5 Best Software for Mortgage Brokers (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading mortgage brokers to share their expertise on the best mortgage broker software tools to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best software that mortgage brokers use and evaluated their features, plans, and pricing information. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

Blend

Blend is a cloud-based digital lending platform that allows brokers, credit unions, and mortgage companies to manage leads and streamline lending services.

Setting it apart are its drag-and-drop function, and its real-time monitoring system for tracking loan statuses, outstanding inquiries, and customer activities all on one dashboard.

These features allow you to streamline your work processes and revolutionize your client’s loan experiences.

Features

Customizable Role-Based Tools

You can create a digital workspace with access to tools tailored to your specific needs as a broker.

This customized workspace helps make tasks like application intake management, referring partners for consultation, and staying in touch with customers easier and quicker to complete.

Loan Officer Landing Page

Blend’s Loan Officer Landing Page stands out among other mortgage commission software tools.

By utilizing Blend’s loan officer (LO) landing pages, you can increase your website traffic and mortgage lead generation.

These landing pages enable seamless online application initiation for borrowers and effective brand promotion.

Co-Pilot

Blend ensures real-time remote support throughout the application process, empowering you to focus on loan origination.

This comprehensive support system bolsters productivity and enhances borrowers’ overall experiences.

Automated Conditions and Workflows

The platform reduces underwriting and processing efforts through smart data analysis, identifying potential issues early in the application phase.

This automation increases efficiency and minimizes complications.

LO Toolkit

Blend also functions as a top credit repair software for mortgage brokers.

Blend offers an all-in-one workspace that incorporates essential tools, such as credit checks, product selection, dual AUS (automated underwriting system) submissions, pre-approval letters, and closing cost estimations.

Plans and Pricing

Blend uses a personalized pricing model. To get the specifics, it’s best to reach out to a Blend customer service representative who’ll provide you with a quote based on your needs.

Pros and Cons

Pros

- Superior customizability. Blend enables a high level of customizability, allowing you to fine-tune the platform to your specific needs.

- Effortless navigation. Customers consistently report a smooth, easy-to-navigate process from start to end. This efficiency gives you peace of mind that your clients can chart their course with minimal support needed.

- Feature-rich. Blend boasts an easy-to-use interface and a rich, resourceful feature set. Its extensive integrations with a number of document management, loan origination, and credit tracking tools also extend its functionality.

Cons

- Limited client-side reporting. You can’t see where a client is in their application. Also, forms can be cumbersome to fill out for potential clients as some of the required fields are unnecessary.

- Learning curve. This mortgage loan broker software system has many features and customization options which can make training new users a hassle.

Integrations

- Docutech

- DocuSign

- Equifax

- Experian

- Salesforce

- Velocify

- Plaid

- Finicity

- Avantus

- Byte

- Total Expert

- Surefire CRM

- Encompass360

Floify

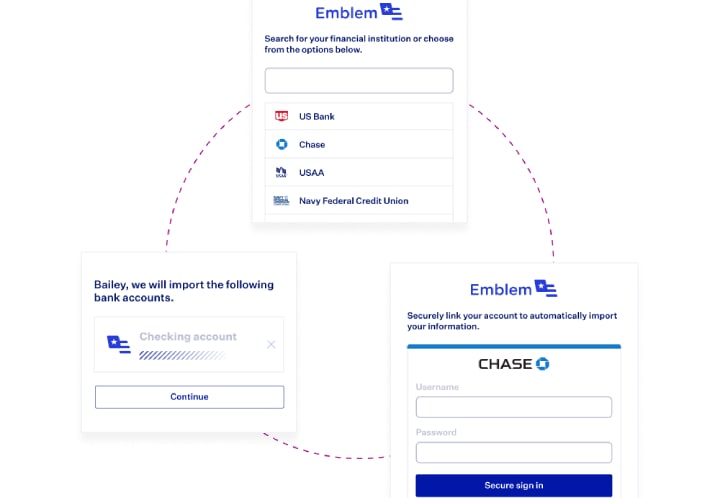

Floify ranks high among cloud-based mortgage brokerage software tools. Distinguished by its advanced digital 1003 and secure document portal, this software accelerates the entire loan application process.

Floify helps brokers streamline their work — from gathering and verifying borrower documentation, monitoring loan progress, and closing deals swiftly, to robust communication with borrowers and other real estate professionals.

Features

Point-of-Sale Portal

Floify offers a secure mortgage point-of-sale portal, presenting an online medium for your borrowers to manage the entire span of their loan journey, from initial application to the ‘clear-to-close’ phase.

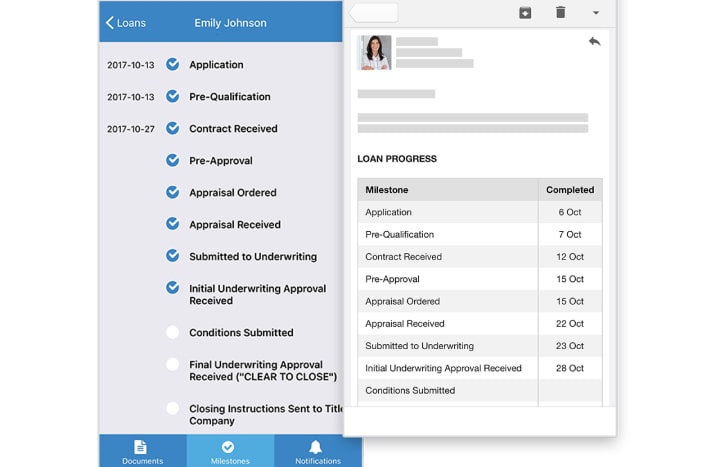

Automated Loan Updates

Floify integrates customizable loan milestone indicators matching your lending process with flexible and easily configurable email templates.

This ensures that you and your borrowers receive a continuous flow of updated insights enhancing the transparency of the lending process.

Interview-Style 1003

Floify provides an interview-style questionnaire that guides borrowers through the loan application process with a step-by-step approach, utilizing visual cues and intelligent routing.

To ensure data accuracy, each section concludes with a summary screen for quick review.

Customizable Interface

Floify’s web-based mortgage loan application is one of the most customizable apps for mortgage brokers.

It is web-based, easily adaptable to the distinctive needs of brokers, and can be customized to highlight your brand, from changing colors and text to altering the form’s length, to adding custom questions and follow-ups.

Centralized Disclosure Tracking

Floify’s centralized dashboard provides instant visibility into the status of all disclosures across your entire operation or a specific loan team.

It gives detailed insights like loan file number, borrower name, and disclosure type in a single dashboard.

Plans and Pricing

Business Plan

For only $70 per month, or an annual prepayment of $840, this plan offers a range of features ideal for single lenders with no additional support users.

Features include access to a secure borrower portal, customizable digital 1003 loan application, automated updates and notifications, native eSignature via Floify eSign, a suite of productivity integrations, and a reporting and analytics dashboard.

Team Plan

This plan is designed for lending teams of one loan officer and up to four support users who work together on the same pipeline.

It is charged at an annual prepayment of $2,400, or a monthly pay of $200. Features include everything in the Business Plan for up to five users.

Enterprise Plan

The Enterprise Plan is the perfect solution for large lending operations that want to optimize productivity, streamline their processes, and maximize profits.

Pricing is tailored to meet your specific needs. This plan includes all the features of Floify’s Business and Team plans.

It also includes enterprise-level integrations with Encompass, MeridianLink, BytePro, Disclosure Desk, Fannie Mae Desktop Underwriter®, synchronization of loan milestones, single sign-on with Active Directory access, and a portal for settlement agents.

Pros and Cons

Pros

- Excellent document management. Floify comes with an outstanding document management system, helping you efficiently maintain, track, and access various types of loan-related documents while maintaining compliance.

- Customizable interface. Floify offers customization options that allow brokers to alter the user interface according to their business branding and processes.

- Intuitive user interface. With a focus on intuitive design, Floify’s simplistic interface efficiently helps your clients navigate through every stage of the mortgage process. With features like direct document upload and automated milestone updates.

- Great support team. The support team responds quickly to issues.

Cons

- Higher-tier integrations. Integrations with tools like Encompass360, MeridianLink and BytePro are only available on the Enterprise Plan.

- Excessive follow-up emails. Floify’s default communication design leans towards high-frequency follow-up emails. While this can foster project completion in some scenarios, reviews indicate that the number of emails can be overwhelming.

Integrations

- Jungo CRM

- Surefire CRM

- Unify by Lone Wolf

- Xactus

- Factual Data

- CoreLogic

- Equifax

- SettlementOne

- MeridianLink

- Plaid

- AccountChek

- Sarma

- Avantus

- BytePro

- Encompass360

ARIVE

ARIVE is an innovative mortgage brokerage software that functions as an integrated loan origination software (LOS), point of sale (POS), and product pricing engine (PPE).

It features a connected lender marketplace designed exclusively for independent mortgage brokers and non-delegated third-party originators (TPOs).

Features include real-time product and pricing search, digital integration for loan transactions with associated lender partners, and the flexibility to work with any lender.

The ARIVE platform was acquired by LendWize in 2021.

Features

Loan Origination Software

ARIVE’s loan origination software allows mortgage brokers to originate loans from anywhere with ease.

It streamlines pipelines, provides instant pre-approvals, offers document storage, and runs 1-click automated underwriting.

Point of Sale

ARIVE’s point of sale system provides your clients with a branded, mobile-friendly, and secure portal for collecting loan applications and supporting documentation following set rules, further enhancing client engagement.

Product Pricing Engine

ARIVE’s product pricing engine enables brokers to quote borrowers with accurate rates.

It also generates fee worksheets with real fees, runs instant total cost analyses, sets up rate alerts, and manages margins, making the loan pricing process efficient.

Lender Marketplace

This mortgage software system offers an industry-first lender marketplace, where you can find accurate pricing, digitally submit loans to lenders, and receive status updates, streamlining the loan submission and follow-up process.

Plans and Pricing

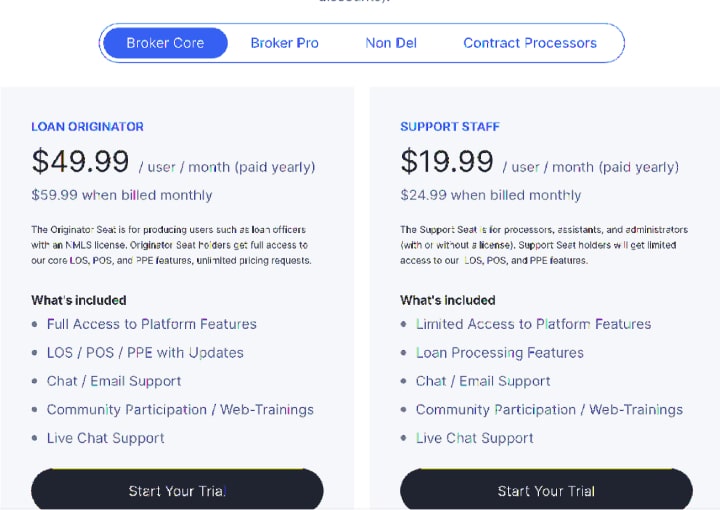

The ARIVE mortgage brokerage software platform offers three pricing plans. New users can test ARIVE for free for 7 days. Paid plans include:

Broker Core

This plan offers two options, which include:

- Loan Originator. Charged at $49.99/user/month when paid yearly and $59.99 when billed monthly, this plan gives you full access to the platform’s features, chat/email support, and community participation/web training.

- Support Staff. Charged at $19.99/user/month (paid yearly) or $24.99 when billed monthly. The Support Seat is for processors, assistants, and administrators. It gives limited access to ARIVE ’s platform features.

Broker Pro

This also includes two pricing options:

- Loan Originator. Charged at $69.99/user/month (paid yearly) or $79.99 when billed monthly, it gives you full access to ARIVE’s core LOS, POS, and PPE features, API integration using Zapier, customized reports, and built-in e-signing.

- Support Staff. Charged at $34.99/user/month (paid yearly) or $39.99 when billed monthly, Support Seat users get limited access to LOS, POS, and PPE features, including all other features previously listed.

Contract Processor

Charged at $49.99/user/month (paid yearly) or $59.99 when billed monthly, the Contract Processor seat is designed specifically for processing centers.

Features include single login to process loans across brokers, contract processing fees setup, join an LO team to process files, community participation/web training, and live chat/email support.

Pros and Cons

Pros

- Consolidated platform. ARIVE offers a comprehensive mortgage platform, allowing brokers to combine various systems.

- Online training. ARIVE provides online training webinars and videos, enabling you to learn and master the platform effectively, further maximizing productivity and software adoption.

- Robust lead sharing mechanism. ARIVE’s groundbreaking lead sharing framework empowers you to connect consumers with local community lenders. In a gamification-driven environment, ARIVE ensures optimal lead allocation based on factors like customer reviews, average loan processing time, and borrower proximity, encouraging best-in-class performance.

Cons

- Implementation challenges. ARIVE’s initial setup and integration with existing systems require extra time and resources to implement.

- Low online presence. The platform has a very low online presence compared to competitors, with scant user reviews.

Integrations

- Zapier

- Copper CRM

- Shape Software

- Factual Data

- Newrez Wholesale

- PowerTPO

- PENNYMAC TPO

DigiFi

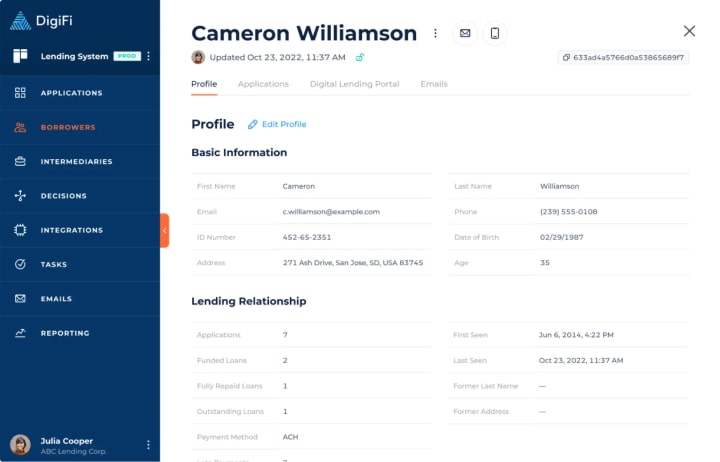

DigiFi is a cloud-based software platform for mortgage brokers revolutionizing the lending journey from application to funding.

This mortgage processing software simplifies borrower information collection, loan decision processing, and variable value assignment for brokers of all sizes.

Its capabilities also encompass compliance management, performance analysis, and data encryption.

It empowers brokers with a centralized platform, optimizing process efficiency and team performance.

Features

Application Processing

DigiFi’s robust application processing tools empower mortgage brokers to work both individually and as a team.

With its ability to track applications through various statuses, it provides a transparent lending flow to foster seamless interaction with real estate investors and other borrowers.

Automated Decisions

DigiFi’s credit decision engine allows you to execute instant and precise decisions that are fully auditable.

By utilizing integrations, rules, formulas, models, and scorecards, you can assess loan applications for creditworthiness, set pricing, verify data, and more.

Document Management

By using DigiFi’s document management system, you can upload files, create documents from templates, initiate e-signature processes, and request files securely from borrowers.

This centralizes and simplifies document handling, ensuring that critical information is easily accessible.

Lending CRM

Integrated within the DigiFi LOS is a powerful CRM for mortgage professionals that allows you to store and view comprehensive information about your borrowers and intermediaries.

This includes their information, applications, loans, communications, documents, and assigned tasks.

Plans and Pricing

DigiFi is one of the most affordable mortgage broker tools. It offers per-application pricing with no feature limits.

You get access to the entire platform without feature-specific pricing or usage limitations, service level agreements, cloud hosting, and 24×5 premium support.

Pros and Cons

Pros

- Highly configurable. DigiFi offers unmatched UI-based configurability and limitless code-level customizations matching the diverse workflows of mortgage brokers and offering the flexibility to tailor the system to your specific needs.

- Flexible deployment. DigiFi provides deployment versatility. You can choose whether to deploy the system onto your own cloud or on-premise servers, or opt for DigiFi’s hosting, suiting different infrastructure setups and preferences.

- Flexible pricing. DigiFi employs pay-as-you-use pricing. Buyers aren’t locked into monthly or yearly plans.

Cons

- Steep learning curve. DigiFi’s impressive robustness brings with it a potential complexity. There may be a steep learning curve if you have never used mortgage software before.

- Implementation hurdles. Given its highly customizable nature and substantial configuration options, you might experience a prolonged setup time.

Integrations

- LoanPro

- DocuSign

- SendGrid

- REST API

Calyx

Calyx mortgage advisor software is a leading cloud-based mortgage platform offering advanced tools for streamlining loan services and marketing operations.

Its comprehensive suite encompasses solutions like Point, Zenly, and PointCentral. Point is a top choice for brokers offering robust features for loan marketing, origination, and processing.

By combining it with PointCentral, you can enhance your mortgage operations with greater versatility.

Features

Calyx Wholesale Marketplace

This feature empowers mortgage brokers to effortlessly locate the most suitable programs for borrowers and establish a direct connection with participating lenders through the origination platform.

Custom Reporting

This residential and commercial lending software offers valuable insights into loan management KPIs by giving you access to comprehensive dashboards and reports within the LOS.

These tools help keep your decision-making data-driven and efficient.

Document Management

Calyx simplifies the document management workflow, allowing you to handle more business without getting weighed down by file management tasks.

The platform also provides e-signature functionality for faster document execution.

Zip

With this mobile-friendly tool, borrowers can apply for a mortgage instantly. Accessible through a personalized URL, Zip offers a no-frills Q&A-style borrower interview, ensuring a straightforward and hassle-free experience for the customer.

Plans and Pricing

Contact the Calyx sales team directly to find out more about the pricing structure and to receive a detailed quote.

Pros and Cons

Pros

- Full-featured LOS. Calyx Point unifies the mortgage loan process within a single application, improving efficiency and accuracy for brokers. With the capacity to cater to organizations of all sizes, it also streamlines processes through an easy-to-manage single-point management system.

- Easy to learn and use. Thanks to its intuitive interface, this mortgage broker marketing tool marries simplicity with effectiveness. It delivers an experience akin to entering data on a paper loan application, minimizing the learning curve and ensuring effortless navigation and integration with major industry players.

- Dynamic customizability. Calyx allows mortgage brokers to integrate or manipulate fields on demand. This extensibility provides ample scope for updates and changes, driving adaptability and allowing LOs to be responsive to the ever-evolving mortgage landscape.

Cons

- Demands technical support. If overseeing a large team using the application, you might require in-house IT support for all integration processes. While Calyx offers support, day-to-day computing issues could necessitate a dedicated individual or team.

- Not cloud-based. While they have an Enterprise-grade cloud solution called Path, Calyx Point is not a cloud-based platform, which might be a shortcoming if you desire a flexible cloud solution.

Integrations

- Avantus

- Shape Software

- NXTsoft

- SigniaDocs Inc

- Surefire CRM

- Optimal Blue

- Cimmaron Software

- Unify CRM

- Pre-Approve Me

- LenderLogix QuickQual

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.