pre-made templates, and more.

The Customer Portal costs $59 per month, or $564 annually. It includes:

- A branded customer portal

- Survey-style lead funnels

- Document request and e-signature

- Automated updates and milestone tracking

- Soft credit pulls

- Automated lead distribution, and more.

The Lead Engine costs $359 per month with a $199 activation fee, or $3,588 annually with no activation fee.

It includes:

- Flexible themes

- Free domain and secure hosting

- Co-branding

- Mobile and responsive design

- Professional setup

- Landing pages

- Custom lead funnels and surveys

- Access to more than 5,000 integrations, and more.

Pros and Cons

Pros

- Customizable workflows. Shape CRM allows users to create customized workflows for their sales process, which can be tailored to meet the specific needs of their business.

- Easy-to-use marketing automation system. Shape Software’s simplicity and intuitiveness make it easy to use. Users can easily and quickly access the information they need, enter data, and perform automated marketing tasks.

- Mobile accessibility. The app is available on both iOS and Android devices, allowing users to stay connected and up to date on the go.

Cons

- Limited reporting capabilities. While Shape CRM has some basic reporting features, such as dashboards and analytics, it does not offer the same level of detail and sophistication as more advanced CRM systems.

- High price. Shape is one of the most expensive mortgage broker CRM systems on the market. Aside from the monthly software costs, users pay a $199 activation fee and $59/user/mo to access the POS software.

Integrations

- Encompass

- LendingPad

- RingCentral

- SimpleNexus

- BombBomb

- Trello

- Floify

- Google Drive

Jungo — Best Mortgage CRM Software with SMS Functionality

Jungo is a cloud-based CRM for mortgage brokers and lenders built on Salesforce.

Jungo allows users to automate repetitive tasks, enhance marketing efforts, and streamline communication.

Jungo shines as one of the best CRM for mortgage lending companies and loan officers due to unique features such as Jungo SMS and Reffinity.

Jungo SMS enables real-time texting conversations with customers and partners right from the CRM.

The Reffinity feature allows users to send automated pipeline reports to referral partners, keeping them informed as borrowers progress through the loan process.

Other features enhancing Jungo’s appeal as a mortgage contact database management software include multi-channel marketing, customizable branding, compliance, and the PrintPub.

Features

Lead Management

Lead management is an integral part of the best mortgage loan CRM software solutions.

Jungo allows you to pull fresh leads based on zip code or zone from Zillow, Trulia, LendingTree, and Informa Research Services.

You can also set up rules to automatically distribute leads to team members based on your criteria and preferences.

The feature offers other capabilities, including automated follow-up task alerts and email notifications, automatic initiation of email drip campaigns, and more.

Jungo SMS

With Jungo, lenders can quickly respond to customer queries, updates, and feedback via text message.

They can send text messages directly from their CRM system to customers, prospects, and partners.

Jungo features SMS automation, allowing you to schedule messages and custom-triggered texts.

You can also personalize messages with custom signatures, templates, images, and even emojis to enliven them and make them stand out from the crowd.

Reffinity

This feature allows you to send automated pipeline reports to your referral partners.

You can customize the reports with the information you want to share, such as loan status updates, property information, and appointment reminders.

You can also create customized referral emails and landing pages that encourage customers to refer their friends and family members to try out your services.

Loan Document Management

Jungo integrates with DocsBar and Floify, allowing lenders to securely manage loan documents and correspondence for every transaction.

Lenders can digitize paperwork, automate workflows, and collaborate with borrowers digitally.

Lenders can also streamline their loan process by assigning follow-up tasks, accessing branded notifications, and instantly communicating with borrowers or realtors through automated loan status emails.

Plans and Pricing

There are no fixed plans and pricing for the software. You need to request a demo and speak with one of Jungo’s sales reps to get a quote.

Pros and Cons

Pros

- All-in-one solution. Jungo is an all-in-one solution that includes marketing, co-marketing, compliance, and mortgage CRM solutions. This comprehensive set of features allows businesses to manage all customer interactions and operations in one place.

- Referral tracking. Jungo’s Reffinity feature makes it easier to track, manage, and communicate with referral partners. It enables businesses to manage their referral partners more efficiently and improve referral rates.

- Robust reporting features. Jungo CRM’s robust reporting feature allows users to generate detailed reports and analytics on various aspects of their business, including sales, marketing, customer interactions, and referrals.

Cons

- Customer support. Some users have reported that Jungo’s customer support is slow and limited, as the platform must contact Salesforce to fix any problem you might have with the software.

- Learning curve. Setting up the software is time-intensive. The instructions for setting up integrations are complex.

Integrations

- Calyx Point

- Mortgage Coach

- Calendly

- Zapier

- Salesforce

- Encompass

- Velocity

- Floify

- LendingPad

- BombBomb

- Optimal Blue

Surefire CRM — Best Wholesale Mortgage CRM

Founded in 2003, Surefire CRM is a customer relationship management system for mortgage businesses.

One of its key features is its power messaging and call feature. This allows you to quickly record and send pre-recorded voicemails and text messages to your borrowers or clients with the click of a button.

Surefire CRM boasts an award-winning creative library of over 1,000 pieces of content, including email templates and flyers, to help mortgage professionals promote their services and stay top of mind with contacts.

The CRM offers audit-ready reporting, LO custom views and pipeline, automatic task management, and more.

Features

Compliance

This feature enables organizations to audit their data and stay in compliance with a variety of regulations, including:

- the Real Estate Settlement Procedures Act (RESPA)

- the Telephone Consumer Protection Act (TCPA), and

- the California Consumer Privacy Act (CCPA)

With the Compliance feature, users can access a full content compliance management system that supports RESPA, TCPA, and CCPA requirements.

The system also provides audit-ready reporting.

Content Management

Users can access an award-winning creative library of over 1,000+ content pieces to use in their marketing campaigns.

They can also access other capabilities such as omni-channel marketing automation, text message marketing, and interactive calculators.

Power Calls

The Power Call feature allows mortgage professionals to automate and streamline the calling process, cutting call time by 66%.

With this feature, you can queue and dial a series of related or unrelated borrowers, leaving pre-recorded voicemails while dialing the next number.

You can also use prewritten or customizable scripts to record personalized voice messages and engage leads effectively.

Client for Life Campaigns

Surefire CRM Client for Life campaigns are strategic, multi-channel marketing campaigns meticulously designed for increased client retention.

By leveraging diverse communication channels, they ensure consistent client engagement before, during, and after the completion of the loan process.

The campaigns utilize a variety of mediums — interactive media, personalized greetings, efficient text messaging, survey engagement, aesthetically pleasing printed postcards, and customized post-closing gifts.

Plans and Pricing

There are no fixed plans and pricing for the Surefire CRM software. Contact one of their customer care representatives for a quote.

Pros and Cons

Pros

- Constantly updated marketing content. Surefire CRM provides award-winning creative content for mortgage professionals to use in their marketing campaigns.

- Powerful automation tools. From lead generation to closing, users can customize their rules, workflow, and data sets for each step in the loan process.

- Compliance tools. Surefire CRM includes compliance features and templates to help users create marketing materials and communications that adhere to industry regulations, reducing the risk of non-compliance.

Cons

- Limited template customization. Some users have reported that Surefire CRM’s pre-built templates may not be customizable enough for their specific needs.

- Lack of deep analytics. Surefire CRM has also received criticism for its lack of comprehensive sales pipeline analytics.

- Learning curve. The software can be complex, and users may face a learning curve when using it for the first time.

Integrations

- Mortgage Coach

- MBS Highway

- MonitorBase

- Sales Boomerang

- Zapier

- Encompass

- Calyx

- LendingPad

- LendingQB

- OpenClose

Salesforce — Best Commercial Lending CRM

Founded by Marc Benioff, Salesforce is a powerful, industry-leading platform that helps businesses manage sales, marketing, and customer support operations.

It’s a popular mortgage CRM for loan officers among other professionals across various industries.

What sets this residential and commercial lending platform apart is its Customer 360. This is an integrated suite of products that unites sales, service, marketing, commerce, and IT teams with a shared view of customer information.

Another of the software’s unique features is its AI cloud, which integrates AI, data, analytics, and automation to provide an enterprise-ready generative AI, called Einstein GPT.

Salesforce has been around for over 20 years and boasts industry-leading integrations with over 1,000 third-party software tools.

The platform offers other capabilities, including pipeline management, marketing campaign management, and financial services cloud.

Features

AI Cloud

Released on June 12, 2023, the AI Cloud is a suite of artificial intelligence (AI) capabilities and experiences across all applications and workflows for customer relationship management (CRM).

This feature offers machine learning capabilities to supercharge customer experiences and company productivity.

At the heart of AI Cloud is Einstein, which powers over 1 trillion predictions per week across Salesforce’s applications.

This feature also integrates with a variety of Salesforce technologies and supports large language models from third parties.

Financial Services Cloud

You can connect financial transaction data with prebuilt-to-custom accelerators that scale for high volume.

The financial services cloud feature has built-in regulatory compliance capability that can help you organize your mortgage process with best practice solutions for Data Privacy and Know Your Customer (KYC) requirements.

Experience Cloud

Experience Cloud allows businesses to create customizable digital experiences and portals for their customers, partners, and employees.

These portals can be designed for a variety of purposes, such as customer self-service or employee engagement.

By utilizing capabilities such as storefronts, users can provide experiences tailored to the complex needs of both B2B and B2B2C customers.

This feature offers other capabilities, including content management, mobile accessibility, secure customer and partner data, and more.

Marketing Cloud

Salesforce helps you create, automate, and manage marketing campaigns and customer interactions across various digital channels.

You can engage with customers through email, social media, mobile messaging and advertising, or web content.

The Salesforce Marketing Cloud also lets you create, personalize, and automate email campaigns.

It offers a drag-and-drop email builder, dynamic content, and personalization capabilities to deliver relevant messages to different segments of your audience.

Plans and Pricing

Salesforce offers different pricing plans for its diverse range of products. For its financial services cloud software, there are four pricing plans.

They include the Starter-Enterprise, Starter-Unlimited, Growth-Enterprise, and the Growth-Unlimited plans.

The Starter-Enterprise plan costs $3,000 annually per user. It includes features like:

- Sales Cloud and Service Cloud functionalities

- Client financial profile

- Action plans with document tracking and approvals

- Household and relationship groups

- Performance management dashboards

- Lightning app builder, and more.

The Starter-Unlimited plan costs $5,100 annually per user. It includes all the features in the Starter-Enterprise plan, plus additional features like:

- A full sandbox for 1 organization (for app testing)

- Email inbox for scheduling and managing communication

- Live agent chat

- A sales engagement platform for inside sales.

The Growth-Enterprise plan costs $3,900 annually per user. It includes all the features in the Starter-Enterprise plan, plus additional features like:

- Industry-specific business processes

- Capabilities for relationship management

- High-performance rollup by lookup (Data Processing Engine)

- Compliant data sharing

- Einstein Activity Capture

- Mortgage data model

- Mortgage business APIs

- Automated syncing with Slack

- Disclosure and consent management

- Actionable segmentation and more.

The Growth-Unlimited plan costs $6,000 per year per user. It includes all the features of the Growth-Enterprise plan, as well as:

- 1 full sandbox for 1 organization

- Inbox management

- Sales engagement tools

- Live agent chat.

Pros and Cons

Pros

- Extensive tutorials. Salesforce offers a large selection of support materials, videos, and tutorials, as well as an online community where users can get help from other Salesforce users.

- AI-powered insights. Salesforce Einstein, the platform’s artificial intelligence (AI) component, offers predictive analytics, automated lead scoring, and AI-driven recommendations. These capabilities empower businesses to make data-driven decisions, identify opportunities, and improve customer engagement.

- Complete customer picture. Salesforce CRM provides a complete customer picture, including insights and engagement-enhancement strategies, ensuring hassle-free contact management.

- Powerful reporting and compliance. Salesforce offers a comprehensive set of reports and compliance tools that enable you to access your data in almost any format. You can use filters and metrics on the platform to get different views of your data. You can also use Salesforce’s GDPR and CCPA compliance modules to ensure that the data meets all necessary standards and requirements.

Cons

- Complexity and learning curve. Salesforce CRM’s extensive features and customization options can make it complex, especially for new users. Businesses may need to invest time and resources in training their teams to maximize the CRM’s potential.

- Cost. Salesforce is known for its high pricing. While it offers various cloud solutions to cater to different budgets, the total cost of ownership, including licenses, customization, and maintenance, can be a significant investment.

Integrations

- Encompass

- Blend

- Jungo

- Slack

- Calendly

- DocuSign

- Google Drive

- Mailchimp

- PandaDoc

- HubSpot Marketing

- ActiveCampaign

- Total Expert

GoCRM — Best Mortgage Lead Management and Distribution System

GoCRM is a customer relationship management solution that combines powerful sales and marketing features.

The software’s key feature is its ability to automatically import leads from hundreds of online and offline sources with all relevant attribution data.

Another unique feature of the software is its visual sales pipeline. This allows you to gain in-depth data on everyone who calls your business and track which campaigns are working.

By using a cloud-based VoIP system, GoCRM allows you to manage all your calls, voicemails and text messages, giving you the option of distributing leads manually or randomly assigning them to your team.

Features

Sales Pipeline Management

This feature simplifies your complete sales process from lead generation to closing.

It offers precise tracking of every lead’s origin and activity, letting you break down marketing performance by campaign to identify which mortgage lead generation services and strategies are working and which aren’t.

You can also follow every form submission and lead origin with website form tracking.

The sales pipeline feature also offers other capabilities, including creation of custom stages, automated action on stages, and identification of stalled deals.

Smart Email

Smart emails allow users to create and send emails from GoCRM, without having to switch back and forth between platforms.

This feature integrates with all major email providers, including Gmail and Hotmail. Any email sent or received from your email accounts will automatically appear in GoCRM.

The smart email feature also allows users to personalize emails and create automated workflows that consist of scheduled emails, SMS messages, and phone calls.

Marketing Attribution

GoCRM’s marketing attribution feature helps businesses track which of their marketing campaigns are driving the most revenue.

By analyzing data, users can gain control over their mortgage lender marketing strategies performance by tracking activity such as SMS and phone calls, website forms, and third-party leads.

They can also create custom rules to track leads based on specific customer journeys.

Built-In Calling and Text Messaging

With the integrated calling feature, you can streamline interactions with customers and enhance your productivity.

You can make calls directly from within the platform, organize and prioritize calls, assign them to specific people, and automate call recordings and notes.

Text messaging allows you to automate messages and create standardized templates for sending them.

You can also contact anyone in any area code from anywhere with a local number. This feature makes it easy to track all your text communications, so you never miss an important response or follow-up.

Plans and Pricing

For individual users, this CRM has an exclusive price of $39 per month per user.

This plan includes all the CRM features you need, including lead generation, built-in calling and text messaging, sales pipeline, smart emails, and more.

You can also try out the software for 30 days free of charge.

For teams, there are two pricing plans: Standard and Professional. The Standard plan costs $99 per month for 3 users, and $19 monthly for additional users.

It includes features like email integration with GSuite or Outlook, task and appointment scheduler, mass email outreach, and marketing attribution.

The Professional plan costs $149 per month for three users, and $29 per month for each additional user.

It includes all the features of the Standard plan, plus additional features like automations and increased SMS usage and call minutes.

Pros and Cons

Pros

- Affordability. GoCRM is an affordable CRM solution suitable for small mortgage brokers and loan officers.

- Free 30-day trial. The software has a free trial period of 30 days, during which users can access and explore all its features and tools.

- Robust mobile app. GoCRM offers a mobile app that allows you to access your CRM data and tools from anywhere with an internet connection. The app lets you monitor incoming and outgoing calls, as well as keep up with email and SMS messages. It is available on both Android and iOS devices.

- Automated analytics. The CRM automatically tracks the origin of leads who submit forms, contact your business, or browse your website. You can also see each action a lead performs on your website, allowing you to know which marketing campaign is driving the most conversions.

Cons

- Limited integrations. GoCRM doesn’t integrate with a lot of third-party software and tools. This limits its capabilities.

- Complex setup. Customizing the CRM and setting up automation can be challenging without technical support. You will need to engage their team to successfully set up automation rules.

- Limited reporting. The CRM does not offer as many reporting features as other advanced CRM tools.

Integrations

- Google Suite

- Yahoo Mail

- Office 365 Email

- Microsoft Exchange

- Calendar

- Zapier

DigiFi Lending CRM — The Most Customizable Mortgage Contact Database Management Software

Founded in 2017, DigiFi is a next-generation platform for digital lending. It offers an innovative CRM that streamlines the loan application process from application to funding.

One of its key features is consolidated records, which allow you to view all of your borrower or intermediary activity in one place.

Another unique feature of the software is its configurable data fields which allow you to go beyond basic contact information by adding any type of information to borrower and intermediary profiles.

Designed for banks, online lenders, and mortgage lenders, the platform offers a level of flexibility that allows lenders to create cutting-edge digital products and deliver amazing borrower experiences.

DigiFi offers other features and capabilities, including performance reports, document management, and automated decisions.

Features

Consolidated Records

DigiFi allows users to develop a 360-degree view of their borrowers and intermediaries.

With the consolidated records feature, you can combine all the information and activity related to a customer or intermediary into a single record.

This includes their contact information, communication history, and loan application status.

The consolidated records feature reduces data digression and boosts productivity by enabling quick and easy access to comprehensive customer data.

Configurable Data Fields

Configurable data fields give businesses the flexibility to customize the data fields or contact information in their database according to their unique requirements.

Going beyond basic contact information, users can add any type of information to borrower and intermediary profiles.

Users can also implement their preferred workflow, visual displays, data structure, email cadences, and task checklists.

Automated Decisions

This feature allows you to automate lending decisions with 100% accuracy and consistency.

By using this feature, you can easily make instant, accurate, and auditable decisions by integrating your data with other applications, creating rules and formulas, and building scorecards to assess creditworthiness, set pricing, verify information and more.

Plans and Pricing

DigiFi offers per application pricing, i.e., you pay per new customer. Pricing ranges from $0.50 to $2.50 per application, and includes full feature access, 24×5 customer support, and flexible hosting options.

Platform features include a LOS system with:

- Support for multiple loan products, multiple borrower types, e-signatures, in-platform document viewing, and more

- Digital lending portals that support online application submission

- Configurable branding and digital document upload

- No-code platform setup with an event based automation builder

- Configurable statuses and workflows

- Configurable hosting options

Pros and Cons

Pros

- Open-source loan origination system. The DigiFi loan origination software is open-source. You can easily integrate it with your cloud server for free, or leverage DigiFi’s hosting capabilities.

- 360-degree view. DigiFi CRM enables businesses to create a 360-degree view of their borrowers and intermediaries. This feature enables businesses to manage all their customer interactions in one place.

- Automated decisions. DigiFi offers the ability to run automated decision processes, including automated eligibility, underwriting, and verification decisions. This mortgage underwriter software feature enables businesses to automate their lending process and improve efficiency.

Cons

- Limited integrations. DigiFi has limited integrations with third-party residential and commercial loan origination platforms and home loan management software tools.

- Steep learning curve. DigiFi’s impressive robustness brings with it a potential complexity. You may need technical assistance to customize the software for your business.

Integrations

- CoreLogic

- Zillow

- Google Maps API

- Quandl

- Plaid

- LexisNexis

- FactorTrust

- TransUnion

- Experian

- Equifax

- Clarity Services

What is the meaning of CRM in mortgage?

CRM in mortgage stands for customer relationship management.

These mortgage broker systems help loan officers and mortgage professionals automate marketing tasks, follow up with prospects, clients, and referral partners in the mortgage industry.

It is the engine of productivity that allows you to market to borrowers and deliver engaging content.

It also helps you meet compliance regulations, connect with technology vendors, and attract top talent in the mortgage industry.

There are several key functionalities that every mortgage CRM should have. They include:

- Loan management

- Document management

- Regulatory compliance management

- Lead management and marketing automation

A mortgage CRM makes it possible for loan officers to effectively manage and automate their mortgage and lending processes at scale.

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.