5 Best Tax & Accounting Software Apps for Airbnb Business (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate investors to share their expertise on the best Airbnb accounting software tools to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best apps for tracking Airbnb expenses and bookkeeping and evaluated them based on critical factors that are important for real estate investors. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

QuickBooks Online with Bnbtally — For Airbnb Hosts With Multiple Properties or Complex Finances

For those searching for the best Airbnb accounting software, QuickBooks Online’s integration with Bnbtally offers an unparalleled accounting solution for managing multiple properties under one umbrella.

QuickBooks Online excels at managing cash flow, tracking expenses, and dispatching invoices — all from a single interface.

Bnbtally expands these functionalities, allowing you to connect multiple accounts, receive detailed performance insights, and track various income streams.

This includes commissions, hosting charges, and cleaning fees, along with listing performance and cash flow.

The integration between the two platforms provides you with more accurate financial records, because all booking information, rental income, and expenses are automatically synced.

This reduces the risk of human error, increasing your efficiency.

Features

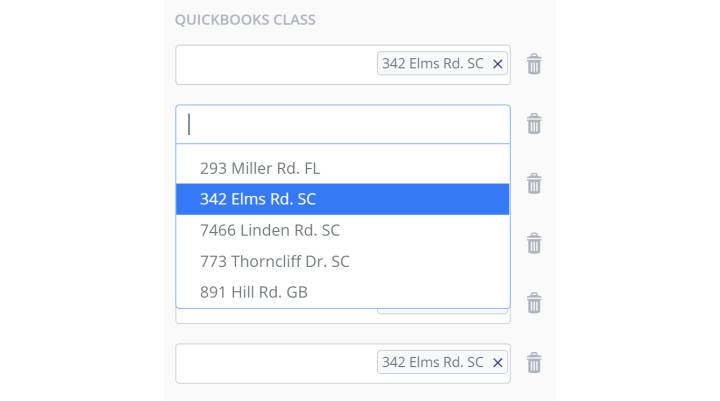

Class Tracking

If you manage multiple listings, class tracking can help separate profit and loss (P&L) and balance sheet reports for each property.

In Bnbtally, you can assign a unique class tracking category to each line item. This approach ensures accurate financial reporting on a per-listing basis.

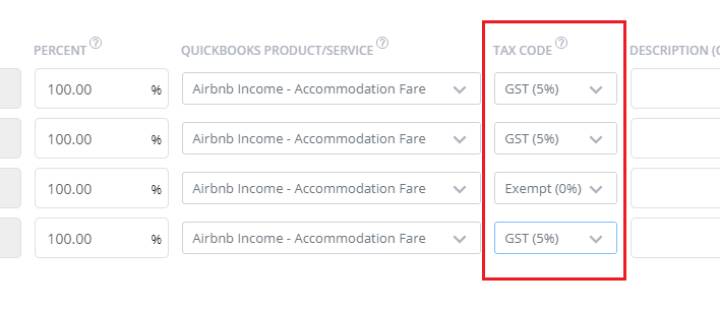

Tax Codes

Bnbtally supports the integration of Tax Codes within QuickBooks Online for certain regions. This permits accurate tracking and calculation of taxes for each item on your invoice.

To enable this feature, activate the “Sales Tax Tracking” setting upon creating your Bnbtally connection.

The result is the ability to generate summarized tax reports directly within QuickBooks via their Tax module.

Historical Data Import

For an added fee, Bnbtally offers a historical data import feature, which lets you import years of reservation data.

Pricing is determined separately, based on the number of months and listings to be imported. Importing payment data for the current and previous months is free.

Bnbtally’s Sync Manager grants you complete control over imported data, enabling you to automate, sync, recreate, or roll back transactions synced to your books.

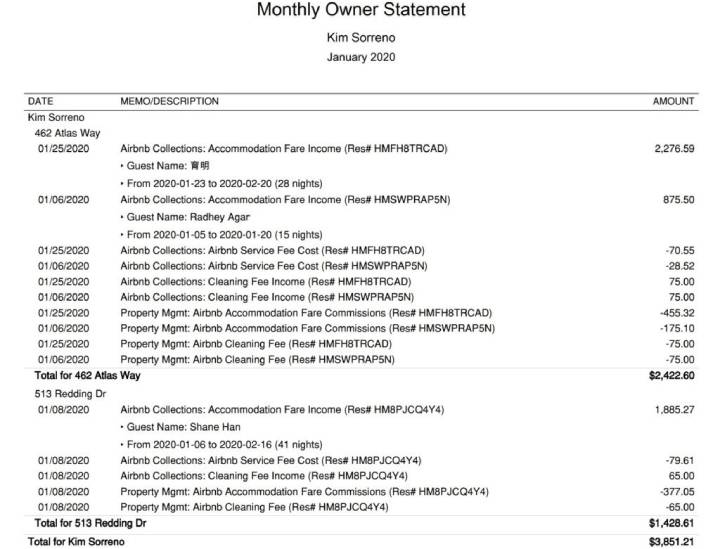

Trust Accounting

Bnbtally’s user-friendly system allows you to easily set up Airbnb trust accounting rules for each listing.

Once the system receives a reservation from Airbnb, it auto-generates an invoice in QuickBooks Online, detailing all financial allocations such as Airbnb collections, property management commissions, cleaning fees, and other splits.

By using this organized data, you can easily process monthly owner statements.

Plans and Pricing

QuickBooks

QuickBooks Online offers a free 30-day trial. You get 50% off all their annual plans. Each plan also offers a 3-month trial for just $1 per month. Their plans include:

- Simple Start costs $18 per month or $194 per year for one user, plus one accountant (if no discounts are applied). Features include progress invoicing, income and expense tracking, sending custom invoices and quotes, bank connection, GST and VAT tracking, reports generation, and receipt capture and organization.

- Essentials is priced at $27 per month or $291 per year for three users, plus one accountant (if no discounts are applied). Features include everything on the Simple Start plan, plus bill management, multi-currency, and time tracking.

- Plus costs $38 per month or $410 per year for five users and an accountant (if no discounts are applied). Features include everything on the Essentials plan, plus inventory management, profitability tracking for each project in your pipeline, and budget management.

Bnbtally

Bnbtally charges $32 per month for the first two listings in your portfolio. Pricing increases based on the number of additional listings you have, at the rate of $7 per listing up to $711 per month for 99 listings.

If you have more than 100 listings, please contact Bnbtally for a custom quote.

Pros and Cons

Pros

- Automated import and detailed bookkeeping. With QuickBooks Online integrated with Bnbtally, you can connect multiple Airbnb and Vrbo accounts to QuickBooks for automated data import. This seamless connection aids in meticulous bookkeeping and simplifies the reconciliation of reservations, ensuring error-free and up-to-date financial records.

- Customizable accounting rules. This accounting software for landlords allows for remarkable flexibility in setting accounting rules. For each reservation, you can separately delineate income line items based on percentages or fixed amounts of the accommodation fee, cleaning fee, Airbnb service fees, any custom taxes, and more.

- Exceptional customer support. Bnbtally prides itself on its responsive and helpful customer support. The team provides timely guidance and solutions to users.

Cons

- Limited integrations. Bnbtally currently supports just two vacation rental reservation systems: Airbnb and Vrbo. This may pose a limitation if you use different or additional platforms for your business. Also, it doesn’t integrate with Airbnb property management software for landlords like Hospitable. This means that data can’t be shared seamlessly.

- Learning curve for beginners. While being among the best bookkeeping software for Airbnb, Bnbtally might present a steep learning curve for novice users.

- Users need to subscribe to QuickBooks Online. Aside from Bnbtally monthly subscription costs, users have to pay for QuickBooks Online or Xero to use Bnbtally.

Integrations

Bnbtally integrations

- Airbnb

- Vrbo

- QuickBooks Online

- Xero

QuickBooks Online integrations

- Bnbtally

- Zapier

- BILL

- Float

- Fundbox

- Mailchimp

- PayPal

- Square

- Stripe

FreshBooks — For Hosts Who Value Simple Design and Invoicing Features

FreshBooks is affordable user-friendly cloud-based accounting software designed for small businesses.

It comes equipped with features such as professional invoicing, systematic expense tracking, invoice status reports, comprehensive reporting, efficient payment management, and a double-entry accounting system.

These features, coupled with its ability to handle multiple currencies, make it an excellent choice even for landlords who manage a rental property from out of state or even internationally.

Features

Automatic Mobile Receipt Scanning

FreshBooks allows you to quickly log and categorize expenses. You simply scan and save paper or digital receipts, and the software automatically captures the merchant, totals, and taxes.

You can also email receipts directly to your FreshBooks account for easy transaction capture.

Invoice Status Reports

With FreshBooks’ invoice status reports, you can see whether a guest has viewed, paid, or is yet to pay an invoice.

FreshBooks also lets you set reminders for late payments, ensuring you get your dues on time.

Expense Tracking

By linking your bank account or credit card to FreshBooks, the software automatically updates your account with your latest expenditures.

This removes the need for manual data entry and ensures your expense records are always up to date.

Double-Entry Accounting

FreshBooks incorporates double-entry accounting, which means all transactions are reflected on both the debit and credit sides of your financial records, reducing errors and ensuring accurate reporting, especially during tax season.

FreshBooks’ double-entry accounting offers access to detailed reports, including a General Ledger, business bank sheets, Trial Balance, Chart of Accounts, and more.

Plans and Pricing

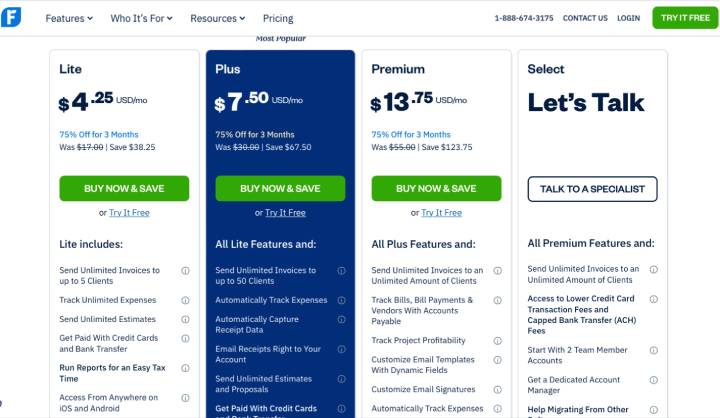

FreshBooks offers four pricing plans and a 30-day free trial on all plans. Currently, new users can enjoy a 75% discount on all plans for the first 3 months. The plans include:

- Lite: Priced at $17/month and built for up to 5 billable clients, the Lite plan lets you track unlimited expenses and send unlimited invoices to a maximum of 5 clients. Other features include sales tax tracking, unlimited estimates, credit card and ACH payments acceptance, access to reports, and the mobile app.

- Plus: At $30/month, the Plus plan increases the number of billable clients to 50. That is, you can send unlimited invoices, estimates and proposals to a maximum of 50 clients. It includes features from the Lite plan, along with recurring billing, business health reports, double-entry accounting reports, automatic receipt capture and expense tracking, a mobile mileage tracker, and the ability to invite an accountant.

- Premium: For $55/month, this plan offers support for an unlimited number of billable clients. It includes everything from the Plus plan, but also features unlimited invoices and estimates, automatic payment reminders, full accounts payable reports, including Profit and Loss and Cash flow statements, project profitability tracking, and custom email templates and signatures.

- Select: The Select plan requires a quote from a FreshBooks representative. The plan includes all the features of the Premium plan, plus reduced credit card transaction rates, standard ACH fees, a dedicated account manager, data migration support, and customized onboarding.

Note that each subscription plan allows for only one seat. Each additional user incurs a $11/month charge.

Advanced payments, like recurring billing, while available for free on the Select Plan costs $20 per month on other plans.

The Gusto Payroll feature is also available on all plans at custom-based pricing.

Pros and Cons

Pros

- Double-entry accounting. FreshBooks employs double-entry accounting, ensuring data integrity and accurate financial reporting. This makes tax preparation a breeze.

- Intuitive interface. Freshbooks is designed to be easy to use, even for those with limited accounting experience.

- Unlimited invoicing. You can send as many invoices as you need, regardless of your plan. FreshBooks scales with your business.

Cons

- Limited accountant access. FreshBooks does not allow an accountant to access the full audit trail regardless of the plan chosen. This presents challenges for accountants trying to fully understand the financial trajectory of a business.

- Each plan allows only one user. FreshBooks charges an additional monthly fee of $11 for each additional team member. This extra cost can quickly add up for larger teams.

- Lack of detailed per-unit reporting. FreshBooks doesn’t support granular financial reports specific to individual properties, making it difficult to analyze profitability and optimize pricing for each unit.

Integrations

- Bench

- Fundbox

- Gusto Payroll

- HubSpot

- Zapier

- Square

- DocuSign

- Everlance

Instabooks.co — For Airbnb Superhosts Seeking AI-Powered Automation and Optimization

Instabooks is a comprehensive AI-powered accounting software for property managers and landlords made for small businesses, with special features designed for Airbnb hosts.

Key features like voice-enabled data entry and AI-powered account classifier aim to deliver efficient and exact financial management, making it the best bookkeeping software for Airbnb hosts.

Other powerful features of Instabook include expense tracking, receipt scanning, payment processing, and financial reporting.

With potential time savings equivalent to $7,000 of reclaimed income, Instabooks signals a new benchmark for accounting efficiency.

This makes it an ideal solution for tech-savvy Airbnb hosts trying to optimize their productivity.

Features

Expense Recording and Tracking

With this accounting software for real estate investors, tracking and recording expenses requires no more than speaking into the app.

Users describe their business expenses and the AI classifies them into accurate expense accounts.

This helps you keep track of your expenses and cash reserves daily, reducing reliance on external services of a real estate bookkeeper.

Sales Tax Calculator

Instabooks also shines as the best tax software for Airbnb hosts, automatically calculating, tracking, and lodging GST, VAT, and sales tax.

It saves Airbnb hosts up to $7,000 and 200 hours. Input the tax invoice details and Instabooks takes care of the math.

You can also check the amount of tax paid during any period with simple commands.

Financial Reports

Instabooks provides a sophisticated reporting system that requires no accounting knowledge.

Use voice commands to access various financial reports: invoice, expense, spending, payments, bad debt, sales tax summary, cash flow, profit and loss, balance sheet, and more.

Real-time tracking helps you make strategic business decisions.

Receipt Scanner

The Instabooks receipt scanner allows you to easily digitize and store your receipts. You can scan receipts through the app to capture expense data and safely store the images online.

Plans and Pricing

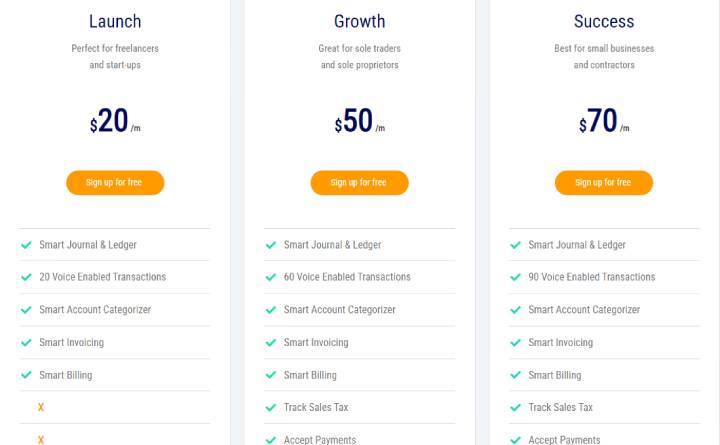

Instabooks offers 3 subscription plans. They include:

- Launch: Costs $20 per month and is perfect for freelancers and startups. It includes features such as smart journal and ledger management, 20 voice-enabled transactions per month, smart account categorizer, smart invoicing, smart billing, and receipt scanning and storage. This plan is for one regular user and one accountant.

- Growth: For those managing multiple short-term rentals, the Growth plan is more suitable, priced at $50 per month. Apart from all the features included in the Launch plan, the Growth plan allows you to track sales, tax, and accept payments. This plan supports up to three users.

- Success: Priced at $70 per month this plan is designed for larger teams and allows access for up to 5 users with up to 90 voice-enabled transactions and email support.

You can test out the platform’s features for free for 30 days to determine which plan is most suitable for your business.

Pros and Cons

Pros

- Automated accounting. Instabooks leverages advanced AI technology to streamline complex accounting processes. Its automated systems can record expenses, categorize transactions, and generate reports quickly and easily.

- Easy-to-use mobile app. The Instabooks mobile app, perfect for tracking Airbnb expenses, enables users to perform various accounting tasks on the go, such as invoicing, expense tracking, scanning receipts, and calculating VAT.

- 30-day free trial. Instabooks offers a 30-day free trial. This gives you ample time to explore and understand the platform’s functionalities before committing to a payment plan.

Cons

- Lack of integrations. Instabooks currently does not offer integrations with other software or services.

- Limited online reviews. Instabooks, while being one of the best Airbnb accounting software options out there, is still fairly new, making it difficult to find online reviews from past or current users.

- Customization limitations. Although Instabooks could be considered the best tax software for Airbnb, it has limited customization options for reports and data views. This might make it challenging to tailor the platform to individual needs and business models.

Integrations

Instabooks has no integration with third-party vacation rental management or real estate accounting software.

Akounto — For Vacation Rental Owners and Managers Who Prioritize Ease of Use and Automation

Akounto is cloud-based accounting software that makes managing short-term rental finances easier.

With its automation of repetitive tasks, simplified transaction categorization and real-time income, and expense tracking, it’s no wonder Akounto is considered one of the best Airbnb accounting software options in the market.

Also, with Akounto, property managers and landlords get a comprehensive view of their business finances on one intuitive dashboard that presents their most important KPIs.

You will also be able to visualize your financial health with customizable, interactive, and easy-to-understand charts and graphs.

Features

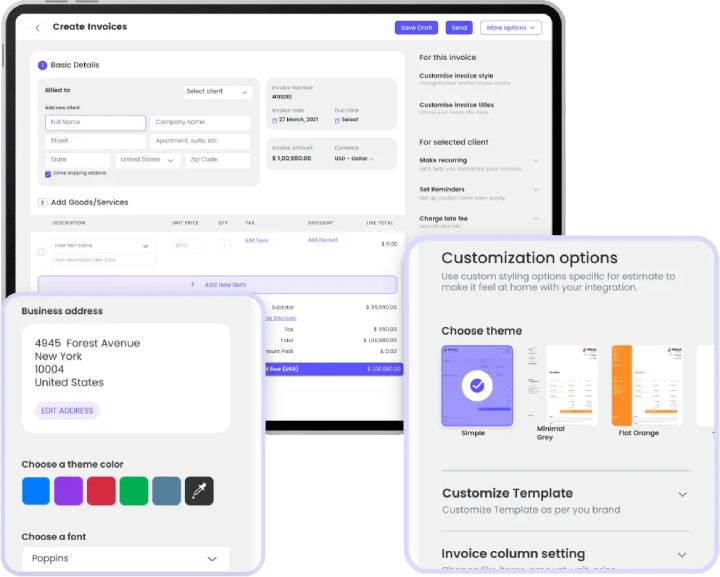

Professional Invoices

Akounto offers real estate investors and other landlords customizable templates for estimates, proposals, and invoices.

Simply choose a template, fill out the necessary fields, add your logo, and receive faster payments online.

For your rental business, you can customize the invoice fonts and colors to suit your taste, and send reminders via email.

Akounto’s invoicing software also enables automated recurring invoices for returning clients.

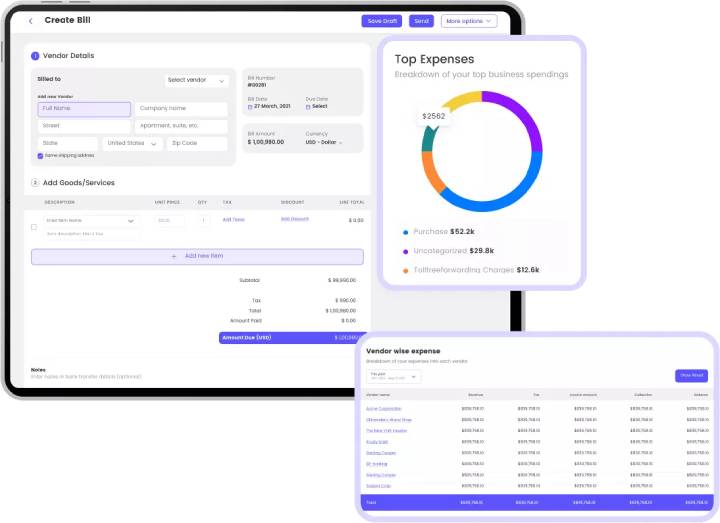

Financial Reporting

Akounto allows you to create custom financial reports effortlessly.

This feature provides you with real-time access to your financial health, letting you generate annual reports, balance sheets, profit and loss statements, and cash flow statements easily.

It also facilitates automatic tax calculations, giving you all the financial data you need in a matter of clicks.

Expense Tracking

Akounto is the best app for tracking Airbnb expenses. You can effortlessly manage your finances with Akounto’s expense tracking feature.

You can analyze your spending to understand your daily expenses and gain insights into your spending habits.

Click on the “Expense report” tab for an organized breakdown of expenses, categorized for your convenience.

Akounto Books

Akounto offers to handle all your accounting and tax filing for a flat monthly fee. Bookkeeping with Akounto Books is carried out by a dedicated finance management team available 24/7.

This helps you save up to 95% of what you’d otherwise pay an in-house accountant.

Plans and Pricing

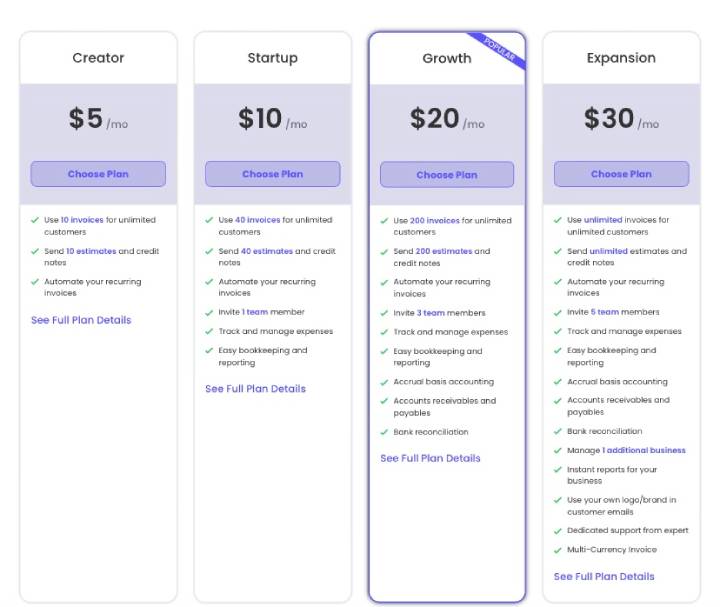

Akounto offers four subscription plans. They include:

- Creator is priced at $5 per month. This option is ideal for small businesses and individuals. Users on this plan can generate 10 invoices per month, add an unlimited number of customers, send 10 estimates, and send recurring invoices.

- Startup costs $10 per month. This plan allows you to generate 40 invoices and estimates, add unlimited customers, send recurring invoices, invite an extra team member, track and manage expenses, and perform basic bookkeeping and reporting.

- Growth is priced at $20 per month. This plan is designed for growing businesses. It allows users to send up to 200 invoices, estimates, and credit notes per month. Users can invite three team members and access advanced financial management features like accrual basis accounting, accounts receivable and payable, and bank reconciliation.

- Expansion is available for $30 per month. This plan features unlimited invoice generation, estimates, and credit notes for an endless list of customers. It allows you to invite up to five team members and manage one additional business. This plan also provides instant financial reports, supports multi-currency invoicing, branded invoices and emails, as well as dedicated support.

Pros and Cons

Pros

- SmartView dashboard. Akounto provides an intuitive SmartView dashboard that uses pie charts and intuitive graphics to present relevant information about your business’s financial standing.

- Customizable invoices and estimates. Users can create professional invoices and estimates tailored to their brand, fostering positive guest relationships.

- Outsourced accounting. Through Akounto Books, which starts at $199 per month, users gain access to expert CPAs that can help with bookkeeping and tax filing.

Cons

- Fewer platform connections. Compared to Bnbtally, Akounto currently integrates with fewer vacation rental platforms and payment processors, potentially limiting its usefulness for hosts with diverse listings or income streams.

- Basic reporting. While Akounto offers basic financial reports, some users may find them not comprehensive enough compared to the more detailed dashboards and tax-ready reporting features provided by competitors.

Integrations

- Plaid

- Yodlee

TopNotepad — For Airbnb Hosts Seeking a Simple, Affordable Solution for Basic Bookkeeping and Invoicing

TopNotepad is a powerful accounting software designed for freelancers and small businesses, including those running Airbnb businesses.

It offers a suite of features for complete financial management, including a cash book for daily business transactions, balance sheets, and P&L reports.

Its capabilities also include the creation of estimates and quotations that can be converted into invoices, and an inbuilt email functionality to directly send these invoices to clients.

TopNotepad is an excellent choice as the best accounting software for Airbnb businesses, providing straightforward financial tracking.

Features

Quotations and Estimates

You can simply enter the specifics of your quotation/estimate and the app auto-fills details such as logo and address in the header and terms and conditions in the footer.

This tool for real estate investors also allows you to download a PDF copy of the estimates or quotations for your records.

If approved, these documents can be converted into invoices with a single click, which you can then email to your clients.

Automated Accounting and Reporting

The software automatically generates Profit and Loss Statements, without additional user input.

All you need to do is initiate the download on TopNotepad, and your Profit and Loss Statement is ready to be used for your records or tax return filing.

This software for vacation rentals accounting also generates tax reports. This report helps you track the tax collected on issued invoices, alongside the tax paid on purchases and expenses.

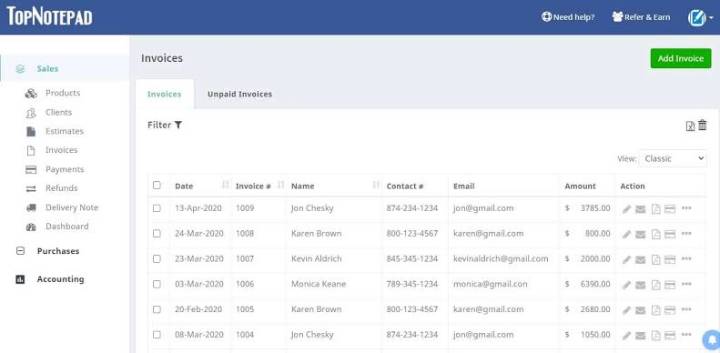

Invoice Dashboard

The invoice dashboard offers a consolidated overview of your business finances. It allows you to track the total number of invoices generated, payments received, and due payments, all in one place.

Expense Categories

TopNotepad lets you create personalized expense categories according to the nature of your expenses.

This allows you to group and monitor your expenses more effectively. Plus, by linking invoices to related expenses, you can track your profitability per invoice.

Plans and Pricing

TopNotepad offers a 7-day free trial which allows you to test out the software and gauge if it meets your needs without any financial risk.

Following the free trial, pricing is customized based on your needs. This ensures users only pay for what they need.

You get a 20% discount on your subscription fee if you commit to an annual term.

Pros and Cons

Pros

- Simplicity and ease of use. TopNotepad boasts an intuitive interface that doesn’t require accounting expertise, making it ideal for beginners.

- Automated accounting features. Users can automate tasks like transaction categorization, bank reconciliation, and tax calculations, saving time and reducing errors.

- Highly secure. TopNotepad offers a unique feature that allows you to restrict user access from specific IP addresses. Businesses with multi-user subscriptions can configure the software to allow access only from within the company’s premises, adding an extra layer of security and control.

Cons

- Non-transparent pricing. The absence of transparent and public pricing plans can make budgeting difficult.

- Limited integrations. Data import relies largely on manual CSV uploads. The software doesn’t integrate with other property management software or accounting tools.

- Limited reporting options. Users have reported a lack of flexibility in customizing reports or generating specific reports needed.

Integrations

- PayPal

- DocHub

- Stripe

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.