6 Best Automated Underwriting Platforms for Real Estate Mortgage Loans (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading mortgage brokers to share their expertise on the best mortgage loan underwriting software to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best underwriting automation solutions for banks and underwriting agencies and evaluated their features, plans, and pricing information. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

Fundingo

Fundingo, developed by CloudMyBiz, is a cutting-edge automated underwriting system designed specifically for non-bank lending businesses.

By accelerating the underwriting process and generating diverse pricing options, it optimizes the workflow of alternative lending and interest-based loan companies on the Salesforce platform.

Additionally, its AI-enhanced capabilities allow it to swiftly and accurately analyze substantial data, extract relevant details from documents, perform credit checks, and assess risk factors.

Features

Automated Document Management

This feature seamlessly automates the entire document lifecycle, from the collection of applicant documents to the creation of essential paperwork such as offer letters and closing documents.

Offer Wizard

Offer Wizard offers a highly intelligent and adaptable solution for generating tailored pricing and term offers.

It allows lenders to effortlessly craft offers that align precisely with each borrower’s unique application while adhering to the lender’s established rules and credit policies.

Application Routing

Fundingo uses a highly efficient system to intelligently direct loan applications to the most appropriate underwriters within an organization.

By analyzing various factors such as application details, underwriter expertise, workload, and credit policies, it ensures that each application is routed to the best-suited underwriter.

Automated Data Entry

This is a time-saving and error-reducing tool that revolutionizes the data input process.

By automatically extracting and transferring all pertinent information from loan applications directly into the system, it eliminates manual data entry while ensuring data accuracy.

Plans and Pricing

Fundingo’s pricing plans are not publicly disclosed on the website.

To obtain pricing details and explore the platform’s offerings, you are encouraged to reach out to the Fundingo team and request a personalized demo.

Pros and Cons

Pros

- Extremely flexible system. Fundingo can be tailored to align seamlessly with the specific processes and requirements of lenders, resulting in a highly efficient and streamlined loan underwriting process.

- Data source integrations. One of the key benefits of this mortgage underwriter software is its ability to easily integrate with borrower verification data sources like LexisNexis, Experian, and DecisionLogic. It allows vital information to be seamlessly appended to application records or processed through a sequence of workflows for risk assessment.

- Built for alternative lenders. Fundingo is a loan management and underwriting automation solution meticulously crafted by industry experts to meet the unique needs of alternative lending companies. It is one of the best mortgage loan underwriting software programs for non-bank lenders.

Cons

- Salesforce license requirement. The need for individual Salesforce licenses for each Fundingo user can significantly contribute to the overall cost of implementing and using the software.

- Poor user interface. As an automated mortgage underwriting system provider, Fundingo could improve its user experience. According to users, the platform needs to be made more intuitive and efficient.

Integrations

- Salesforce

- DocuSign

- Dropbox

- LexisNexis

- Conga

- Hoopla

- Amazon Web Services

- QuickBooks

- Five9

- Evernote

- Pardot

- DecisionLogic

- ACHWorks

- ACH Processing Company

- Heroku

- OwnBackup

- Experian

- Ocrolus

- Quiktrak

- Chargent

- PandaDoc

- TimeValue Software

FundMore

FundMore is an automated underwriting system that harnesses the power of machine learning to optimize the pre-funding process for lenders.

As an innovative automated loan underwriting software platform, FundMore provides customizable automation options, enhancing the borrower experience through advanced analytics.

It also mitigates risk via AI-driven insights and expedites the onboarding process for new accounts.

It employs pattern recognition and logic-based decision-making, utilizing a scoring system to evaluate mortgages.

Features

Customizable Dashboard

FundMore offers a fully customizable dashboard that can be tailored to align with an organization’s internal policies and preferences.

This dashboard provides a comprehensive view of key metrics and analytics relevant to a business’ lending operations.

You can modify the system to assess various critical factors, including collateral, creditworthiness, character, capital, and capacity.

Analytical Reports

FundMore provides users with real-time reporting that keeps track of efficiencies, applications, and funded files.

Document Management and Automation

The FundMore mortgage underwriter software efficiently manages document handling for lenders, allowing seamless collection, classification, processing, validation, and secure storage of client documentation.

This feature ensures all necessary paperwork is not only organized but also easily accessible.

Automated Verification and Analysis

FundMore automates the verification of critical elements in a loan applicant’s financial profile.

This includes authenticating their identification, validating historical income, predicting future income trends, assessing property values, and scrutinizing credit history.

Plans and Pricing

FundMore does not provide pricing information on its website. To access pricing details, interested users are invited to request a personalized demo.

Pros and Cons

Pros

- User-friendly interface. FundMore’s automated loan underwriting software platform is intuitively designed, prioritizing accessibility and ease of use, thus making it an attractive choice even for lenders who may lack experience with advanced property underwriting tools.

- Document management automation. FundMore’s AUS (automated underwriting system) provides a secure document portal with e-signature, ID verification, and automated document classification and processing capabilities. The platform’s AI-powered algorithms can quickly and accurately identify and extract relevant information from loan documents, reducing the need for manual data entry and review.

Cons

- Relatively new platform. FundMore.ai is a relatively new platform, and one of the notable challenges that potential users may encounter is the limited availability of comprehensive information about FundMore from online sources.

- Pre-funding focus. FundMore’s tools help lending businesses optimize the pre-funding process by automating manual processes. There are limited calculators or deal assessment tools.

Integrations

- Filogix

- Opta

- Coforge

- VeriFast

- ezidox

Inscribe.ai

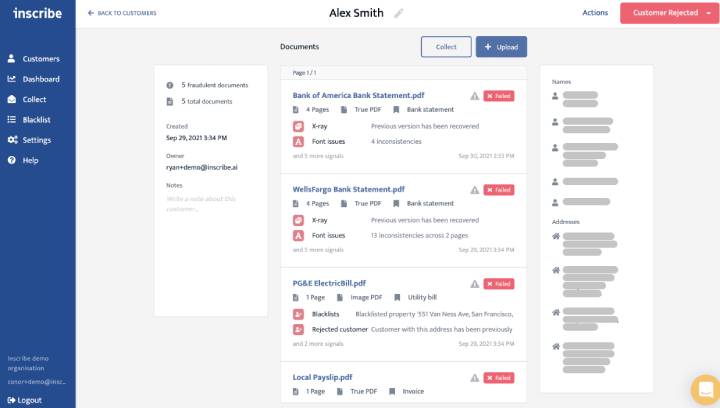

Inscribe is a startup leveraging AI-driven technology to combat financial fraud.

The platform stands out as an exceptional credit underwriting software, providing financial institutions with robust tools for detecting fraudulent documents, and using intelligent automation to assess customer creditworthiness.

Inscribe’s automated underwriting system excels at classifying, parsing, and matching names and addresses based on user-defined criteria, providing rapid assessments of document authenticity.

Features

Fraud Detection

This is a powerful tool designed to swiftly identify document authenticity. Documents are analyzed within seconds, and precise details are provided about any changes made.

Users gain insight into the document’s metadata, including any software modifications made to items like pay stubs or bank statements.

It allows users to interact with portions of the document where issues have been detected, providing a clear view of discrepancies.

Data Extraction and Digitization

This tool takes the hassle out of document processing. It automates the often tedious and error-prone tasks of classifying various document types, parsing essential details, and validating names and addresses.

Credit Insights

This is a powerful tool that enables faster and more frequent underwriting.

It achieves this by providing comprehensive bank statement insights, enabling financial institutions to gain a holistic perspective of their applicants’ financial profiles.

Automated Decision-Making

This feature provides users with efficient and data-driven decision-making capabilities.

It allows users to opt to auto-accept or auto-reject applicants based on the severity of fraud results, ensuring that documents are sent for manual review only when necessary.

This streamlined process reduces the risk of human error and eases the stress associated with manual reviews.

Plans and Pricing

There are no specific pricing details available on Inscribe’s website.

To access comprehensive pricing information and explore offerings, interested buyers are encouraged to request a demo.

Pros and Cons

Pros

- Excellent fraud detection. This professional mortgage software stands out among property underwriting tools with its AI-powered algorithms designed specifically to detect fraudulent documents that may not be easily caught by human reviewers. Trained on an extensive dataset of documents, the platform can identify patterns and anomalies that might otherwise go unnoticed.

- Increased transparency. Inscribe provides lenders with clear and concise decision explanations. This transparency not only helps lenders comprehend the decisioning process but also enables effective communication of results to borrowers, enhancing overall transparency and trust in the lending process.

Cons

- Learning curve. Customizing the software and integrating your data sources might take some time. Training and support might be essential to ensure effective utilization of the platform.

- Fraud detection focus. While Inscribe does an outstanding job in areas such as fraud protection, document automation, and verification, the platform has limited deal assessment tools in comparison to other automated mortgage underwriting system providers. Consequently, users might need to complement Inscribe with other tools for a comprehensive assessment and approval process.

Integrations

- HERE

- Salesforce

- Datadog Inc.

- Pinecone Systems

- Gong.io

- Twilio

- MuleSoft

- HubSpot

- Kofax Marketplace

Help With My Loan

Help With My Loan (HWML) is a robust and independent loan search engine that automates the frontend underwriting process for various loan types, including commercial, residential, business, and personal loans.

It sets itself apart by offering access to a broad spectrum of lending options from over 300 vetted lenders, including traditional banks, through a simple and user-friendly application.

HWML’s AI accelerates the approval process by up to 80% and streamlines lender matching by quickly scanning financial documents.

Additionally, HWML offers lender matching, a leads marketplace and a consumer portal for mortgage brokers. It also includes a loan CRM dashboard as a mortgage marketing tool.

Features

Loan Matching

This feature simplifies the lending process by allowing borrowers to automate the task of finding the right loan options.

This mortgage broker software system acts as a dedicated shopping assistant, swiftly matching borrowers with a multitude of loan choices to ensure they can explore and select from as many options as possible.

CRM

The CRM allows lenders to seamlessly oversee the loan process right from their personalized dashboard, providing them with a clear and organized view of each step in the journey.

It allows users to anticipate and plan for upcoming milestones and tasks, ensuring a smooth and well-coordinated lending experience.

Automated Underwriting

HWML leverages smart automation to help users process documents and complete underwriting efficiently.

By using this innovative technology, you can process documents with remarkable speed and precision.

This reduces the time and effort traditionally required for manual underwriting and enables you to make faster and more informed lending decisions.

Plans and Pricing

This residential and commercial real estate mortgage system caters to both brokers and lenders with flexible pricing options.

Brokers can choose from three plans. The Quick Search plan at $99.99 per user per month includes access to the lead marketplace, lender matching, and email support.

For a more robust solution, the $299.99 Standard plan adds automated underwriting, a CRM dashboard, and phone support.

HWML’s Professional plan costs $499.99 per user per month. It offers everything in the Standard plan, plus a consumer portal and white glove support.

Lenders have two choices. Dashboard Only at $499.99 per user per month offers automated lender match, unlimited monthly matches, and more

Database + Lender Dashboard/CRM at $399.99 per month plus $199.99 per user per month features automated underwriting with OCR technology, comprehensive dashboards, admin tools, and pipeline reports.

Pros and Cons

Pros

- Efficient lender matching. This residential and commercial loan underwriting software provides excellent lender matching tools, streamlining the process for users to quickly find the right loan that suits their needs.

- User-friendliness. HWML offers a user-friendly software solution, making it very easy to use for borrowers and lenders. In addition to its intuitive interface, the platform is supported by an exceptional customer service team.

- Great collaboration features. HWML integrates status updates seamlessly, ensuring that all team members remain well-informed without the need to open individual emails. This streamlined communication approach ensures that team members receive automatic notifications regarding business loans and SBA, enhancing collaboration and transparency within the platform.

Cons

- Limited underwriting functionality. The underwriting features in the software are not as robust as in dedicated mortgage underwriting tools.

- Lack of third-party integrations. The platform does not provide options for third-party integrations, potentially restricting users from connecting to external tools and services.

Integrations

Help With My Loan does not offer integrations with third-party software tools.

TurnKey Lender

TurnKey Lender is a leading unified lending management system, providing intelligent loan underwriting software that streamlines the process of making accurate lending decisions and growing your lending business.

It offers an integrated infrastructure that automates every aspect of lending operations, spanning from loan application and borrower assessment to loan origination and ongoing servicing.

Features

Credit History Analysis

This tool examines a borrower’s credit history. This analysis encompasses a detailed assessment of critical elements, including payment history, outstanding debts, and various other pertinent factors.

This enhances the overall credit evaluation process, providing lenders with valuable insights to make informed lending decisions.

Monitoring and Reporting

This residential and commercial loan origination software provides users with valuable tools to gain real-time insights into their loan portfolio.

With advanced monitoring and reporting capabilities, users can track and assess their loan portfolio’s performance in real time.

Customizable Decision-Making Rules

This feature enables businesses to finely tailor the decision-making processes to align precisely with their unique business requirements.

It enables users to exercise a high degree of control and customization in shaping lending decisions, enhancing their ability to meet specific objectives and optimize lending outcomes.

Instant Scoring Reports

This residential and commercial loan management platform provides users with access to real-time scoring reports that offer a comprehensive snapshot of a loan applicant’s creditworthiness.

This valuable tool enables users to make more informed and data-driven decisions by leveraging accurate and up-to-the-minute data to assess applicants’ credit profiles.

Plans and Pricing

This mortgage loan origination system does not provide pricing information on its website. Interested users are invited to request a customized demo to access pricing details.

Pros and Cons

Pros

- Multi-user management. The platform allows for multiple users, each managing their functions independently without compromising privacy or administration levels, fostering collaborative and organized loan management.

- Highly customizable software. This mortgage manager software stands out with its excellent API documentation, allowing users to flexibly build additional services, expanding the platform’s capabilities to meet their specific needs.

- Easy to setup and use. TurnKey Lender simplifies the process of setting up loan products and integrations. It offers seamless out-of-the-box integrations for ACH payments, SMS and email updates, facilitating quick deployment and immediate functionality.

Cons

- Basic reporting. Some users believe the reporting feature lacks depth, requiring third-party solutions to get full analytical insights.

- Platform speed concerns. Platform speed is occasionally slow. These speed fluctuations can potentially impact productivity and efficiency.

- Price. While TurnKey Lender offers an out-of-the-box solution, further enhancements and customization of the product may entail higher expenses.

Integrations

- Repay

- USAePay

- Payliance

- Authorize.net

- Stripe

- PayPal

- Experian

- TransUnion

- Equifax

- FactorTrust

- Clarity

- MicroBilt

- Plaid

- Flinks

- Gmail

- SendGrid

- BulkSMS.com

- Adobe Sign

- SignNow

- eSignLive

- Salesforce

- QuickBooks

- Google Analytics

- Microsoft Excel

Desktop Underwriter by Fannie Mae

Desktop Underwriter by Fannie Mae is an automated bank underwriting software program that helps lenders evaluate home loan eligibility quickly and accurately.

It streamlines the lending process by providing efficient underwriting recommendations, fast automated options for purchase and refinance loans, detailed findings reports, and data validations.

Features

Risk Assessment

Desktop Underwriter’s risk assessment module employs a C++ mortgage scoring model to quantify the statistical credit risk associated with each loan application.

It leverages the results of automated reasoning agents and integrates them into an overall risk assessment. This helps lenders determine whether to approve or decline a loan.

Data Collection and Verification

Desktop Underwriter collects, merges, and validates data from diverse sources, including loan applications and credit reports.

It adeptly tackles common challenges like data gaps, incompleteness, or duplications, ensuring that the underwriting process relies on trustworthy and comprehensive information.

Rent Payment Data

Desktop Underwriter leverages asset verification reports to broaden the pool of potential borrowers who qualify for mortgages.

It focuses on validating 12 months of positive rent payment data during the qualification process, enabling lenders to extend their reach to a wider audience of eligible borrowers.

Reports

Desktop Underwriter offers five crucial reports, providing clarity on underwriting decisions and key loan and credit information.

The Underwriting Findings report explains recommendations and offers direct access to Fannie Mae’s guidelines.

The Ratings report provides numerical ratings for primary risk factors. The Credit Summary report consolidates credit information.

The Sources of Income report details income sources. The Underwriting Analysis report is essential for completing the Transmittal Summary Form, which accompanies any Fannie Mae loan application.

Plans and Pricing

The pricing for Desktop Underwriter is not publicly available. Interested users would need to inquire directly with the provider about specific pricing details and options.

Pros and Cons

Pros

- Enhanced compliance. Desktop Underwriter incorporates Fannie Mae’s underwriting guidelines, ensuring compliance with regulatory requirements and industry best practices.

- Rent payments history. As part of the software’s creditworthiness assessment, the “positive rent payment history” considers the borrower’s rental payment discipline.

Cons

- Lack of transparency. Desktop Underwriter’s decision-making process is based on complex algorithms and proprietary models. Although Desktop Underwriter is one of the most widely used software for underwriting agencies, it doesn’t provide detailed explanations for its decisions. This makes it challenging for borrowers and lenders to understand why a loan may have been denied or receive feedback for improvement.

- System limitations. As an automated system, Desktop Underwriter might not capture every nuance of individual borrowers’ situations. Some potential risk factors could be overlooked, or the system might overstate other risks.

Integrations

- Floify

- Gateless

- Encompass

- Vesta

- BeSmartee

- Okta

- ComplianceEase

- Collateral Underwriter

__

About the Author:

Kristina Morales is both a licensed mortgage loan originator and real estate agent in the State of Ohio. Inspired by her years of working with buyers and sellers and seeing a need for more consumer education, Kristina created loanfully.com, an online educational resource for borrowers and industry professionals. In addition to real estate sales and mortgage lending, Kristina had an extensive corporate career in banking, treasury, and corporate finance. She ended her corporate career as an Assistant Treasurer at a publicly traded oil & gas company in Houston, TX. Kristina obtained her MBA from the Weatherhead School of Management at Case Western Reserve University and her B.A in Business Management from Ursuline College.