5 Best Commercial Mortgage Lending Origination Software for Brokers (2024 Reviews & Comparison)

Real Estate Bees’ editorial team asked a number of industry-leading lenders to share their expertise on the best commercial mortgage broker loan origination software to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best commercial loan processing systems and evaluated their features, plans, and pricing information. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

nCino

nCino is a renowned provider of commercial loan origination software that harnesses technology to streamline the loan process for financial institutions.

The software automates loan pre-qualifications and credit approvals based on pre-established policy rules, identifying parameters for automatic loan approvals, declines, or manual reviews.

One of nCino’s standout features is nIQ. This tool utilizes machine learning, artificial intelligence, data, and analytics to reduce manual data entry and expedite essential processes, offering significant intelligence and insights.

Features

Customer Onboarding

nCino’s commercial loan origination software includes a cutting-edge customer onboarding feature that notably enhances front, middle, and back-office procedures.

Smooth and secure digital document submissions facilitate seamless workflow management and make data verification effortless.

Automated Workflows

nCino enables automatic handling of loan pre-qualifications and credit approvals based on your company or institution’s predefined policy rules.

It discerns specific parameters to determine whether a loan should be automatically approved, declined, or forwarded for manual review.

Automated Spreading

nCino’s commercial mortgage broker loan origination software features an automated spreading function that uses machine learning algorithms to auto-extract financial data from uploaded documents like financial statements and tax returns.

This data is then populated into a standardized spreadsheet template, negating the need for manual data entry.

Compliance Management

nCino features an integrated repository that holds all your institution’s policy-related documents.

It also leaves a visual audit trail, providing a transparent record for both auditors and team members.

The software auto-generates notifications to remind users of upcoming covenant due dates. This proactive approach minimizes the risk of non-compliance.

Plans and Pricing

nCino’s pricing information isn’t publicly available, as it’s tailored to each organization’s specific needs.

To get a plan tailored to your organization’s needs, you can request a demo on their website and chat with a customer care rep.

Pros and Cons

Pros

- Integration with core banking systems and tools. nCino’s commercial lending origination software seamlessly integrates with most lenders’ existing core and transactional systems, facilitating a more streamlined and efficient operational flow.

- Faster loan progression. According to nCino’s official website, it helps lenders originate loans 54% faster. This improvement is achieved by automating several steps during the loan origination cycle. For instance, it aids in quickly transferring information from the borrower’s financial statements into the bank’s financial analysis program—a process known as “spreading financials”.

- Clean UI. The platform’s new UI is designed to be user-friendly, with a step-by-step process that guides users from end to end.

Cons

- Learning curve. The software’s wide array of features, while useful, can appear complex and daunting for new users. For this reason, considerable training and practice is required to fully benefit from all of its functionalities.

- Approval process issues. Feedback from various sources indicates that there can be occasional technical flaws in the software’s approval processes, leading to disruptions in the loan origination process.

- Limited data storage. This commercial lending system uses Salesforce’s data storage solution, which limits the amount of data users can store in its document manager. Salesforce offers tiered data storage solutions. So, an organization utilizing nCino might find they quickly exhaust the base storage allocation because of the large volumes of data typically associated with commercial loan origination.

Integrations

- Salesforce

- MortgagebotLOS by Finastra

- DocuSign

- Mambu

- Expere

- Built

CLOSER by SitusAMC

CLOSER by SitusAMC is a commercial real estate loan origination software platform designed to streamline the loan management process from pipeline tracking to asset management.

Its robust features include customizable underwriting templates, sophisticated text narratives, and comprehensive data sets for various CRE property types, and executions.

With intuitive navigation, role-based security, email alerts, shared calendars, and system messaging, CLOSER offers a seamless and secure solution for managing commercial loans.

Features

Workflow Management

CLOSER’s workflow management features streamline the loan origination process, reducing manual efforts and improving efficiency.

As a commercial mortgage underwriting software, it allows underwriters to perform deal-specific cash flow analysis directly within Microsoft Excel, enabling real-time updates to calculations and the addition of specific worksheets.

The software also provides an easy-to-use pipeline management feature that ensures effective tracking of all ongoing loan deals, and secure document management.

CLOSER Xchange

Connectivity tools provided by CLOSER Xchange link lenders, borrowers, third-party vendors, loan servicers, and asset managers in a seamless network.

By connecting all these stakeholders on the same platform, CLOSER Xchange allows for swift collaboration and decision-making throughout the loan life cycle.

Pre-Application

CLOSER’s commercial loan origination software integrates a robust pre-application feature, designed to make the initial stages of the loan origination process efficient and flexible for organizations.

It allows users to manage and analyze complex deal structures that may involve multiple loans, properties, tranches, and borrowing structures.

Robust Reporting

CLOSER allows users to generate varied types of reports, including asset summaries, ad hoc reports, enterprise reports, data tapes, and custom reports.

Plans and Pricing

The pricing model of this commercial loan underwriting software is not public, as it’s tailored to each user’s needs and requirements.

Interested buyers can sign up on their website to have one of their professionals reach out to schedule a demo and discuss pricing options.

Pros and Cons

Pros

- Intuitive workflow management tools. Customers praise the platform’s ease of use, flexibility, and automation capabilities.

- Complex transactions support. Among commercial loan origination system vendors, CLOSER is renowned for its ability to handle intricate transaction structures, such as agency supplemental loans. It efficiently tracks the entire borrower structure, allowing businesses to gain comprehensive insights into borrower behavior and loan portfolios, facilitating informed decision-making.

- Ad-hoc reporting. Ad-hoc reporting allows users to create customized, one-off or on-demand reports. The ad-hoc reporting interface allows users to build and save queries that are commonly used for their reporting and data aggregation.

Cons

- Limited user reviews. There is a lack of online reviews and feedback from users, making it difficult for potential customers to assess the software’s effectiveness and usability.

- Limited data import options. Currently, the platform only supports Excel data imports, which can be a limitation for financial institutions that use other data formats or have complex data structures.

- Limited automation features. When comparing CLOSER with other commercial lending origination software tools, the platform’s automation capabilities are relatively limited. CLOSER does not offer advanced automation features, such as machine learning-based risk assessment or automated loan decision-making.

Integrations

- Microsoft Excel

- VMS Valuation Management

- rBudget

- ComplianceEase

- ProMerit

- DocAcuity

- BRES

- ReadyPrice

RealINSIGHT

RealINSIGHT is a sophisticated commercial real estate loan origination software platform that handles all facets of CRE finance.

From loan origination to securitization, underwriting, surveillance, asset management, and dispositions, RealINSIGHT is the epitome of an end-to-end commercial mortgage broker loan origination software.

Features include customizable origination systems to align products with funding sources, precise deal evaluation per investor, client, and management requirements.

The software also allows elective deal screening per borrower based on collateral and deal terms.

Features

Custom Reports

RealINSIGHT’s custom reports feature allows users to create tailored reports that can accommodate any field, providing flexibility and control over data analysis.

Users can create reports that meet their specific needs, whether for loan origination, risk management, or portfolio analysis.

Analytics

With RealINSIGHT, users can construct loan term scenarios integrated with operating budgets, allowing them to assess covenant compliance, extension eligibility, and future funding disbursements.

By evaluating different loan term scenarios, users are able to make informed decisions and predict loan cash flow return projections more accurately.

Workflow Management

This software for mortgage brokers and lenders allows you to map each proposal to a specific product and funding source. This ensures that each proposal aligns with the relevant checklists.

Once the proposal is linked to a product and funding source, your predefined exhibits, models, and workflows are automatically activated.

This means all your standard processes, tasks, and documentation related to that product and funding source are put into play.

Deal Management

RealINSIGHT’s deal management feature tracks deal sources, providing users with visibility into where deals are originating from.

Users can also log and manage their contact information, ensure follow-ups, track email communication, and keep essential notes or reminders.

All this information can be linked to a specific deal, maintaining organized communication trails and contact directories per deal.

Plans and Pricing

While the precise pricing for the RealINSIGHT platform is not explicitly listed on their website, some online review platforms suggest a ballpark figure of around $50,000/user/year.

The actual pricing of RealINSIGHT is quote-based. This approach means that costs are determined considering your organization’s specific requirements, and size.

The company generously offers a 60-day free trial of its platform, giving potential users an opportunity to test the software before making a financial commitment.

Pros and Cons

Pros

- Highly customizable system. As a leading commercial loan application and processing software, RealINSIGHT allows lending companies to customize the software for the unique products they offer and their funding sources. The system’s scalability ensures it adapts and grows with the needs of the lending organization.

- Integrations. RealINSIGHT’s API management functionality makes it easy to integrate with other systems and services. The software provides a set of APIs that allow developers to connect RealINSIGHT with other systems, such as mortgage servicing systems, credit reporting agencies, and title companies.

- Free trial. RealINSIGHT offers a 60-day free trial for new users. During this period, users can explore the various features, try out the integrations, and assess if the software fits their specific requirements.

Cons

- Limited user reviews. The platform appears to have a poor online presence, and user reviews are difficult to find.

- Learning curve. The software’s complexity implies that comprehensive training is required to fully utilize its functions. While the RealINSIGHT team provides this training, the duration and depth of the training period can vary extensively depending on the unique requirements and the specific modules each client chooses to use. This could be a potential drawback for customers who require immediate implementation.

Integrations

- Microsoft Excel

- Salesforce

- ARGUS

- Yardi Systems

- Dropbox

HES FinTech

HES FinTech’s commercial loan application and processing software, powered by automation technology, offers cost-efficiency and speed necessary to scale your lending business.

By leveraging machine learning, the commercial loan origination software scrutinizes historical data of closed loans to discern patterns in high-delinquency assets.

A distinctive feature is the HES LoanBox module that provides a seamless loan origination and management experience.

It offers a clean, white-labeled, and user-friendly digital onboarding interface, which can be custom-branded.

Plus, features like intuitive navigation, a real-time loan calculator, and a helpful FAQ section facilitate visitor conversion.

LoanBox also boasts document management, automatic decision making, and loan deal management in its back office.

Features

Payment Automation

This mortgage lending system can be integrated with any bank or payment provider. This integration empowers users to automate all their payment processes without needing to switch between various systems or platforms.

Credit Decisioning

HES FinTech uses a credit scoring model to evaluate the creditworthiness of your borrowers.

The model considers various factors, such as credit history, income, and debt-to-income ratio, to determine the borrower’s credit score.

KYB & AML Verifications

HES FinTech’s commercial loan origination system includes a KYC (Know Your Customer) verification feature that checks the identity of your borrowers.

This is done by verifying their government-issued ID, such as a passport or driver’s license, to ensure that they are who they claim to be.

In addition to KYC verification, HES FinTech’s commercial loan origination system also includes an AML (Anti-Money Laundering) verification feature.

This feature checks your borrowers against a database of known fraudsters, terrorist financiers, and other individuals or organizations involved in money laundering or other illegal activities.

Reporting

HES FinTech’s commercial loan origination software includes a reporting feature that allows you to create informative reports and charts.

This feature supports multiple BI integrations. This means that you can generate reports in a variety of formats, including Excel, PDF, and Power BI.

Plans and Pricing

While the HES FinTech platform doesn’t explicitly make pricing details available, some online sources claim that the cost of the platform starts at $1,050 per month.

However, it’s important to note that pricing can vary depending on your specific needs and requirements.

If you’re interested in the platform, we advise booking a demo on their website and speaking to a customer care rep to get a quote based on your needs.

Pros and Cons

Pros

- Knowledgeable team. HES FinTech’s team of business analysts and developers have years of experience in the banking and finance industry. This enables them to develop software tailored to meet the specific needs of their clients.

- 100+ integrations. The software can be seamlessly integrated with a wide range of systems and services, including credit bureaus, KYC/AML (Know Your Customer/Anti-Money Laundering) providers, payment and notification providers, mortgage banking accounting software, and BI (Business Intelligence) solutions.

- Easy to set up. HES FinTech is marketed as an “out of the box” solution, implying that it can be rapidly deployed and configured without requiring complex setup procedures.

- High level of automation. HES FinTech uses Artificial Intelligence (AI)-powered automation to streamline various aspects of the loan origination and underwriting processes. This technology facilitates automated data collection, loan application processing, risk assessment, and decision-making.

Cons

- Low support for small-screen mobile devices. The management interface of the software is not optimized for small-screen devices, making it difficult for users to access and manage loan applications on their smartphones.

- Development costs can add up. HES FinTech offers a customizable loan origination software solution that suits various lending businesses. However, when it comes to customizing this software to meet a company’s specific requirements, the costs can add up and become high. This is due to the hourly rates charged by HES FinTech developers for modifications and customizations.

Integrations

- Plaid

- VoPay

- Stripe

- Jumio

- Acquired.com

- Twilio

- Enable Banking

- SendGrid

- Squarepay

- PandaDoc

- Google Maps

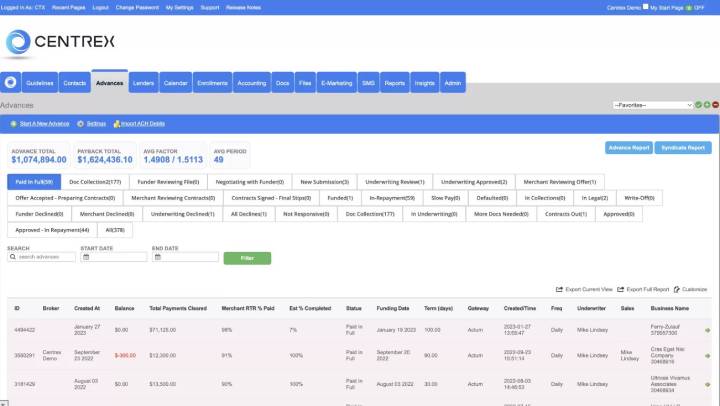

Centrex Software

Centrex is a mortgage CRM system catering to business loan brokers, direct lenders, and various types of real estate investors.

It features loan origination, mortgage lead generation software tools, and deal management capabilities.

Centrex’s lender matchmaking matches businesses with lenders based on entity type, experience, or credit score, and tracks deal closing performance.

Centrex also offers a unique white-labeled mobile app, fully integrated via their API. This app, available on Google and iOS stores, allows loan applicants to link their bank accounts via Plaid, enabling financial monitoring of business health.

Features

Client Portal

The client portal in the Centrex software commercial loan origination software is a fully white-labeled portal that allows clients to access their loan information, make payments, and communicate with their lender.

This mortgage marketing tool can be customized to match your branding and messaging. It features loan document upload and e-signing, payment processing, loan status tracking, balance viewing, communication tools, and task management.

Syndication Portal

The syndication portal in Centrex software is a reporting portal that allows syndication partners to track their deal participation through Centrex’ integration with Supervest.

It provides real-time reporting on deal performance and communication tools to your syndication partners.

Contact and Deal Management

The contact and deal management feature in Centrex allows users to create custom workflows, build custom lists, create custom deal statuses, manage multiple deals per contact, and communicate with contacts.

Multi-Lender Submissions

When you are ready to submit a loan package, the software selects lenders based on a 100% match rate and highlights these recommendations in green.

This way, you don’t need to remember which lenders to submit to. Centrex handles it for you, saving you time and ensuring each loan package reaches the best suited lenders.

Plans and Pricing

Centrex Software adopts a quote-based pricing model. However, if we refer to information available from online resources, pricing for Centrex Software typically falls within the range of $25 to $100 per user per month.

Pros and Cons

Pros

- Great customer support. Centrex’s customer support team is highly responsive and knowledgeable about the software.

- Vast integrations. Centrex seamlessly integrates with a wide range of payment gateways, credit reporting tools, SMS and phone systems, and other software solutions commonly used in the lending industry.

- Ease of use. The Centrex platform is easy to set up and use.

- Affordability. Centrex is designed to be cost-effective, which makes it accessible to small lending businesses.

Cons

- Limitations in the e-sign feature. The built-in document signing tool that comes with this mortgage loan origination system is not as robust as dedicated e-signature solutions like Docusign, and Centrex does not integrate with Docusign or other third-party e-signature providers.

- SMS template creation is clunky. Setting up SMS templates and SMS role permissions on the platform isn’t very intuitive.

Integrations

- Actum Processing

- Supervest

- Plaid

- ACHWorks

- Twilio

- Gmail

- Microsoft 365

- DecisionLogic

- MeridianLink

- TransUnion

- SendGrid

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.