5 Best Accounting Software for Short-Term Rentals (2024 Reviews)

Real Estate Bees’ editorial team asked a number of industry-leading real estate investors to share their expertise on the best accounting software for short-term rentals to help our readers make a more educated purchase decision when researching available solutions.

With the help of the experts, we identified the best accounting and tax software for vacation rentals and evaluated them based on critical factors that are important for short-term rental property owners. Visiting retailers of the listed products by clicking links within our content may earn us commissions from your purchases, but we never receive any compensation for the inclusion of products and/or services in our consumer guides. Read our editorial guidelines to learn more about our review and rating process.

QuickBooks Online + Bnbtally

The integration of QuickBooks Online with Bnbtally provides some of the best accounting software for short-term rentals, merging efficient automation with cloud-based accounting capabilities.

One of the key features of this integration is the ability to connect with multiple Airbnb accounts and configure specific accounting rules for each listing, allowing automated invoicing and reconciliation of bills.

QuickBooks Online’s integration with Bnbtally makes accounting for Airbnb reservations easy.

Users can generate detailed invoices for each reservation and separate each reservation income line by line based on predefined rules and tracking categories.

Features

Tax Tracking

Bnbtally allows you to accurately track refunds and service fees. These figures can then be used as tax write-offs against your Airbnb income.

It also provides a detailed system to efficiently track bills. Users can monitor what is owed, to whom, and when, which makes reporting to owners, partners, or tax authorities seamless.

Bnbtally also enables users to conveniently split income for different listings based on their accommodation, cleaning, or host fees, and more.

Historical Import

Available for an additional fee, this feature enables seamless import of reservation data into QuickBooks or other real estate accounting tools.

It also grants users full control over all imported records, offering remarkable flexibility with the ability to automate, synchronize, recreate, or even roll back transactions or reservations.

Class Tracking Categories

This feature provides a convenient way to generate explicit profit and loss, as well as balance sheet reports for multiple listings.

Users can also use the class tracking feature to monitor their income, expenses, and profitability for each listing.

By enabling the class tracking feature in “accounts and settings” and selecting the “one to each row in transaction” option, users can easily categorize and track income and expenses across different segments or revenue streams linked to each property.

Invoicing

Users can create invoices for each of their Airbnb and Vrbo reservations. They can separate their income by line, showing the percentage of each portion going toward accommodation fees, cleaning costs, and host fees.

Additionally, users can set predefined prices based on the number of nights per reservation, the number of guests, and more.

Plans and Pricing

Bnbtally

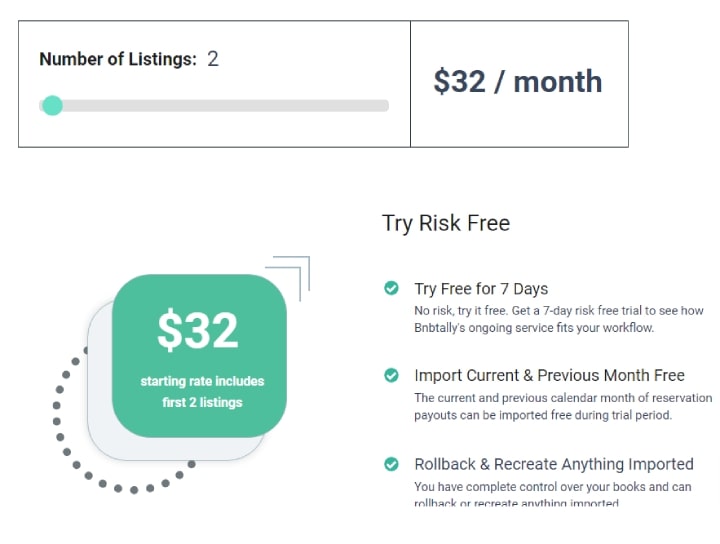

Bnbtally offers an initial 7-day free trial, with unrestricted access to list any number of properties and import relevant reservation data from the current and previous calendar months.

After the free trial, users can opt for a subscription plan, the cost of which is dictated by the number of listings they want to manage.

The initial subscription rate is $32 per month, allowing users to manage up to two listings. The pricing model scales up with the number of listings, reaching up to $711 per month for 99 listings.

Businesses with 100 or more listings have to request a custom quote.

QuickBooks Online

QuickBooks Online offers three plans and pricing options: Simple Start, Essentials, and Plus.

The Simple Start plan includes income and expense tracking, custom and progress invoicing, GST and VAT tracking, insights, and reports. It is accessible to just one user and their real estate accountant.

The Essentials plan is for 3 users and one accountant. It includes all the features in the single plan, plus multi-currency, bills and payments management, and employee time tracking.

The Plus plan allows up to 5 users and 1 accountant. It includes all the features of the Essentials plan, plus features like project profitability tracking, recurring billing, and inventory tracking.

QuickBooks Online offers several discounts. New users can take advantage of any of the plans for just $1 per month for their first 3 months. The yearly plan offers a 50% discount on all plans.

Pros and Cons

Pros

- Accurate financial tracking. The Bnbtally platform accurately categorizes and tracks income and expenses, giving hosts a complete financial picture of their rental property business.

- Automated data import. Bnbtally automates the import of all transaction data from Airbnb and Vrbo, saving valuable time and effort for users.

- Helpful customer care. The platform offers helpful and personalized customer care. Their customer service team goes above and beyond to address customer needs.

Cons

- No phone support. While the platform boasts a dedicated customer care team, it lacks phone support as a means of communication. Bnbtally users have to schedule an appointment via Zoom for personalized help. This can result in delayed resolutions or inconvenience for those who prefer more direct contact.

- Limited integrations. Even though the QuickBooks Online + Bnbtally combo could be recommended as the best accounting software for vacation rentals, currently, it only integrates with Airbnb and Vrbo. This limitation might deter accountants or property managers who need integration with a broader range of short-term rental platforms.

- Pricing concerns. Bnbtally’s pricing structure, particularly for larger portfolios, can be higher than some competitors, making it less budget-friendly for certain users.

Integrations

- Airbnb

- Xero

- Vrbo

- QuickBooks Online

Mesha.club

Mesha.club is an innovative AI-powered platform designed to assist business owners in managing their financial operations from a unified dashboard.

This platform features a comprehensive suite of tools and other resources to refine financial strategies, which makes it some of the best accounting software for vacation rentals when managing rental property remotely.

What also makes Mesha.club a top contender among the best vacation rental accounting software tools is its unique AI search feature, which offers personalized financial guidance.

With an impressive array of over 1,000 integrations, Mesha allows users to control expenses, manage assets, prepare tax reports, and organize financial data all from a single dashboard.

Features

AI Search

By using the power of artificial intelligence, Mesha.club’s AI search tool gives instant answers to users’ financial questions.

This innovative feature allows users to easily interact with their company’s financial data and gain detailed insights by asking simple queries in plain language.

Capable of analyzing vast volumes of data, Mesha AI identifies patterns, trends, and insights, while eliminating errors or inconsistencies.

Invoicing

Mesha has a user-friendly invoicing tool that streamlines short-term rental billing. Users can create, customize, and personalize professional-looking invoices in just a few seconds.

They can also set up automated payment reminders and streamline the payment process by providing a variety of payment options for their customers.

This feature automatically calculates taxes and additional charges, positioning Mesha as an advanced vacation rental tax software.

Mesha offers several other useful capabilities, including multi-currency payment support, easy reconciliation of all international transactions, and more.

Interactive Reports

The reporting feature in Mesha.club drastically simplifies financial decisions for global businesses by intelligently consolidating financial data from various entities and accounting systems.

At the click of a button, users can generate investor-ready reports, having the flexibility to view interactive charts and reports that cover accounts receivable (AR), accounts payable (AP), and inventory.

This innovative feature offers pre-built, customizable templates designed for different roles and reporting needs.

Bill Pay

Mesha.club offers an intuitive solution for businesses to effectively handle bill payments and overall financial management.

Users can track their bills and payments, automate payment approvals, and get a consolidated view of their AP and cash flow.

Users can also speed up payments through powerful integrations with leading payment gateways, pay multiple bills at once, and save time by storing them online for easy access.

Plans and Pricing

With its outstanding list of features and pricing plans, Mesha.club undeniably qualifies as one of the best vacation rental accounting software tools and a top choice for managing vacation rental finances effectively.

For a monthly cost of $49, users can access the core accounting and invoicing software, which includes features like:

- general ledger management

- automated bill payment

- tax management

- cash flow management

- budgeting and forecasting

- expense tracking

- automatic reconciliations

- audit trails

- AI search

- billing and invoicing, and more.

This plan is available free of charge to accountants and CPAs.

For users who require additional support, Mesha.club offers a range of add-ons to their accounting software.

These include bookkeeping for $199 per month, tax prep and filing assistance for $99 per month and payroll starting at $40 per month.

Alternatively, users can opt for Mesha’s all-in-one financial suite for $249 per month.

This comprehensive plan includes features like bookkeeping, accounting, and payroll, as well as accounting and legal consultations.

Pros and Cons

Pros

- Powerful automation features. Mesha automates tedious tasks like expense tracking, income tracking, and bank reconciliation, streamlining accounting processes.

- 24/7 customer support. Mesha.club offers round-the-clock customer support. Whether it’s an inquiry or a request for help, the responsive team at Mesha.club provides solutions via live chat, phone, or email.

- Tax preparation assistance. Mesha’s CPAs help with tax preparation by calculating taxes, generating tax reports, and offering guidance on specific regulations.

Cons

- New platform. As a new platform, Mesha.club might have a smaller user base, translating to fewer user reviews and potentially limited community support or troubleshooting resources.

- No integration with short-term rental platforms. The tool lacks integration with most popular vacation rental platforms like Airbnb, which could be a dealbreaker for some users looking for the best accounting software for short-term rentals.

Integrations

- Gusto

- Stripe

- Razorpay

- Sage

- Brex

- MatchMove

- QuickBooks

- Xero

- Zoho Books

- Shopify

Escapia

Escapia property management software, backed by Expedia Group, is designed specifically for vacation rental property management.

Founded in 2010, the platform allows short-term rental hosts to track revenue and expenses, generate reports, and monitor financial performance.

Escapia’s trust accounting system streamlines property management accounting and ensures compliance with industry regulations.

The platform seamlessly connects to 30+ distribution channels and provides built-in channel management.

Features

Trust Accounting

This feature enables users to complete month-end and year-end reporting tasks in minutes with dynamic built-in reporting, ensuring accurate owner statements and compliance with reporting requirements.

It allows users to create consolidated statements for owners of multiple properties, split statements for shared ownership, and manage recurring owner payouts and year-end IRS reporting by tracking all income and expenses.

Rates Manager

The rates management feature in Escapia provides users with a comprehensive solution for setting and managing vacation rental rates based on seasonal fluctuations, demand, and specific date ranges.

Users can quickly set and change rates for one or multiple units by using a calendar interface. It also offers streamlined global rates settings which allow users to set and update policy rates for all units from one screen.

Performance Dashboard

Escapia’s Performance Dashboard is a business intelligence tool that provides real-time insights into the performance of vacation rental properties.

You can view consolidated year-over-year reporting for your properties, compare their performance against others in the same area, and identify areas of opportunity or decline.

This feature allows you to view, filter, and sort data on one screen, filter results by a specific period, and share standard or custom reports with others.

Reporting

Escapia’s reporting feature allows users to access hundreds of pre-built reports, gather important insights, calculate real-time metrics, and identify origination sources for bookings.

Through its reporting tool, Escapia also allows hosts to manage owner reporting by generating insightful reports and account statements for each owner.

Managers can control which fees appear on owner reports, filter data to suit specific needs, and automate year-end IRS reporting (1099s and 1042s).

Plans and Pricing

Escapia’s pricing is custom-based. Users pay a flat monthly fee based on the number of properties they manage.

The flat fee includes access to a dedicated implementation specialist, unlimited eSignatures, access to all current and new features, unlimited bookings, unlimited support hours, and no added distribution fees for listing on Vrbo and other platforms.

You can also add any number of users for free. Based on online reviews, for 100 units, pricing starts at $10 per unit.

Pros and Cons

Pros

- Ready support. This software for real estate investors provides prompt customer support, helping users solve issues quickly and efficiently.

- Numerous integrations. Escapia easily integrates with other short-term rental platforms and Airbnb automation software, allowing for more efficient data transfer and communication.

- Detailed financial statements. The trust accounting system streamlines and provides detailed financial statements for users. Users can generate financial statements with improved speed and accuracy, as well as perform month-end accounting easily.

Cons

- Non-transparent pricing. The absence of fixed pricing plans means that customers need to engage with customer care to get pricing details, which might seem inconvenient to some.

- Steep learning curve. Many users have had to frequently interact with customer support while using the software, which indicates a level of difficulty understanding its functions.

- Integration issues. While offering multiple integrations, some users report occasional glitches or limited connection capabilities with specific vacation rental booking systems or financial tools.

Integrations

- Yapstone

- PriceLabs

- Lynnbrook Group

- Authorize.net

- RemoteLock

- Brivo

- PointCentral

- Gueststream

- Wheelhouse

- Breezeway

Clearing

Clearing is an innovative expense and revenue management platform designed specifically for rental (short-term rental and long-term rental) property managers and real estate investors.

This financial management software for landlords streamlines trust accounting, automated bookkeeping, enables fast bank account reconciliation, and facilitates one-click payments to homeowners and vendors.

Clearing features zero-balance accounts for bank reconciliations, and allows property owners to systematically collect and organize funds by homeowner or group of properties.

Features

Bookkeeping

Leveraging automated rules to minimize human errors, Clearing’s bookkeeping functionality allows users to connect any source of income or expenditure to track all their transactions in one place.

Users can create rules by merchant, property, transaction type, account, and more to streamline the bookkeeping processes.

This Airbnb accounting software also includes automated reconciliation, matching booking transactions to users’ bank account deposits.

Trust Accounting

Leveraging zero-balance accounts and segmented sub-balances, Clearing’s trust accounting feature automates income and expense tracking.

Added to this robust system is ACH payment integration that lets users settle payments for homeowners, vendors, bills, and utilities directly from the Clearing platform.

Sub-balances in the Trust Accounting system simplify categorization of funds by property or homeowner. This makes tax reporting much easier.

Expense Management

By consolidating tracking, splitting, and categorizing expenses into a unified view, Clearing allows users to oversee their finances with seamless precision.

You can add notes and receipts to transactions, fostering smooth collaboration with your accountant.

Other features of the expense management module include the ability to filter transactions by homeowner, property, and category; create dynamic reports to analyze cash flow; generate owner statements and P&L statements, and further export transactions to Excel for further analysis.

Reporting

The reporting feature serves as a real-time window into your business’s cash flow, allowing you to track financial transactions by category and property.

Reports include, but are not limited to, profit and loss statements per property or for the business in general; cash-flow statements by category, asset, or homeowner; owner statements; and management statements.

Users can easily compare various listings’ performance, generate and customize owner statements, and collaborate with accountants or homeowners through a portal designed with specific permissions for accountants and homeowners.

Plans and Pricing

Clearing’s pricing increases based on the number of listings in your portfolio.

The monthly plan starts at $27.50 for one property. This plan goes up to $350 for 50 properties, $675 for 100 properties, and $1,300 for 200 properties. Pricing options beyond 200 properties are enterprise-specific and determined based on the total number of properties.

There’s a 10% discount on all plans for annual subscribers.

In addition to the monthly or annual plan, users must pay a one-time implementation fee that ranges between $99 to $299.

This fee covers the cost of setting up and integrating Clearing’s accounting software into the user’s rental property business.

Pros and Cons

Pros

- Automated trust accounting. This accounting software for landlords automates the complex trust accounting process, ensuring accurate and compliant financial records.

- Originally built for short-term rentals. Clearing was specifically built for short-term rental accounting and as such it features integrations with popular short-term rental management platforms. It has now expanded into mid-term rentals and long-term rentals as well.

Cons

- Pricing structure. Clearing’s pricing is tiered, based on the number of units you manage. While this structure benefits larger portfolios, smaller operators might find the base monthly fee steep compared to other options on the market. However, in most cases, the pricing is similar to other accounting systems for operators of all sizes.

- Lack of reviews. Clearing is a new platform with little online presence. This can be a drawback for users who prefer well-established accounting platforms with reviews or testimonials online. However, users can check out their website for customer stories which get updates every week.

Integrations

- Hospitable

- HostAway

- Uplisting

- Guesty

- Hostfully

- OwnerRez

- Lodgify

- Hostify

- Jurny (coming soon)

- Fantastic Stay (coming soon)

- Turno

- Stripe

- QuickBooks

- VacationRentPayment (coming soon)

- Authorize.Net (coming soon)

- Plaid

RentalHero

Launched in 2017 by the team behind Realtyzam, the RentalHero platform simplifies the tracking of income and expenses for all kinds of rental properties — single-family homes, multi-unit properties, short-term rentals, or storage units.

What sets RentalHero apart is its impressive profit and loss reporting feature that facilitates the straightforward generation of income, expense, and profit reports for tax purposes.

RentalHero also offers automatic data feeds from over 15,000 banks and credit cards. This allows users to download new transactions daily and categorize them based on custom rules.

Features

Expenses

This Airbnb management tool allows users to automatically categorize utilities, home taxes, and supplies, ensuring accurate and up-to-date financial records.

Users can filter expenses by year and view a pie chart of expenses by category, making it a top-notch vacation rental tax software.

Additionally, RentalHero allows users to attach receipts to any expense by using their computer, tablet, or phone.

This ensures that they have a digital copy of the receipt linked to that expense for easy reference and recordkeeping.

Rentals Database

RentalHero allows users to add unlimited properties, unlimited tenants, and offers unlimited document storage.

Users can create a comprehensive list of their rental properties, detailing crucial information such as tenants, rent amounts, rent due dates, and lease end dates.

Additionally, RentalHero offers search tools that enable users to easily locate properties and refine their search results. This expedites the process of finding specific properties.

Profit and Loss Reports

Users of this accounting software for property managers can generate printable tax reports that present a clear picture of their business’ profits and losses.

RentalHero simplifies financial reporting by allowing users to produce detailed reports of income, expenses, as well as profits and losses for each rental, group of rentals, or even individual companies.

Bank Linking and Reconciliation

With this feature, users can connect their bank accounts to RentalHero and have new transactions automatically downloaded from those feeds into the platform.

The system categorizes these transactions based on set custom rules.

Plans and Pricing

This real estate investor accounting software offers a free 30-day trial, allowing users to explore and test the platform’s features without commitment.

After the trial period, the platform charges a subscription fee of $10.75 per month, or $129 annually.

This subscription includes unlimited properties, units, and tenants, as well as unlimited reminders, unlimited document storage, and more.

Pros and Cons

Pros

- Affordability. The software offers unlimited document storage, property accounting, and bank reconciliations for just $10 per month.

- Automated transactions. RentalHero significantly reduces manual labor by automatically uploading and categorizing income and expense transactions from linked bank accounts each morning, promoting efficiency and accuracy.

Cons

- Limited customization options. Some users report that RentalHero’s accounting features may not be as customizable as other software. One might encounter difficulties adapting it to specific property management needs, such as creating custom reports or tracking specific financial metrics.

- Limited reporting options. While RentalHero can generate profit and loss reports, other key reports like real estate balance sheets, capital expense reports, and tenant rent ledgers are not available.

Integrations

RentalHero offers no integration with third-party software tools.

__

About the Author:

With over 20+ years of experience in real estate investment and renovation, Brian Robbins brings extensive knowledge and innovative solutions to the HouseCashin team. Over the years Brian has been involved in over 300 transactions of income producing properties across the US. Along with his passion for real estate, Brian brings with him a deep understanding of real estate risks and financing.